The Future of Transaction: Going Contactless

Have you ever seen anyone pay for their groceries by tapping their card or phone to the terminal instead of the usual swipe? It looks like magic but we’re here to tell you it’s definitely not an illusion — it’s contactless payment.

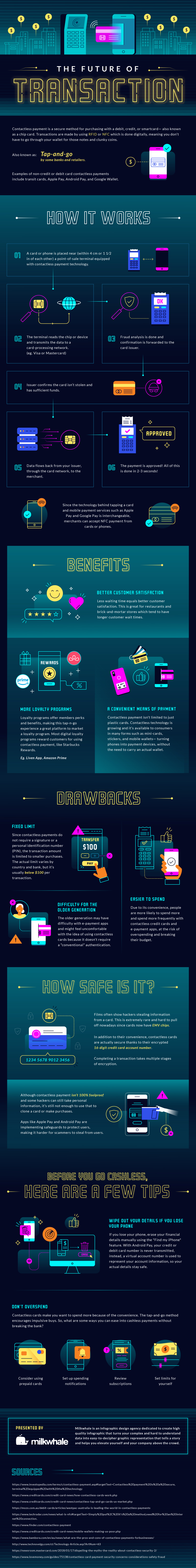

Contactless payment is defined as a secure method for consumers to make transactions by using a debit, credit, or smartcard — also known as a chip card that uses RFID or NFC. Since the emergence of smartphones and advanced technology, we’ve seen people use their phones to make transactions with Android Pay or Apple Pay.

So how does it actually work? In order to make a contactless payment, you simply tap your card phone near a point-of-sale terminal that has RFID of NFC technology. Due to the convenient nature and ease of transactions, contactless payment transaction sizes are limited. People usually opt for this method when shopping for groceries or paying for their meals because they don’t need to enter any credentials.

Despite the fact that they don’t need to enter any credentials, this method of payment is highly secure. Each transaction goes through multiple steps of encryption, making it impossible for hackers or scammers to decode personal information.

Benefits of going cashless

Going cashless or contactless has various benefits. It’s secure, simple, and mainly, it’s more convenient for users and businesses.

Contactless payment is great for restaurants and any brick and mortar businesses because it decreases waiting times which increases customer satisfaction. Customers and cashiers don’t need to fumble for the right amount of change— we all know how annoying it gets to find the right notes and coins to hand over to the cashier!

Since paying with apps became popular, loyalty programs have increased. Loyalty programs don’t just benefit businesses, they actually give users perks and benefits too. Some programs have discounts and cashback for their users for encouraging them to use their services. A few examples are Starbucks, Liven App, and even Amazon Prime.

Before You Go Cashless

However, before you start going cashless right away, there are measures to consider. Since most of your data will be on your gadget, it’s important to keep your data secure. Make sure to use apps that are verified and established such as Google Pay, Android Pay, Apple Pay, and programs that have been acknowledged by established institutions. Another thing you can do is prepare for the worst— in case you lose your phone.

Don’t Fear the Future

Although the idea of leaving your wallets at home can seem terrifying, going cashless is nothing to fear. If anything, it may be the future of the transaction.

To make it easier, the folks at Milkwhale made this simple infographic to help you understand what contactless payment is.

About the author

Andre Oentoro is one of the co-founders of Milkwhale, an internationally acknowledged infographic production agency. He helps businesses increase visibility on the internet with visual data and well-placed outreach campaigns.

Image courtesy of PSD Codax