ICO Trends. The past, the present, the future. Lessons learned in the first half of 2018

“Veni, vidi, regulari.” The governments are on the move

From a regulatory perspective, 2018 witnessed stronger global attention, especially after the spike in crypto prices during December last year, and the very high number of scams which resulted in a loss of over $1.3 bln. Regulators realized that a serious action should be taken in order to deter scammers and market manipulators away from the cryptographic sphere. China continued hardening its grip on the market, moving from ICO ban to crypto exchanges ban, foreign crypto exchanges ban and exchange-like services ban eventually. While the IRS in the United States approached the leading crypto exchanges to submit reports about all transactions carried on their platform by US citizens in order to detect tax evasion. Those strict measures were accompanied by several crackdowns from the SEC and other agencies who sent cease and desist orders to scam-like ICOs.

The important G20 summit also included blockchain and crypto in their agenda, sending a signal for the market that the regulators now pay attention to the industry, and this is only the beginning.

Don’t stop at the TOP. The largest crypto projects competing, new ideas, new tech emerge

Technologically speaking, scalability remains the biggest challenge for many cryptocurrencies including the two major cryptos, namely Bitcoin and Ethereum. Bitcoin has implemented SegWit (Segregated Witness) as a soft fork and Lightning Network as an additional layer in order to increase the number of transactions processed per second. Ethereum has made some progress in moving from PoW (Proof of Work) to PoS (Proof of Stake) by releasing Casper V0.1.0 officially on GitHub. Sharding, Plasma and off-chain transaction processing are still work in progress which are expected to be implemented during 2019 at the earliest.

EOS is one of the most successful ICOs; eventually, they managed to raise more than $700 mln last year and more than $3 bln during the first half of 2018, totaling $4 bln raised during a year-long ICO. One of the fascinating facts about this ICO is that it is supposed to create a decentralized infrastructure which is directly competitive to Ethereum where the ICO took place. In the centralized world, no company will allow its fierce direct competition to use its very own infrastructure to raise such staggering amount of money in an attempt to create a superior platform which supports smart contracts and supposedly higher number of transactions per second. This is the most painful point for Ethereum and other blockchain projects operating on a public network.

So what has changed since 2017 and what should investors and ICO founders be looking for?

The most important question of 2018: is it a must to run an ICO initially?

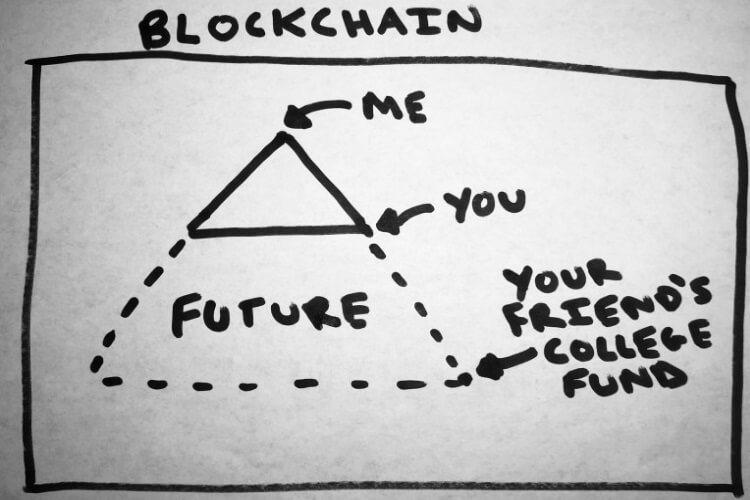

Potential investors will be questioning whether the proposed solution could also be achieved equally efficiently without using the blockchain technology. After all, databases have been used for so long quite successfully, and not every single new project must be run on the blockchain. So make sure that the ICO documentation addresses this issue very clearly.

2017 witnessed the first spike in the number of ICOs which were sold to the public, reaching close to 1,000 ICOs compared to few ICOs which could be counted on one hand for the previous years. The easiest solution was to launch an ICO and raise funds from global retail investors, who will happily throw their hard earned money almost blindly to any random ICO. The funniest case was the ponzi-coin. Yes, the ICO was called PonziCoin! More than that, their flagship was “PonziCoin is a Transparent, Decentralized, Ponzi Scheme that you can trust.” Well, that’s decent enough. Not sure what investors had really in mind, and what consequences will the founders face in the end, as they have been very honest from day one. Still, they managed to raise close to $300K. Was this the only obvious successful Ponzi scheme? Be amazed, no! This Ponzi scheme was followed by ScamCoin. This is the exact name of the ICO and, believe it or not, they also managed to raise over $100K. As Einstein said, two things infinite, the Universe and human stupidity.

Regardless of obvious frauds, many ICOs did not need a token for their ecosystem to function initially — they could have used just any existing token like ETH. Moreover, they did not need blockchain at all. A great example coming from a reputable, well established and competent company is the Kodak ICO introducing the Kodak Coin.

This ICO has attracted a lot of attention and triggered a lot of criticism, even a whole research paper of 22 pages of drawbacks has been published by Kerrisdale Capital. The papers criticize both the executives who granted themselves a share of the company one day before the announcement and investors who pumped the price of Kodak share with more than 300% since the announcement. What Kodak is trying to do is to solve a copyright problem by using blockchain technology and pay photographers with the platform’s native token.

The fact is, blockchain does not solve the copyright problem in any way which is superior to a traditional database. Actually, to the contrary, any person can claim that a certain image is theirs and upload it to an immutable blockchain. When the actual owner realizes that their work has been stolen and certified on the blockchain, it will be a great deal to fix it. Lastly, why would any photographer want to get paid in Kodak Coin and not a fiat currency? Or even in Bitcoin, Ethereum or any other existing crypto? This example shows us that blockchain is not bringing any added value, nor there is a need for a native coin at all. As a matter of fact, the share price of Kodak has dropped from almost $12 following the ICO announcement back to $4 just a few months later.

ICO is neither a panacea nor a trendy move

Time to draw conclusions. The hype over the ICO should become manageable eventually. It’s an entirely new instrument, and it demands new rules and a different approach. The next article will contain a list of questions every ICO should answer before the start in the second half of 2018.