When digital assets are ill-defined and poorly regulated, it pays to get ahead of the regulatory game. Coinbase (COIN), the largest crypto exchange in the US, played this game well.

Coinbase Trusted by Institutions

Coinbase is the key supplier of blockchain analytics software to a host of federal agencies, from ICE to the Secret Service. While these relationships may be unpopular, they do create inter-agency familiarity and codependency.

Likewise, Circle and Coinbase’s USDC is one of the top regulated stablecoins. USDC is subjected to oversight by 46 state regulators as a stored value instrument. Meaning, just like a prepaid card, USDC is regulated under the money transmission laws.

Although Gary Gensler, the SEC Chair, foiled Coinbase’s plan to launch its Lend program last September, the company is taking it in stride. In lieu of the upcoming crypto legislation, Coinbase recently picked Scott Bauguess as vice president for global regulatory policy. Notably, he spent over 10 years working as a deputy chief economist for the SEC.

Bauguess will join Thaya Knight, another recent hire and former acting director of the SEC’s Division of Trading and Markets. In the lobbying department, Coinbase hired Faryar Shirzad last year as a chief policy officer. He was Goldman Sachs’ top lobbyist in Washington.

Coinbase plans to add up to 2,000 more employees to fill Product, Engineering, and Design roles in its core business through 2022.

Why is Coinbase Hiring More People?

After going public on Nasdaq last April, Coinbase’s valuation at one point reached $112 billion, to later close at $86 billion. That is to say, the key benefit of going public is to flood the company with cash for expansion. Therefore, additional Coinbase employees should be viewed in that light:

- Launching the NFT marketplace this year.

- Improving security and usability of Coinbase Wallet.

- Getting involved in building Web3 infrastructure.

Interestingly, when there is a lull in the crypto market, Coinbase views this as an opportunity.

“Through the highs, we get to focus on scaling and many new people get introduced to crypto. During the lows, we get to focus on product innovation.”

That certainly turned out to be the case with Bitcoin’s SegWit upgrade that helps the network’s scaling. In contrast to Binance, the world’s largest crypto exchange, Coinbase already integrated SegWit before Binance took the first serious steps.

Join our Telegram group and never miss a breaking digital asset story.

What Does the DEX vs. CEX Trend Say?

The nature of centralized companies is that they always have to onboard more employees to expand. The same cannot be said of companies that rely on smart contracts instead. Last summer, we noted that Uniswap achieved 77% of Coinbase’s trading volume with 33x fewer employees.

In a nutshell, this is the cost differential between a decentralized (DEX) and centralized (CEX) exchange. However, if we zoom out, we also saw that Coinbase’s valuation rivaled Goldman Sachs, with just 4% of the bank’s employees.

If we compare trading volumes of Coinbase vs. Uniswap this month, from February 1st to February 15th, we arrive at the following numbers:

- $49.2 billion for Coinbase

- $22.3 billion for Uniswap

Once again, it is clear that centralized convenience is still prioritized, but not by much. With Coinbase’s additional 2,000 employees to be added this year, Uniswap is now poised to have over 33x fewer employees while delivering just over half less volume.

Is this sustainable in the long run, if fast and cheap layer 2 solutions like Arbitrum keep going online to alleviate Ethereum’s congestion and gas fees?

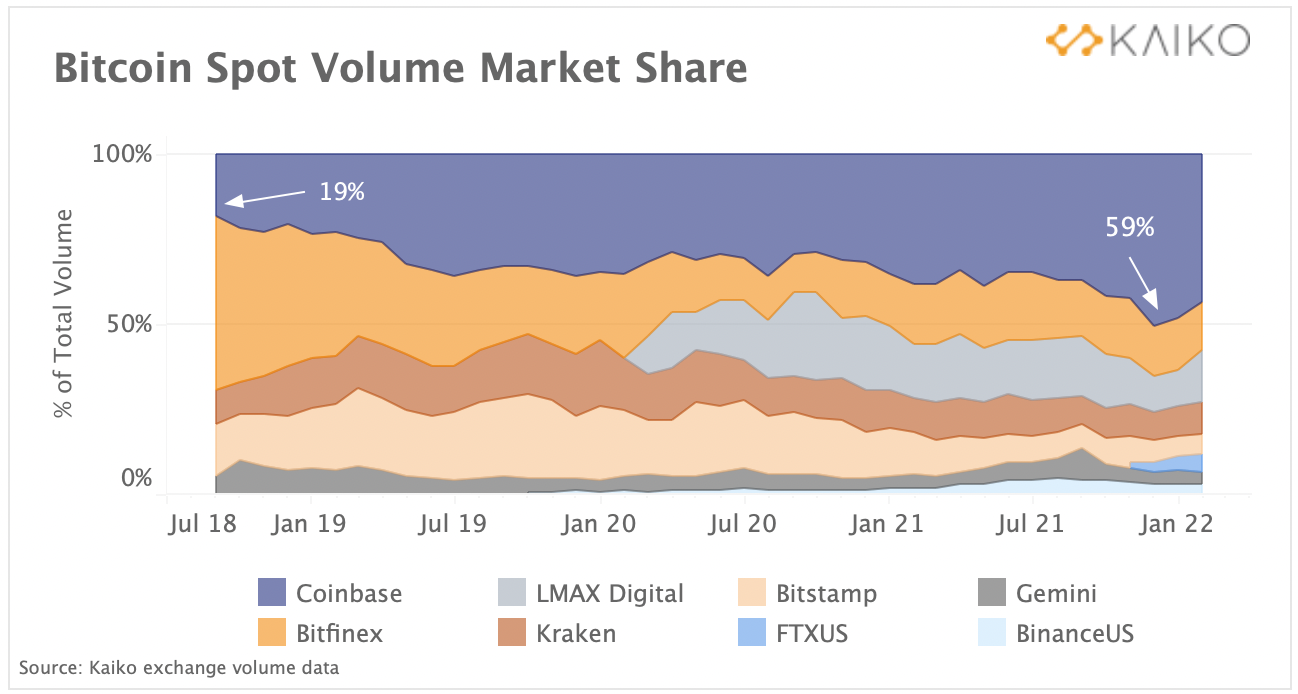

On the other hand, how could DEXes be properly regulated to attract institutional investors as Coinbase can? Judging by their pre-emptive ex-SEC hiring and partnerships with federal agencies, Coinbase seems to be betting on this to play out. Already, Coinbase soundly beat its closest competitors, FTX.US and Binance.US.

As things stand now, Coinbase is shaping up to become a magnet for institutional investors, as both publicly traded and highly-regulated crypto on-ramp. In that landscape, DEXes will remain, but as a minor niche for the more FinTech savvy.

Do you think most people will care that Coinbase acts as a surveillance crypto company? Let us know in the comments below.

tokenist.com

tokenist.com