Japan’s National Tax Agency has published an updated guideline related to the taxation of NFTs. Among other things, NFT transactions in blockchain-based games will be subject to taxation.

Japan’s National Tax Agency has issued guidelines for the taxation of NFT transactions, including those involved in blockchain games. The authority published the guidelines, offering a simplified method to tax these transactions, which are numerous and frequent.

The NTA stated that “in-game currency (tokens) are frequently acquired and used, and it is complicated to evaluate each transaction.” As such, the taxation would only consider the total income based on the in-game currency, evaluating it at the end of the year. It also mentions that taxation does not apply if the asset isn’t exchanged outside the game.

There is some lack of clarity regarding the taxation of NFTs, and investors in the space will want more details on the actual tax calculation. Still, investors now know that income tax applies if an NFT is sold to another party. Business or miscellaneous income applies in the case of primary NFT sales. ‘Transfer income’”’ applies in the case of secondary sales.

NFT creators will also face their own taxation. If creators sell their NFTs to Japanese consumers and earn from them, they face consumption tax. There are more such specific applications of consumption tax, which the NTA will hopefully clarify soon for Japan’s enthusiastic NFT use base.

National Tax Agency Not the Only One Focusing on NFTs

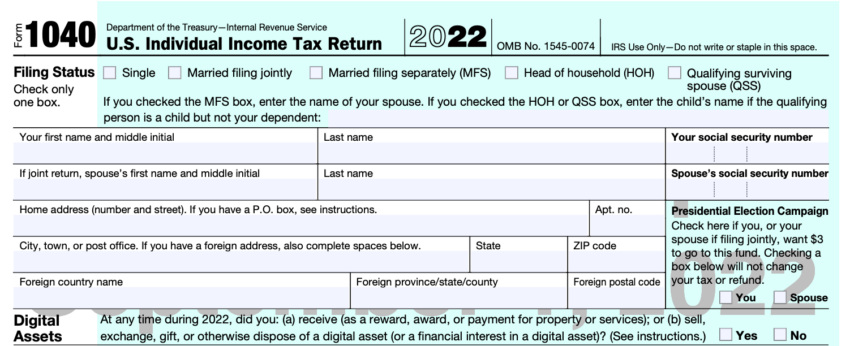

Japan is far from the only country to begin publishing tax guidelines for NFTs. The United States recently revised its tax forms to clarify this matter. The Internal Revenue Service updated guidelines that NFTs will be taxed similarly to other cryptocurrencies.

The United Kingdom has taxed NFTs similarly. The assets are subject to capital gains tax or income tax and follow the same taxation rules as typical cryptocurrencies.

79% of Indians want the government to regulate crypto and NFTs, which could alter the status quo. India has also imposed strict taxation for cryptocurrencies, which include NFTs. This includes the minting of NFTs, which has doused the interest in the NFT market somewhat in the country.

Japan Making Big Moves in Crypto

While Japan is taxing crypto, the country has shown interest in the web3 sector. Numerous developments have taken place in recent months, including a proposed tax cut by crypto advocates to keep talent in the country. The country hopes to revitalize its economy by focusing strongly on the metaverse.

Banks are also joining in on the digital revolution. Nomura, one of Japan’s largest banks, plans to roll out crypto trading for institutional clients in early 2023. The firm will offer such services as crypto trading, DeFi, stablecoins, and NFTs.

beincrypto.com

beincrypto.com