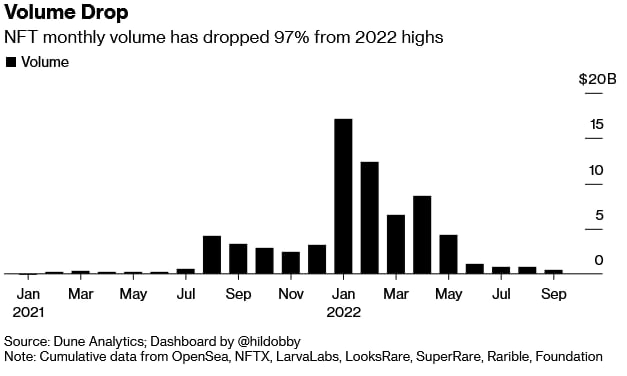

Since reaching an all-time high in January this year, trading volumes in non-fungible tokens (NFTs), also known as digital art and collectibles recorded on the blockchain, have dropped by 97%.

The crash is in tandem with five months of consecutive decline as the interest around NFTs starts to wane. In particular, NFT monthly volume dropped to barely $466 million in September after reaching a high of $17 billion at the beginning of 2022, according to the statistics provided by hildobby on Dune Analytics.

As a result of rapidly tightening monetary policy, investment flows are being cut off from speculative assets, contributing to a bigger wipeout in the crypto industry, seeing roughly $2 trillion leave the market since its peak in November 2021.

Interest in NFTs on the wane

In August, Finbold first reported that trade activity for non-fungible tokens in Q2 had plummeted by 40% as digital collectibles’ interest dwindled. Footprint Analytics noted:

“In mid-May, the crypto market faced considerable challenges, and the NFT market cooled off. NFT trading volume dropped from $19.02 billion in Q1 to $11.26 billion in Q2.”

It was also found that OpenSea, the world’s largest NFTs marketplace, saw a significant decrease in the daily quantities of its trades. Trading volume on the NFT marketplace fell as low as $10.05 million as of August 26, the lowest since July 2021, marking a one-year low as the effects of the crypto winter take hold.

Elsewhere, in June, a survey found that the vast majority of customers, particularly 64.3% of persons surveyed, only purchased NFTs to “make money.” It probably shouldn’t come as a surprise that trading volume declined during the second quarter of 2022, given that more than half of investors purchase NFTs only for the purpose of increasing their financial position.

finbold.com

finbold.com