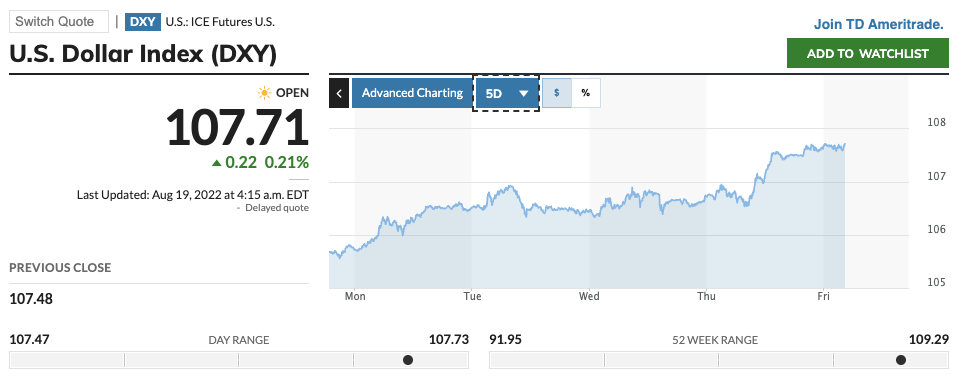

On Friday (August 19), the $ETH price is down around 6% — which is not that bad considering that $ADA, $SOL, $DOT, $MATIC, and $AVAX are suffering double-digit percentage losses — thanks to the current “risk-off” mood that has resulted in the U.S. Dollar Index (DXY) surging to nearly 108 this week.

This could mean trouble for #stocks and #crypto.

— Justin Bennett (@JustinBennettFX) August 18, 2022

The $DXY just closed above 107.30, which means the next stop is most likely 108.70.$BTC $ETH pic.twitter.com/BwKnzgxokp

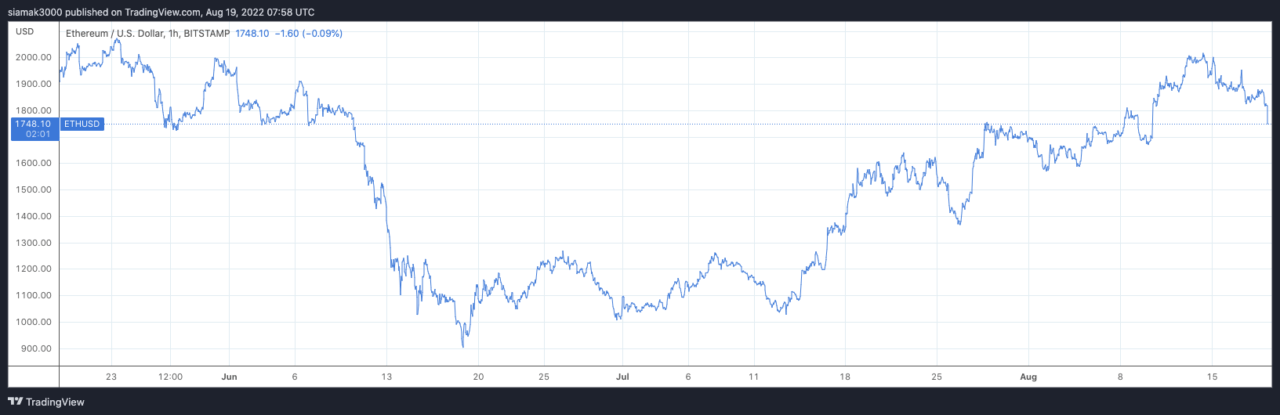

According to data by TradingView, on crypto exchange Bitstamp, ETH-USD is currently (as of 7:58 a.m. UTC on August 19) trading around $1,748.10, down 5.25% in the past 24-hour period, but up 93.72% since the intraday low on June 19.

Ethereum’s upcoming “Merge” protocol upgrade — expected to take place around September 15/16 — is when the Ethereum network is making the transition from proof-of-work (PoW) to proof-of-stake (PoS).

Here is how Ethereum Foundation explains the Merge, which is expected to take place around September 15:

“The Merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake consensus layer, the Beacon Chain. It eliminates the need for energy-intensive mining and instead secures the network using staked ETH. A truly exciting step in realizing the Ethereum vision – more scalability, security, and sustainability.

“It’s important to remember that initially, the Beacon Chain shipped separately from Mainnet. Ethereum Mainnet – with all it’s accounts, balances, smart contracts, and blockchain state – continues to be secured by proof-of-work, even while the Beacon Chain runs in parallel using proof-of-stake. The approaching Merge is when these two systems finally come together, and proof-of-work is replaced permanently by proof-of-stake.

“Let’s consider an analogy. Imagine Ethereum is a spaceship that isn’t quite ready for an interstellar voyage. With the Beacon Chain, the community has built a new engine and a hardened hull. After significant testing, it’s almost time to hot-swap the new engine for the old mid-flight. This will merge the new, more efficient engine into the existing ship, ready to put in some serious lightyears and take on the universe.“

Australian crypto investor and analyst Miles Deutscher, who recently joined “Crypto Banter” to host a daily DeFi show, explained earlier today why the Merge may not be fully priced in:

Seeing a large portion of CT fading the $ETH merge gives me hope that maybe it isn’t fully priced in..

— Miles Deutscher (@milesdeutscher) August 19, 2022

And crypto analyst Ali Martinez offered today this technical analysis of Etheruem’s latets price action:

#Ethereum appears to have broken out of a rising wedge. The technical formation forecasts that $ETH could enter a 28% correction toward $1,300. #ETH pic.twitter.com/rcwbW3xyuo

— Ali Martinez (@ali_charts) August 19, 2022

Data shows that 675,500 addresses had previously bought 8.91 million $ETH between $1,700 & $1,750.#Ethereum must hold above this demand zone to have a chance of recovering. Otherwise, these addresses could try to break even in their positions, triggering a correction to $1,300. pic.twitter.com/aGIHbb4LcM

— Ali Martinez (@ali_charts) August 19, 2022

Image Credit

Featured Image via Unsplash

cryptoglobe.com

cryptoglobe.com