Trading volumes on decentralized exchanges (DEX) have slumped for six consecutive months to their lowest levels since January 2021.

Volume on DEXs decreased to $44.28 billion in September, the sixth consecutive monthly decrease and the lowest recorded volume since January 2021, according to DefiLlama data.

During the first quarter of this year, DEXs experienced a surge in monthly trading activity. This growth was precipitated by increased regulatory scrutiny directed at their centralized counterparts, including major platforms like Kraken, Bittrex, Coinbase, and Binance.

As a result of these regulatory measures, crypto traders migrated their activities towards DEX protocols. In March, trading volume on these decentralized platforms reached an impressive $140 billion. However, this spike was short-lived, with volumes plummeting to around $82 billion in April.

Subsequently, trading activities on these DEXs have been on a consistent decline.This decline can be attributed to a combination of factors, including overall market conditions and the ongoing regulatory pressures facing the industry.

For context, the U.S. Commodity Futures Trading Commission (CFTC) filed charges against three DeFi protocols, including Opyn, Deridex, and ZeroEx. The regulator alleges they illegally offered unregistered derivatives trading products on their platforms.

Additionally, these platforms have regularly been victims of hacks and exploits, making it difficult for users to trust them with their assets.

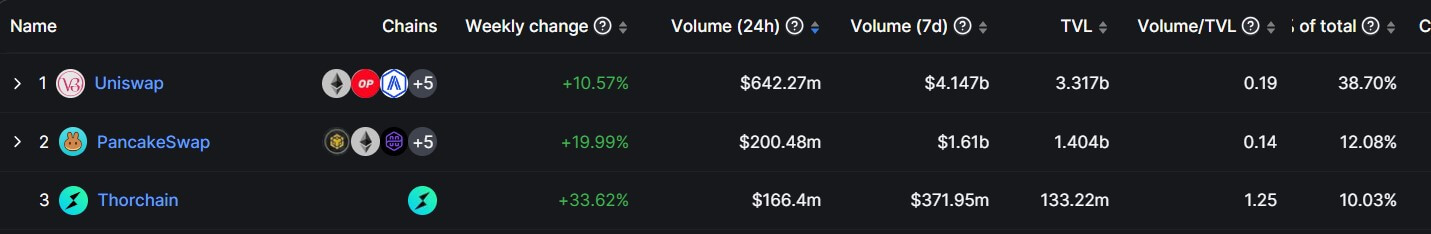

Uniswap remains the dominant decentralized exchange platform despite the falling volume across the board. The protocol contributes more than 38% of the daily volume, and its cumulative volume is three times higher than its closest rival, PancakeSwap.

Meanwhile, trading activity on centralized crypto exchanges is also seeing a downturn. According to available data, trading volume on these platforms fell by 26% to $311.93 billion in September, marking the lowest level since November 2020.

cryptoslate.com

cryptoslate.com