Recent developments in the United States have put DeFi platforms under the regulatory spotlight, causing a stir in the crypto community.

Sanctions in crypto seemed excessive until 2023, specifically with FTX’s collapse. Despite the fact that governments have been pursuing this market for quite some time, cryptocurrencies were once thought to avoid the same degree of politicisation as the currency system due to their promise of anonymity, decentralisation, and resistance to censorship.The year 2023 proved how unrealistic their forecasts had been.

This new Russian tide

Before FTX, As a result of the international outcry that the crisis in Ukraine sparked in February, the United States imposed further sanctions on Russia. The West has imposed economic sanctions on both prominent Russian people and the nation as a whole as a means of aiding Ukraine and reducing Russia's military might.

In particular, international money transfer firms like Western Union and credit card companies like Visa and Mastercard ceased transferring funds to and from Russia, thus cutting off that country's banking system from the rest of the world. Russian nationals and residents were blocked from using European Union-based cryptocurrency exchanges in October.

U.S. Court Upholds Sanctions on Decentralized Crypto Platforms

After FTX’s collapse, watchdog’s launched war on DeFi in a scheme to fish ou fradulent activities. In a landmark decision back in august 2023, the U.S. court upheld sanctions on decentralized crypto platforms. This ruling sent shockwaves through the DeFi community, as it marked a significant shift in the regulatory approach towards these platforms.

The court's decision stems from concerns over anti-money laundering (AML) and know-your-customer (KYC) compliance. Regulators argue that DeFi platforms, despite their decentralized nature, must adhere to these rules to prevent illicit financial activities. This decision underscores the growing importance of regulatory compliance in the DeFi space.

CFTC Cracks Down on DeFi Firms in the U.S.

In parallel with the court ruling, the U.S. Commodity Futures Trading Commission (CFTC) intensified its efforts to regulate DeFi firms just a few days ago. While the intention is to ensure investor protection and market integrity, the course of action has raised concerns within the DeFi community.

DeFi proponents argue that strict regulations could stifle innovation and limit access to DeFi services for users. Striking a balance between regulatory oversight and preserving the core principles of decentralization is a challenge that DeFi platforms must grapple with in the coming years.

The U.S. insistence on AML rules for DeFi platforms signifies a broader trend towards regulatory clarity. Authorities argue that the anonymity and pseudonymity often associated with DeFi can be exploited for illicit activities, such as money laundering and terrorist financing.

Compliance with AML rules will likely require DeFi platforms to implement KYC procedures and transaction monitoring. While this may be a departure from the original ethos of DeFi, it is a necessary step to gain legitimacy in the eyes of regulators and traditional financial institutions.

Tornado Cash Scrambles

The Treasury's Office of Foreign Assets Control banned Ethereum mixer Tornado Cash in August. Cause: North Korean cyber group Lazarus utilised the mixer. Another mixer was approved this year. Tornado Cash is an open-source, noncustodial technology, thus crypto enthusiasts were outraged.

Tornado Cash censure, the most high-profile crypto sanction case, sparked criticism. Coin Centre and Coinbase sued OFAC, saying it had overstepped its powers and denied Americans the freedom to private bitcoin usage.

OFAC considers Tornado Cash a money-laundering entity, despite its open-source technology and decentralised autonomous organisation (DAO) handling upgrades.OFAC also allowed DAOs and other decentralised organisations to be considered ‘entities’ for sanctions and enforcement.

If OFAC pursues decentralised money, this will certainly happen again, says Ari Redbord, director of legal and government relations at blockchain intel startup TRM Labs. Redbord said monthly Tornado Cash deposits dropped 68% because to the penalties.

The crypto community highlighted that innocent Tornado Cash users had their money trapped in sanctioned wallets. In response, OFAC advised users to register for a licence to withdraw money, deanonymizing themselves and their wallets and negating the purpose of utilising a mixer.

This method isn't guaranteed to work. After their money was trapped in the custodian wallet in 2021, Chatex customers filed for licences a year ago and are still waiting. We don't know what happens when you ask OFAC to release crypto from a sanctioned wallet. Tornado Cash tests potential.

SEC vs. Binance, Coinbase

Again in august, the SEC went after Binance and Coinbase, two significant cryptocurrency exchanges. The SEC alleged that Changpeng 'CZ' Zhao, CEO of Binance, and Guangying 'Helina' Chen, the business's finance manager, misappropriated millions of dollars from customers using a shell company.

According to the SEC, Zhao used a middle company named Key Vision Development Limited to funnel payments to entities directly under his command.

An SEC accountant named Sachin Verma has testified in support of these claims, which the agency intends to use to seek a temporary restraining order against Binance.US.

The SEC claimed that $12 billion went to Zhao and $162 million went to a Singapore-based business controlled by Chen, citing Verma's forensic analysis of Binance and Zhao's corporate network's bank accounts. The SEC reports that the majority of these resources are stored in "offshore" accounts.

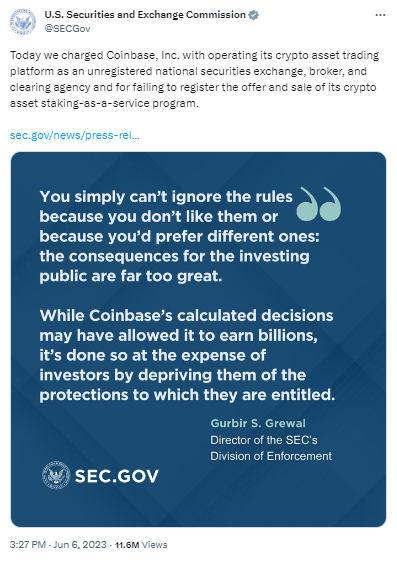

The SEC also filed a lawsuit against Coinbasealmost in the same period. According to the SEC's complaint, Coinbase had been doing business in the United States since 2019 without the proper registrations as a broker, national securities exchange, or clearing agency.

The regulator also argued that Coinbase's Staking Programme was a security since it included "five stakeable crypto assets" (Ethereum (ETH), Cosmos (ATOM), Solana (SOL), and Tezos (XTZ). s.

SEC snap | source: X (Formerly Twitter)

What now? Conclusion

Protocol-level sanctions would be far more effective than service provider-level sanctions. It remains to be seen whether regulatory agencies will require development teams to do so, and if protocol maintainers would comply. That would usher in a brand-new world in which being banned from an exchange may result in the freezing of your cryptocurrency wallet in the same manner as a bank account.

That degree of oversight would likely be welcomed by government officials. And in this event, authorities would once again see truly decentralised networks like Bitcoin as a strange annoyance. A strong urge to crack down on Bitcoin and discourage its use might arise.

cryptonews.net

cryptonews.net