$XRP might require a small amount of capital inflow to reach the much-coveted $1 trillion market cap.

As the momentum behind $XRP Exchange Traded Funds (ETFs) builds in 2025, discussions around the impact of such products on $XRP’s valuation are now becoming relevant.

Notably, a recent analysis by xAI’s Grok suggests that $XRP could achieve a $1 trillion market cap with relatively modest capital inflows. However, the analysis assumes there is a large multiplier effect and sustained institutional interest.

Currently, $XRP holds a valuation of $140 billion, trading at $2.39 with a circulating supply of around 58.55 billion tokens. The possibility of a spot $XRP ETF in the United States has raised questions about how much capital would be necessary to push $XRP’s market cap into the trillion-dollar range.

Capital Inflows Necessary for $XRP to Hit $1T Market Cap

Grok, an AI chatbot developed by xAI, answered this question using a market cap multiplier model, which assesses how capital inflows lead to increases in asset valuation.

According to Grok’s analysis, $XRP has shown high market responsiveness to inflows, largely attributed to its liquidity and trading volume. For instance, on April 12, 2025, $XRP experienced $12.87 million in inflows that resulted in a $7.74 billion increase in market cap.

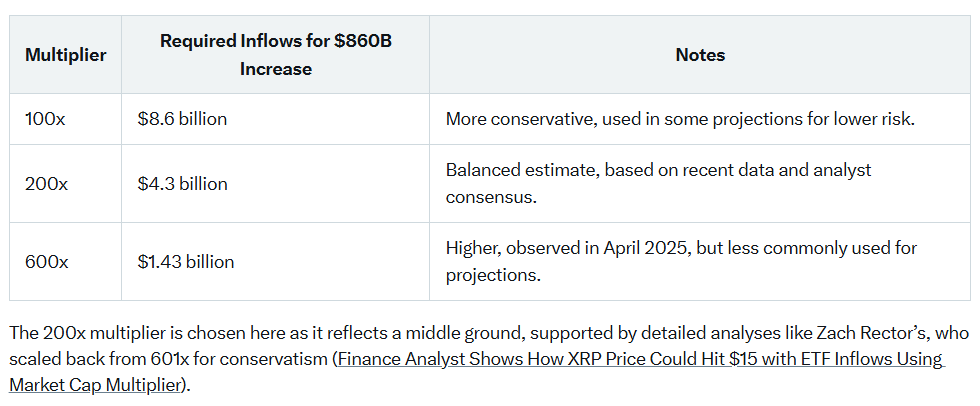

This translates to a multiplier effect of about 601x. However, Grok used a 200x multiplier in its estimates to ensure a more conservative and realistic projection.

Meanwhile, $XRP would need $860 billion in additional valuation for its market cap to reach $1 trillion. Leveraging the 200x multiplier, the capital necessary to welcome this $860 billion additional valuation would be around $4.3 billion in net inflows.

Importantly, if the actual multiplier drops to 100x due to less favorable market dynamics, the inflow requirement will double to $8.6 billion. On the other hand, should $XRP continue to maintain a higher multiplier similar to past performance, inflows as low as $1.43 billion might be enough to push it to $1 trillion, which translates to a price of $17.

Interestingly, JPMorgan estimates that $XRP ETFs, once approved, could attract between $4 billion and $8 billion in their first year. This range aligns with Grok’s $4.3 billion estimate, making the trillion-dollar milestone potentially within reach if investor interest remains strong.

$XRP ETF Prospects

Meanwhile, several recent developments have added momentum to $XRP’s ETF prospects. On April 8, Teucrium Investment Advisors launched the Teucrium 2x Long Daily $XRP ETF (XXRP) on the NYSE Arca exchange.

The leveraged product debuted with $5 million in trading volume, ranking in the top 5% of ETF launches in U.S. history. Teucrium has already announced plans to introduce an inverse product depending on investor demand.

In addition, ProShares is set to launch three $XRP futures-based ETFs on May 14, after receiving regulatory approval. Notably, ProShares has also filed for a spot $XRP ETF, which remains under SEC review.

Internationally, Brazil became the first country to approve a spot $XRP ETF. Specifically, Hashdex’s XRPH11 began trading on the B3 stock exchange on April 25. The fund has roughly $40 million in assets under management and allocates at least 95% of its holdings to $XRP or $XRP-linked products.

In the United States, optimism around regulatory approval is growing. Nine major asset managers, including Grayscale, Bitwise, Franklin Templeton, and 21Shares, have submitted applications for spot $XRP ETFs.

Key decision dates are approaching, with Grayscale’s SEC deadline on May 22, and Franklin Templeton expecting a verdict by June 17. Analysts now predict approvals could arrive in the second half of the year, likely by Q4.

Now, with Ripple having settled its long-running legal battle with the SEC, and the current administration adopting a notably pro-crypto stance, market participants see fewer obstacles ahead.

thecryptobasic.com

thecryptobasic.com