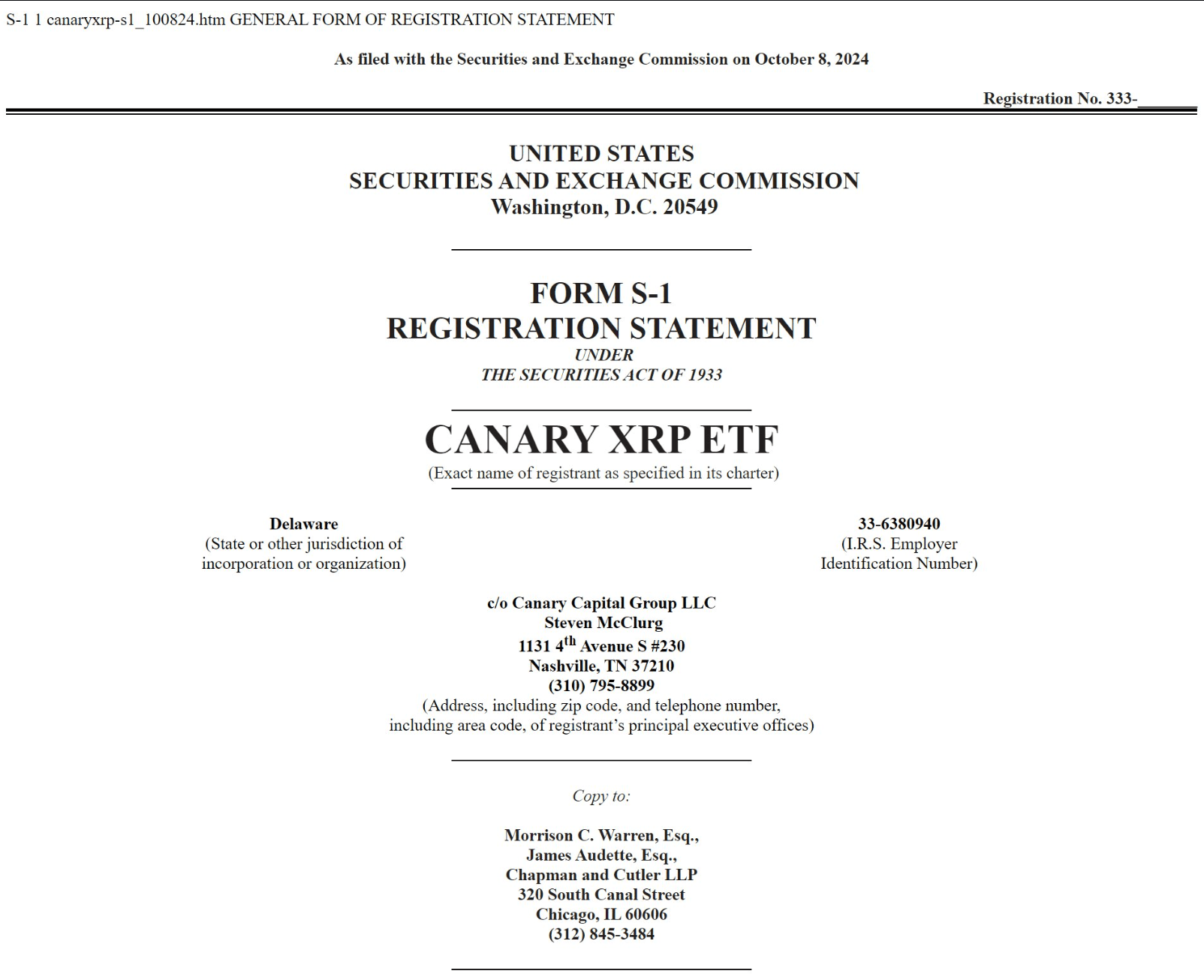

Crypto investment firm Canary Capital has filed for a spot XRP ETF with the U.S. Securities and Exchange Commission (SEC), following Bitwise’s lead in pushing for XRP-based financial products. The ETF, named the Canary XRP ETF, aims to provide investors with easier access to XRP by tracking the cryptocurrency’s price without requiring direct purchases. The filing is seen as a sign of growing confidence in the potential for cryptocurrency products beyond Bitcoin and Ethereum.

Positive Sentiment, Despite Regulatory Challenges

While Canary Capital is optimistic about a "progressive regulatory environment," significant uncertainties still loom. The SEC recently filed an appeal challenging the July 2023 ruling that XRP is not a security when traded on secondary exchanges, adding to the ongoing legal battle with Ripple Labs. This appeal has raised questions about whether the XRP ETF filings by Canary and Bitwise will gain approval amidst the ongoing regulatory scrutiny.

Steven McClurg, Founder of Valkyrie Funds and the driving force behind Canary Capital, is confident in the firm’s move despite these challenges. He highlighted the increasing demand from institutional and retail investors for access to cryptocurrencies beyond established assets like Bitcoin and Ethereum. The ETF will use secure cold and hot wallets to manage XRP and provide a simpler way for investors to gain exposure to the token without the complexities of direct crypto management.

Uncertain Path Forward for XRP ETF

The SEC’s regulatory crackdown on the crypto industry continues to impact the status of altcoins like XRP, and many speculate that the agency’s appeal in the Ripple lawsuit could stall any progress on the XRP ETF filings. Though the SEC has approved Bitcoin and Ethereum ETFs, other crypto assets still face regulatory ambiguity. Approval of the XRP ETF, as well as ETFs for other altcoins like Solana or Dogecoin, remains uncertain under the SEC’s current stance.

Despite these hurdles, Canary Capital's filing marks a significant step in the broader push to bring altcoins into traditional financial markets through ETFs. Whether or not the regulatory environment evolves favorably, this move reflects a growing belief in the long-term potential of cryptocurrencies like XRP.

bsc.news

bsc.news