This integration is expected to boost Sui's appeal to developers and users. Meanwhile, the TON Foundation partnered with Curve Finance to improve stablecoin trading on the TON blockchain by using Curve's Constant Function Market Maker (CFMM) technology. Tether's USDT now dominates 75% of the stablecoin market, driven by increasing demand during both bearish and bullish markets. Additionally, the UK’s finance trade body is exploring blockchain-based payment systems through the Regulated Liability Network (RLN) to boost innovation, security, and efficiency in the country's finance industry.

USDC to Launch on Sui Network

Circle, the issuer of USD Coin (USDC), announced that the stablecoin will soon be natively supported on the layer-1 blockchain Sui network. Circle CEO Jeremy Allaire shared the news of the expansion to a new blockchain on Sept. 17.

The stablecoin already runs on over 15 blockchain networks, and will become available on Sui through the Cross-Chain Transfer Protocol (CCTP). This makes seamless transfers of USDC between different blockchains possible via native minting and burning mechanisms.

Sui was launched in 2023, and is an L1 blockchain and smart contract platform with the goal to simplify the development of decentralized applications and services within the Web3 ecosystem. Its architecture was built using the Move programming language, and it supports parallel transaction execution, which improves scalability and efficiency.

The integration of native USDC on Sui is expected to boost the blockchain’s security, usability, and interoperability even more, which could increase its appeal even more to both developers and users.

Adeniyi Abiodun, co-founder and chief product officer of Mysten Labs, which is the developer of the Sui network, believes USDC’s availability on Sui is a big deal, and even called it a key milestone in the network's growth. He also shed some light on how USDC, which is recognized as one of the world’s most trusted digital currencies, will bring added value to the Sui ecosystem and solidify its position as an industry leader.

USDC is one of the largest stablecoins in the world. It was originally launched as an ERC-20 token on Ethereum in 2018, and has since expanded to numerous other blockchains, including Algorand, Solana, Polkadot, and Hedera.

Just days before the Sui announcement, Circle also revealed plans to launch USDC on Soneium, a layer-2 network on Ethereum developed by Sony Block Solutions Labs.

TON Blockchain Partners with Curve Finance

In other stablecoin-related news, the TON Foundation, which is a nonprofit supporting The Open Network (TON) blockchain, has partnered with decentralized exchange Curve Finance to improve stablecoin trading on the TON blockchain. The collaboration will focus on incubating a new TON-based stable swap project that integrates Curve Finance’s Constant Function Market Maker (CFMM) technology.

This technology is renowned for minimizing price volatility and slippage in stablecoin swaps. This offers users a much more efficient and accessible trading experience.

Vlad Degen, the DeFi lead at TON Foundation, believes there are a lot of benefits to the CFMM integration, and explained that it will make trading more accessible to users who are not yet fully engaged in the blockchain ecosystem. The partnership also aims to make TON-based trading more seamless, which will help accelerate the blockchain’s adoption by offering a smoother stablecoin trading experience.

The process of selecting a team to develop the stable swap project will be conducted transparently, with Curve Finance founder Michael Egorov serving as an advisor. The chosen team will be granted permission to implement Curve Finance’s stable swap formula and receive token allocations airdropped to qualified users.

Curve Finance has also shifted towards its native stablecoin, crvUSD, to improve its utility and incentivize users. This transition allows users to earn fees in a dollar-denominated stablecoin, providing a simpler and more stable method for earning returns. Overall, the partnership between Curve Finance and TON is expected to improve the blockchain ecosystem by providing new opportunities for stablecoin trading.

USDT Dominates 75% of Stablecoin Market

Tether’s US dollar-denominated stablecoin, USDT, now controls two-thirds of the stablecoin market. According to data from Token Terminal, USDT’s market share rose from 55% to 75% over the past two years, and its supply reached $118 billion.

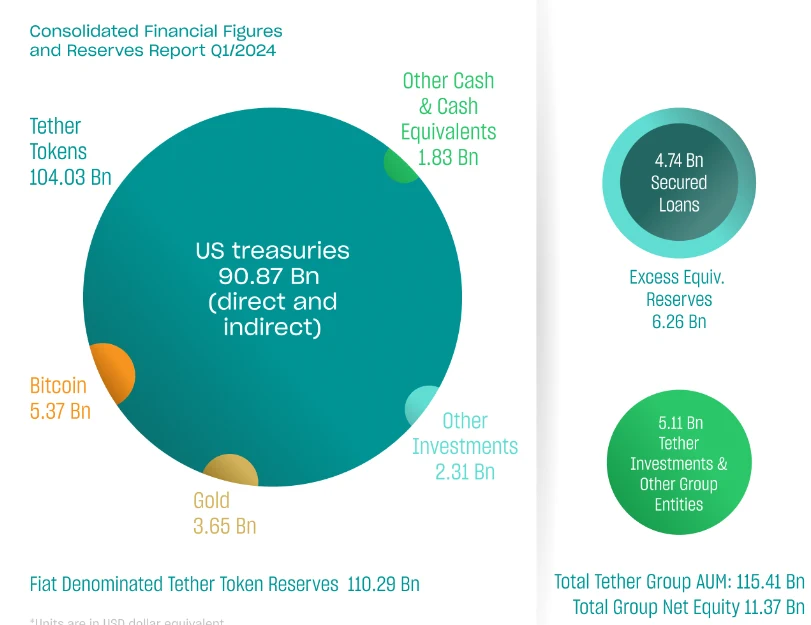

Tether has also generated $400 million in revenue in the 30 days leading up to Sept. 16, after a record-breaking first quarter in 2024, during which it earned over $4.5 billion in profit. About $3.52 billion of that profit came from financial gains in Bitcoin (BTC) and gold, with only $1 billion attributed to operating costs.

Tether financial reserves (Source: Tether)

The growth comes at a time when Tether is prioritizing organizational expansion, including Tether’s recent appointment of PayPal’s former regulatory relations head, Jesse Spiro, as its new head of government affairs. Additionally, Tether’s USDT balance on crypto exchanges hit a record $20.3 billion in August. This indicates that investors are preparing to deploy these stablecoins into crypto assets.

Tether’s stablecoin reserves often rise during both bearish and bullish markets. During downturns, traders look for the safety of USDT, while in bull markets, they accumulate stablecoins for future crypto purchases.

Looking ahead, Tether also plans to double its workforce to 200 employees by mid-2025. Its main focus will be in expanding its compliance team.

Blockchain Ledger Could Revolutionize UK Payment Systems

UK Finance, the country’s finance trade body, has pointed out some of the potential benefits of a blockchain-based ledger for payments and settlements in the UK’s finance industry, which processes $14.5 trillion annually. The comments came after the successful experimental phase of the Regulated Liability Network (RLN), which is a blockchain-based ledger that is designed to handle central bank digital currencies (CBDCs) and tokenized assets.

The RLN could boost innovation and introduce new functions, like programmable payments, while reducing fraud and the cost of failed transactions. UK Finance believes it is important to further engage with regulators and public bodies to develop the RLN, which could become a platform for innovation in the UK’s flexible regulatory framework.

Jana Mackintosh, the managing director of payments at UK Finance, noticed that the private sector is very eager to invest in the future of commercial bank money, and collaboration with regulators is key to achieving success. The RLN uses distributed ledger technology (DLT), and is aimed primarily at commercial banks and can house wholesale CBDCs, commercial bank money, and electronic money. It also facilitates the recording, transferring, and settling of funds, as well as tokenizing payments and settlements.

Quote by Peter Left ,Head of Digital and Markets Innovation at Lloyds Banking Group (Source: UK Finance)

One interesting outcome from the experiments was the RLN’s potential to provide new firms with a common access point to established institutions and enhanced payment systems. UK Finance also stated that the platform could help the UK payments industry meet objectives outlined by the Bank of England, including maintaining the singleness of money and promoting sustained innovation.

The experiments began in April, and involved collaboration with major financial institutions like Barclays, Citi, HSBC, Mastercard, and Visa.