The Layer 1 blockchain Avalanche suffered a major outage that took its network offline for over five hours on Friday.

This interruption halted block production temporarily, causing concern within the crypto community, with some drawing comparisons with Solana.

What Caused Avalanche’s Outage

Kevin Sekniqi, co-founder of Ava Labs, initially linked the problem to a “new inscription wave.” However, he later clarified that the problem was code-related and not a performance-related problem. Sekniqi said the bug caused nodes to max out CPU usage due to excessive gossiping.

“Clarification on this: the issue seems to be a gossip-related mempool management bug, which is purely a code-related bug, and not an issue with performance handling. Inscriptions seem to have hit the edge case, but inscriptions did not affect performance,” Sekniqi said.

He further clarified that a “buggy logic” caused each node to saturate its allocation with unnecessary transaction gossip. However, the team swiftly resolved the issues by updating the software to disable the problematic logic introduced in v1.10.18, which caused validators to exchange gossip excessively.

Following the issues, several crypto community members compared Avalanche’s outage to Solana’s previous incidents. Solana has a track record of outages, the latest occurring earlier this month.

Still, this outage represents the first major disruption to the Avalanche network since its inception in September 2020. An analyst clarified that Solana’s crashes typically result from its inability to manage high loads, while Avalanche’s recent issue stemmed from a bug introduced during an upgrade.

“Solana crashes because it can’t handle the load. Avalanche crashed because of a bug introduced by an upgrade, but otherwise can handle the loads (so no inherent problem with Avalanche). This is the problem with a system that upgrades – each upgrade can introduce bugs,” the analyst explained.

$AVAX Suffers a Steep Correction

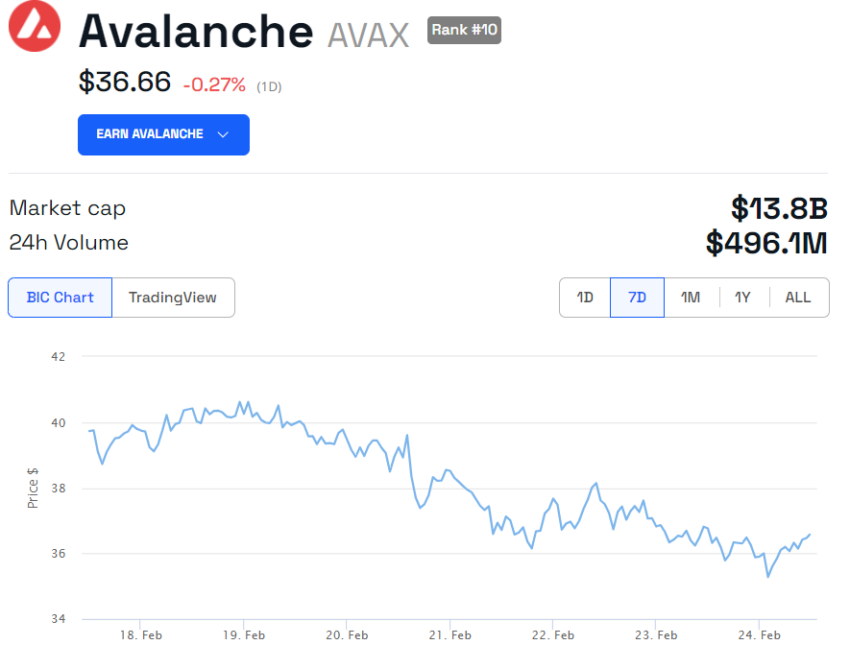

This issue emerged at a critical juncture for Avalanche’s $AVAX token, experiencing a sustained decline in its market value. Throughout the week, heightened selling pressure has notably influenced its price trajectory.

On Thursday alone, Token.Unlocks data reveals that approximately $365 million of locked-up tokens were released from vesting and injected into circulation. This combination of token unlocking and the system outage has precipitated a substantial decline of nearly 10% over the past week, with $AVAX now priced at $36, according to BeInCrypto data.

Read more: Avalanche ($AVAX) Price Prediction 2024 / 2025 / 2030

Despite this, crypto traders remain bullish on the $AVAX, citing its adoption by major institutional players and potential.

“I am accumulating as much $AVAX as I possibly can right now. When the masses realize the financial institutions have chosen Avalanche as THE blockchain, the price of red coin will go parabolic. I don’t need to play with memecoins or NFTs, this is my generational wealth trade,” an Avalanche validator 0xSpartacus said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

beincrypto.com

beincrypto.com