- SUI token’s value surged by 300% in three months, rebounding from South Korean regulatory concerns in late 2023.

- SUI’s ecosystem witnessed remarkable growth with a 2,200% increase in trading volume and an 828% rise in Total Value Locked (TVL).

SUI, the native token of the Sui layer one smart contract platform, has recorded a staggering 300% increase in value over the last three months. This surge in price has catapulted SUI into the spotlight, signifying a robust recovery and growing investor confidence after a challenging phase in late 2023.

SUI had a turbulent October 2023 due to accusations of supply manipulation made by regulators in South Korea. The price of the token and traders’ interest temporarily dropped as a result of this debate. However, SUI’s recent bounce, which analysts credit to a combination of strengthening fundamentals, technical strength, and on-chain data signals, demonstrates the company’s resiliency.

Ecosystem Growth and TVL Expansion

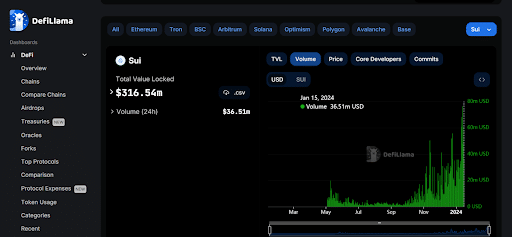

SUI has significantly benefited from the bullish momentum in the larger crypto market. Total Value Locked (TVL) is crucial to SUI’s health and potential. Leading DeFi data aggregator DeFiLlama, reports that SUI’s TVL has increased dramatically by more than 828% from $54.39 million at the start of October 2023 to an astounding $316.54 million. This TVL increase is more than a figure; it is an important turning point in the project’s development and reflects growing investor confidence and ecosystem maturity.

Several protocols contribute to this thriving ecosystem. Cetus, a decentralized exchange, boasts a TVL of $62 million. Navi Protocol follows closely with a TVL of $60 million, experiencing a 485% increase in the last 90 days. Other notable contributors include Scallop Lend, DeepBook, and FlowX Finance. Adding new projects and the expansion of Solend, a major lending protocol on Solana, to the Sui platform further underscores the platform’s burgeoning appeal.

The Unlock Event

Significant SUI tokens will also be distributed to stakeholders during the scheduled unlock. Thirty-three percent (465 million SUI) of 962 million tokens will go to cryptocurrency investors. In addition, early contributors and stake subsidiaries will receive 7% of the grant total, with community reserves scheduled to receive 22% of it. There may be selling pressure as a result of this token flood into the market, which could affect SUI’s price projections.

Wacy, along with other market analysts, is closely monitoring this development and sees it as a chance for investors to secure a favorable entry point into the market after it unlocks. This feeling is consistent with a more general market viewpoint, in which noteworthy token unlocks are frequently seen as pivotal events that have the power to completely transform a market.

$SUI – $962M will be unlocked on May 3 – 75% of the current market cap.

Out of this, investors will receive $540M – 43% of the current MC.

Logically, the price should be higher so that investors can less painfully take profits.

This is probably the most not obvious 3-5x.… pic.twitter.com/JS53CpGyed

— AlΞx Wacy 🌐 (@wacy_time1) January 12, 2024

Traders’ Growing Interest and Future Outlook

There is a measurable increase in interest in SUI. Its trade volume has increased dramatically. According to SUI’s Relative Liquidity Ratio (RLR), the rise in trading volume reflects both the token’s liquidity and the growing interest of traders.

The price trajectory of SUI has been favorable in the short run. It has increased by over 300% after establishing support at $0.36 and peaked on January 15 at $1.4486. The positive trajectory is additionally reinforced by technical indicators: significant moving averages incline upward, and the Relative Strength Index (RSI) remains close to 68, indicating advantageous market circumstances for sustained expansion.