- tDOT is pegged against Polkadot’s native token $DOT and generates sustainable yield from multiple sources including derivatives and protocol fees, and is easy and simple to use.

- It already boasts close to $10 million in total value locked and over $60 million in cumulative trading, and with its StableAsset architecture, offers extremely low slippage.

The Polkadot ecosystem has grown by leaps and bounds in recent years, and while this growth is positive, it has affected $DOT liquidity negatively, making it more fragmented. tDOT is out to solve this challenge and is unifying $DOT and all other ecosystem tokens into a liquid synthetic asset that generates sustainable yield from multiple sources and is easy to use.

Offered by Taiga Protocol, tDOT is the latest and most transformative way to hold $DOT, Kusama’s native token, KSM and other ecosystem tokens.

Introducing @taigaprotocol with tDOT – another way to hold $DOT!

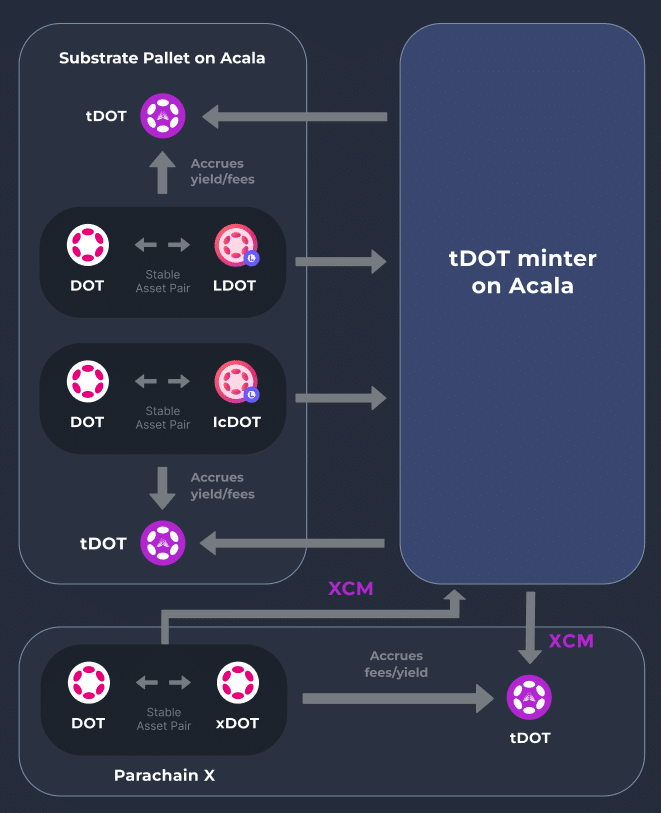

Taiga unifies $DOT and $DOT tokens into a single, highly usable synthetic asset.

Already boasting $10M in TVL, with hundreds of active holders & users – read on to learn more! pic.twitter.com/YPja4ziVxb

— Taiga (@TaigaProtocol) January 2, 2024

tDOT is out to solve a challenge that Polkadot’s ecosystem now faces; as a result of growth in the number and size of parachains, the liquidity of the $DOT token is becoming increasingly fragmented and siloed in these individual projects. As CNF reported, there are now 50 parachains on Polkadot, with the leading parachains accounting for more transactions than the main chain, known as the Relay Chain.

tDOT is out to solve this fragmentation, offering a unified liquidity standard for all stakeholders. It states:

With tDOT, you no longer have to choose between holding an LST of $DOT or providing liquidity – you now do both! Protocols also don’t have to choose between integrating various derivative assets and instead can adopt tDOT and have access to all of it’s underlying liquidity.

tDOT Introduces the Future of $DOT Staking

Holders of tDOT can use the token in the Polkadot ecosystem with the assurance that it will maintain a stable peg against $DOT. This exposes them to all the benefits of liquid staking and participation in yield farming through liquidity pools.

“No longer do you have to choose between multiple staked $DOT assets – you can instead be exposed to all of them!” says Taiga.

One of the common challenges with such products is slippage as users convert from one token to the other. To solve this, Taiga relies on its state-of-the-art Stable Asset System, which guarantees “extremely low-slippage swaps between $DOT and $DOT derivatives, enabling efficient trading and arbitrages,” as demonstrated below.

Taiga Protocol was previously known as Tapio Protocol, and in that stage, it received two grants from the Web3 Foundation and one grant from the Acala Ecosystem Grant program to develop its technology. The Web3 Foundation was established by Dr Gavin Wood, the Polkadot founder, and pushes for the development of the Polkadot ecosystem, while the Acala Ecosystem Grant funds projects making waves in the Acala, a leading Polkadot parachain.

tDOT is a product that aims to benefit every stakeholder in the Polkadot ecosystem. For the $DOT investors, it gives them a sustainable and high yield, while for the liquidity providers, they get to earn yield without impermanent loss. Traders get lucrative arbitrage opportunities, while app builders on Polkadot get one solution for consolidated $DOT liquidity, rather than having to integrate multiple derivative solutions.