The native token of the Elastos ecosystem, ELA, has emerged as the top gainer among the top 500 cryptocurrencies while a key indicator suggests downward momentum.

ELA is up 35% in the past 24 hours and is trading at $4.24 at the time of writing. The asset’s market cap rose to $91 million, making it the 384th-largest crypto asset. While daily trading volume of Elastos also recorded a 50% rally, reaching $2.57 million.

Data shows that over 64% of the spot ELA trading volume comes from Coinbase with the US dollar trading pair.

You might also like: Solana DEX volume breaks $28b in December

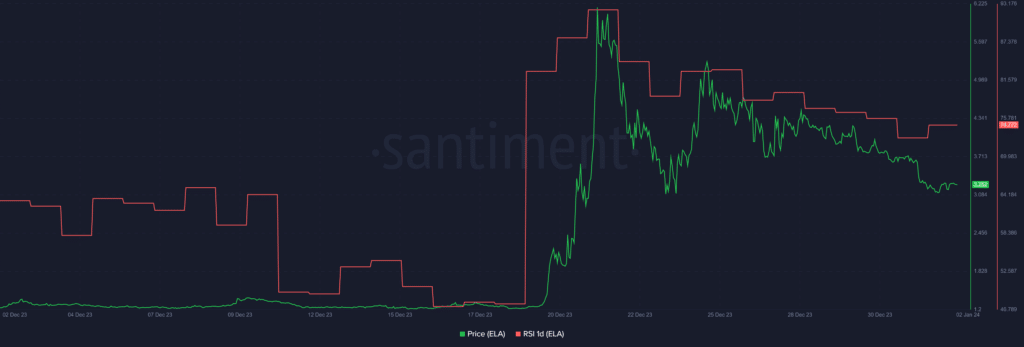

According to data provided by the market intelligence platform Santiment, Elastos could face notable selling pressure as the asset has been recording consecutive declines since reaching a local top of $4.6 on Jan. 2.

Per Santiment, the Relative Strength Index (RSI) of the ELA token currently stands at 74.7. The RSI indicator suggests the possibility of a further price drop as the asset’s bullish momentum might have been triggered by big players.

With the recent spike, Elastos registered a 425% price rally over the past year after falling to an all-time low of $0.79 on Jan. 3, 2023. The price hike started in mid-December 2023 after the blockchain developer announced a layer-2 network for Bitcoin (BTC) — calling it “Bitcoin Elastos Layer2” or “BeL2” for short.

Despite the recent price rally, ELA is still down by 95% from its all-time high of $93.9, which it hit on Feb. 24, 2018.

Read more: Modest investors turned into millionaires via Solana rally