Tether (USDT) is live on the Aptos chain, after months of preparation. The launch comes as USDT’s supply continues to rise, going above 120B tokens. Aptos has also gained ground by itself.

Aptos is the latest chain to support native Tether (USDT) after more than two months of waiting. Aptos is one of the few L1 chains to expand in 2024, while most of the traffic went to L2 platforms.

Tether announced native USDT is live on the chain

USD₮ is now live on @Aptos pic.twitter.com/Yhjx9j7PBc

— Tether (@Tether_to) October 28, 2024

Tether (USDT) has selected a limited number of chains to create native, unbridged USDT. Usually, those chains facilitate some form of economic activity, especially payments. Aptos was chosen for its focus on payments, potentially building on the success that TRON and Toncoin (TON) have seen with the leading stablecoin.

“Aptos’ innovative technology offers the ideal platform for facilitating faster and more cost-effective transactions with USDT. This collaboration underscores our ongoing efforts to lead with innovation and support our users with stable, reliable financial tools,” stated Paolo Ardoino, CEO of Tether.

Tether already hosts stablecoins on other L1, including Solana, Tezos, and Kusama, as well as multiple Ethereum-compatible chains. Its USDT launches typically seek out active, well-connected chains that can ensure long-term liquidity.

Tether picked Aptos for its growth trend in DeFi, as well as its technology for providing fast, extremely cheap payments with USDT tokens. Aptos offers 1/100 of the fees of comparable L1 chains, along with low-latency transactions.

The new native Tether (USDT) address is already visible on the Aptos block explorer. The asset goes under the USDt ticker, not to be confused with USDT on Aptos, which refers to other types of bridged tokens.

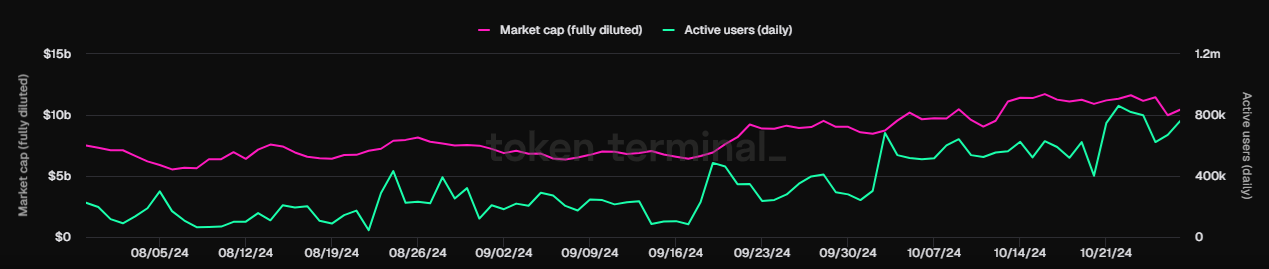

Tether pre-announced the Aptos launch on August 19. The launch announcement arrives at a time when Aptos already carries more than 700K daily active addresses after significant growth in the last few weeks.

USDT is now awaiting integration on apps and protocols running on Aptos. The Panora DEX is one of the first Aptos apps to announce the integration.

DeFi lending is relatively new on Aptos. The Echo lending protocol has become one of the main drivers of growth over the past month.

Aptos’ DeFi ecosystem has grown even before native USDT launch

Aptos already carries several tokens named USDT, due to bridging from other chains. The Aptos bridge holds $272.73M in stablecoins, out of $816.88 of all bridged assets. The bridge itself holds near-record value locked, coinciding with sustainable growth in daily active users.

Aptos is closing in on the $1B milestone held in its DeFi protocols, potentially surpassing more developed L2 chains. Aptos depends on 149 validators, spread worldwide across multiple regions. Most of Aptos’ validators run from European countries, contrary to the general shift of crypto projects to the USA.

In terms of funding, Aptos has already attracted $350M, similar in size to some of the largest ICO projects. Backers include Binance Labs and Dragonfly Capital, as well as a16z, Franklin Templeton, Coinbase Ventures, and Jump Crypto. More than 59% of APT tokens are still locked and held by early backers, and token unlocks will keep accelerating in the coming months.

Aptos is one of the older projects tapping into the euphoria of the previous bull market, though making some of its biggest moves in 2024. After the news of the Tether integration, APT expanded to $9.02, still far from its peak value of $18. APT has traded since early 2023, which means it avoided the worst of the 2022 bear market.

Aptos may be an overvalued chain, with a market cap above $4.8B, though only around $816B in value locked. Aptos also receives relatively small inflows from Ethereum, at around $4.78M as of October 28. The Aptos chain still carries relatively small apps, though the leading Kana Labs invites nearly 100K daily users.

As of October 2024, Aptos is the fourth-largest L1 that is not EVM-compatible. The chain is also in the top 10 of all L1 networks. Based on active users, Aptos is catching up to the Toncoin (TON) chain, one of the most active markets for USDT.

Aptos still carries small-value transactions, but has already surpassed SUI with its daily traffic. The chain carried 326M daily transactions, almost 10 times the traffic on Binance Smart Chain (BNB).

cryptopolitan.com

cryptopolitan.com