Aptos is poised to secure its lead as the blockchain network with the highest year-over-year growth in DEX trading volume in 2024. This is despite a little over 8 weeks left to conclude the year.

Aptos has achieved over 3420% growth in DEX trading volume within its ecosystem in the last 12 months. This placed it in poll position according to AlphaGrowth, based on data from Artemis and CryptoRank.xyz.

Top 10 Blockchains by YoY DEX Trading Volume Growth.@Aptos +3.432%@solana +1.789%@GnosisDAO +486%@flow_blockchain +391%@Starknet +380%@Celo +370%@StellarOrg +316%@Fuse_network +269%@osmosiszone +223%@trondao +175% pic.twitter.com/J85s80E6Dv

— AlphaGrowth (@alphagrowth1) October 24, 2024

Even more impressive was that Aptos almost doubled the DEX trading volume growth that Solana, the runner-up achieved during the Same period. The ranking and achievement highlighted the busy state of Aptos ecosystem.

Aptos TVL Soars To New Historic High

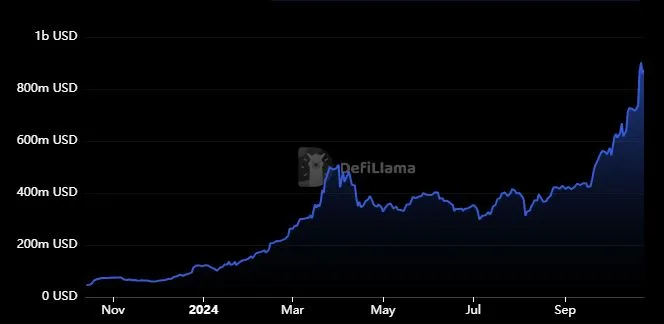

The latter was evident in the network’s total value locked which has achieved parabolic growth in the last four months. To put things into perspective, Aptos TVL had a 4-month low of $298.31 million on 5 July.

The network’s TVL figure recently soared to a new all-time high of $873.82 million on 24 October. Aptos TVL therefore grew more in the last 4 months than it did before that since its launch.

The performance reflects the robust rate of adoption that the network has achieved so far this year. TVL goes hand in hand with stablecoin growth for healthy liquidity flows within the ecosystem.

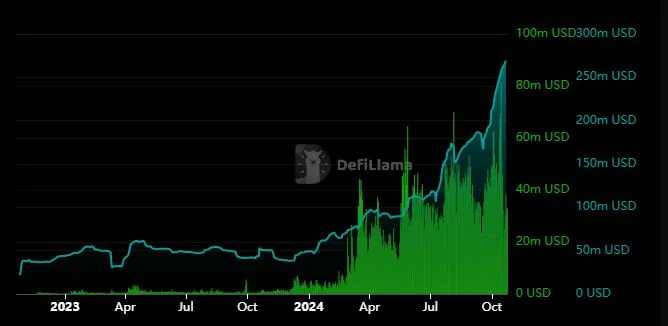

Unsurprisingly, Aptos stablecoin marketcap also soared to a new ATH of $271.37 million on 24 October.

Aptos on-chain volume has also enjoyed explosive growth so far this year. Daily volume recently hit a historic high above $81 million in mid-October. An impressive figure considering that the daily on-chain volume was lower than $2 million on 1 January 2024.

APT on track for a recovery after a bearish Q2 2024

Aptos native cryptocurrency APT has been subject to long term price action swings. It spent most of 2023 on a bearish trend but achieved a 303% upside from October 2023 to March 2024.

The cryptocurrency’s latest swing low resulted in a 77% pullback from March highs. It entered recovery mode from August lows and has since achieved a 158% rally to its latest local peak at $11.24.

Despite its recent recovery, APT’s latest price level was still a long way from its historic all-time highs. The network’s latest performance may underscore its attractiveness to potential investors. This is because its growing DeFi ecosystem.

APT’s latest rally also drew some parallels with its performance from October 2023 to March 2025. If history repeats or rhymes, then the cryptocurrency could be on the verge of another explosive run-up in the next 2 months.

thecoinrepublic.com

thecoinrepublic.com