Top-5 Trends Augmenting the Growth of IoT Gateway Devices Market by 2027

Advent of process automation, robotics, and Industry 4.0 across the manufacturing sector, coupled with the expansion of healthcare, semiconductor, and consumer electronics sectors, has instigated the adoption of efficient connectivity solutions. In this regard, IoT gateway technology is gaining wide prominence as it enhances productivity and output which helps in achieving faster time-to-market. The increased technology significance in a wide range of industries is expected to drive IoT gateway devices market proceeds over the coming years.

The industry growth is being further fueled by increasing government investments toward empowering the industrial sectors. For instance, in May 2021, the South Korean government announced allocating USD 451 billion by 2030 to bolster domestic semiconductor industry space. Apparently, this will further increase the adoption of AI, IoT, and Robotic Process Automation (RPA) across semiconductor manufacturing facilities. This will provide lucrative opportunities to IoT gateway device manufacturers.

According to the latest report by Global Market Insights, Inc., IoT gateway devices market size is projected to exceed USD 20 billion by 2027, given the prominence of the below-mentioned trends:

New product offerings by major market players

Numerous players active in IoT gateway devices industry are largely focusing on enhancing their research work in order to accelerate their offerings in new industry verticals. The latest example of such developments is Cisco’s new series of Catalyst industrial routers for fixed asset and mobile connectivity and a range of IoT gateway systems for IoT use cases. Introduced in June 2021, this new product portfolio is expected to extend the enterprise network and SD-WAN and would allow companies to leverage that valuable data to power up connected operations.

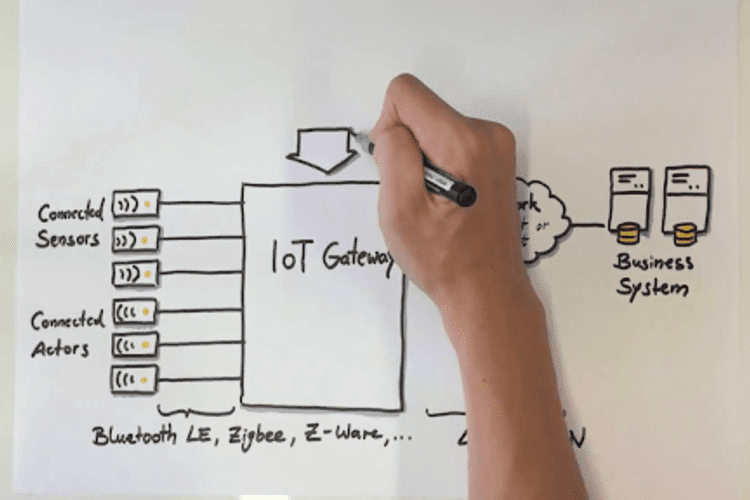

Mounting popularity of ZigBee technology

The elevating popularity of ZigBee technology can be attributed to its high-end features offered by it, such as energy efficiency, high-end encryption, and wireless communication of a long-range of up to 100 meters. Reportedly, the ZigBee segment is estimated to observe a lucrative CAGR of 13% through 2027. Zigbee connectivity operates on the radio frequency of IEEE 802.15.4 and is majorly used to control and monitor devices across consumer electronics, medical and industrial sectors. Zigbee Alliance, in April 2020, collaborated with Digital Illumination Interface Alliance to develop IoT luminaries space systems. The collaboration is anticipated to increase the standardization of IoT gateway devices.

Growing adoption of sensors

Sensors find extensive applications in healthcare, automotive, consumer applications, and home automation systems. They collect data mainly from their surroundings and transfer it to the connected devices for processing of the signal, which is indirectly or directly connected to the IoT networks. These sensors are integrated into the IoT devices and are used for monitoring physical parameters like pressure, temperature, proximity, humidity, flow, etc. Given the high product usability, the sensor segment is projected to record an appreciable CAGR of over 13.5% by 2027.

Heightened demand in the healthcare sector

Ongoing digital transformation and the increasing need for connected medical devices and remote health monitoring have fueled the demand for IoT gateway devices in the healthcare domain. This has urged market players to introduce more innovative IoT solutions for healthcare which in turn is supporting the industry growth. For instance, in January 2021, Zyter, Inc., launched a Bluetooth-based IoT gateway system for smart hospitals to enable patient monitoring, patient tracking, hospital bed device monitoring, etc. Considering the increasing demand, the healthcare segment is estimated to register a substantial CAGR of over 17.5% through 2027.

Increasing demand for smart consumer electronics in Europe

A considerable rise in the demand for consumer electronics, home automation solutions, and connected devices in Europe has positively influenced the industry space. The establishment of new regulations and the introduction of new initiatives by the European government to protect the data and privacy of residents has impelled the adoption of IoT security solutions. Quoting an instance, in January 2020, the UK government established a law for enhancing and strengthening the security standards for IoT-connected devices across various households. In light of these factors, the European IoT gateway devices market had held around 18.5% share in 2020 and is expected to observe a robust CAGR of over 14.5% through 2027.

About the author

Despite being armed with rich corporate exposure in the software and marketing domains, Shreya Bhute nurtured a deep interest in content development. Intrigued by the same, she took to writing as a career and currently pens down diverse articles pertaining to the business, automotive, healthcare, and chemical sectors. Shreya holds an engineering degree in Information Technology and has relevant experience in the field. Her other interests include reading, gardening, cooking, and restaurant hopping.