Simplifying Crypto Perpetuals with the Bella Signal Bot

Perpetuals (perps) trading is a liquidity lodestone with over $249.5 billion trading volume across Decentralized Exchanges (DEXs) in Q3 2024. This reflects its limitless opportunities and growing popularity.

But perps can get too complicated too soon. From analyzing market trends and navigating regulatory changes to profitably managing positions, it can be very daunting.

To address these challenges, Bella Protocol launched the Bella Signal Bot in September 2024. This AI-powered trading assistant simplifies perpetual trading by delivering real-time, actionable insights. Designed for both beginners and seasoned traders, the bot is transforming how users interact with the dynamic crypto markets.

Perpetuals trading 101

Perpetuals futures contracts or Perps allow traders to speculate on asset prices without any expiration date. Thus unlike simple futures, these contracts don’t require settlement at a fixed time, giving traders the freedom to hold positions indefinitely.

Broadly, traders have the following choices when dealing with perps:

- Going Long: Buying in anticipation of a price increase.

- Going Short: Selling to profit from a price decline.

- Closing: Exiting a position to lock in profits or prevent further losses.

Perps are closely tied to an underlying asset’s spot price through a mechanism called the funding rate, which ensures minimal deviations.

However, though perps offer flexibility, trading these instruments effectively requires a deep understanding of market dynamics. That’s where the Bella Protocol comes handy, simplifying perps trading for all.

Bella Signal Bot: AI-Driven Models for Every Trading Style

There are five AI models at the core of Bella Signal Bot, each tailored to specific trading styles and market conditions. They analyze live and historical data to provide actionable signals that traders can use to make well-informed decisions.

1. KnightML

KnightML is perfect for traders seeking flexibility in their strategies.

-

How it works: This model generates incremental long (buy) and short (sell) signals, allowing traders to adjust their positions based on subsequent updates. Rather than committing to a full position immediately, traders can scale in or out as new signals are received, providing a more controlled and adaptable trading experience.

-

Use case: Ideal for traders looking to align signals with their unique strategies and risk preferences, offering the ability to fine-tune exposure in response to evolving market conditions.

2. ViperAI

ViperAI specializes in detecting and capitalizing on sustained price trends, whether bullish or bearish.

-

How it works: Operating within a market-neutral framework, ViperAI employs deep learning algorithms to analyze granular market data, including price action, volume, and transactional patterns. It generates definitive long or short entry signals, accompanied by built-in stop-loss mechanisms to mitigate risk.

-

Use case: Suited for traders aiming for consistent returns across various market conditions. ViperAI’s ability to adapt to both upward and downward trends makes it a robust tool for navigating market volatility.

3. AI Directional Risk

For traders prioritizing risk control, AI Directional Risk is the perfect companion.

-

How it works: This model segments the market into two distinct zones—favorable (green) and unfavorable (red)—based on an advanced assessment of risk probabilities and market stability. It provides recommendations on scaling positions up or down accordingly.

-

Use case: Ideal for traders seeking to balance risk and reward, allowing them to adjust their exposure to align with the prevailing market regime and minimize potential losses.

4. AI MeanRev

AI MeanRev excels in capturing short-term trading opportunities in range-bound or oscillating markets.

-

How it works: The model identifies price turning points, such as local highs and lows, to provide signals for short-term trades. With an average holding period of about one day, it is particularly effective in markets exhibiting low volatility where other trend-following strategies may underperform.

-

Use case: Designed for traders focusing on capitalizing on minor price fluctuations and seeking quick profits during periods of market consolidation.

5. OptimaShort

OptimaShort is specifically engineered for bearish market conditions, enabling traders to profit from declining prices.

-

How it works: Building upon the foundation of ViperAI, OptimaShort incorporates core technology updates and rigorous parameter optimization to detect sharp downward market movements. While primarily focused on short positions, it occasionally provides long signals to capture corrective bounces.

-

Use case: Essential for traders aiming to maximize returns during market downturns, offering a strategic advantage when traditional long strategies may falter.

By selecting the AI model that best aligns with their trading strategy and market outlook, users can effectively navigate various market scenarios—whether seeking flexibility, advanced risk management, or trend-tracking capabilities.

Getting started with Bella Signal Bot

Setting up the Bella Signal Bot is simple and intuitive. Users simply need to complete the following steps:

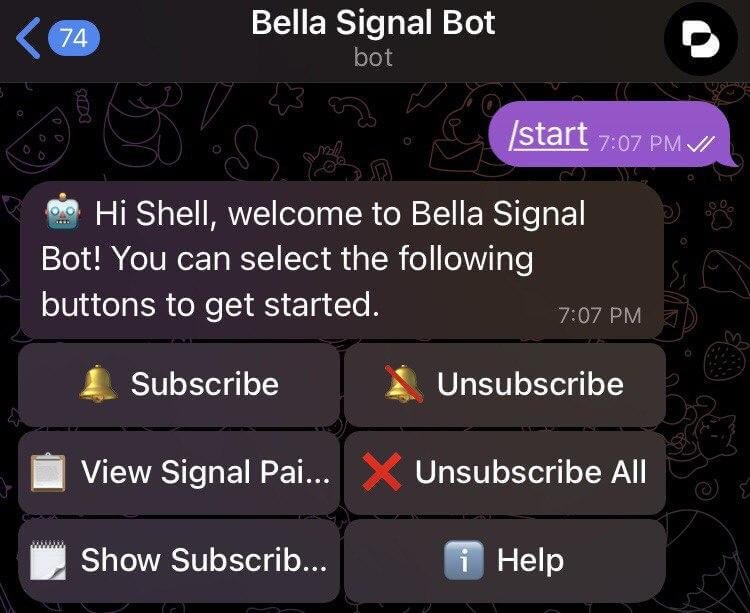

1. Subscribe via Telegram: Visit the Bella Signal Bot link and type /start to activate.

Image 1: Main Menu

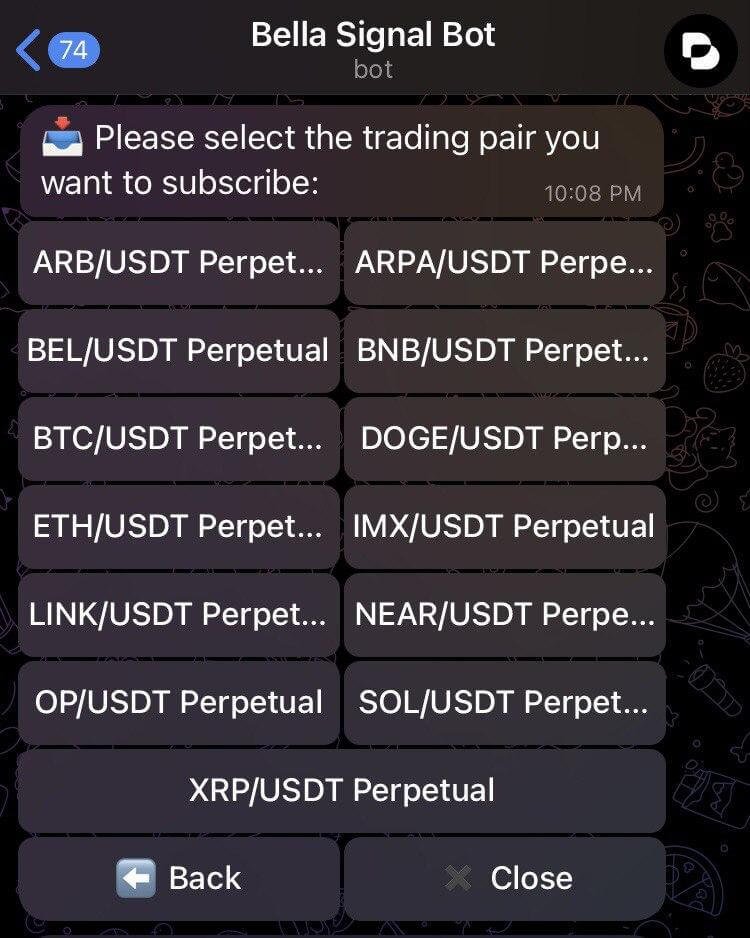

2. Choose Token Pairs: Select from popular options like BTC/USDT, ETH/USDT, and more.

Image 2: Token Pair Menu

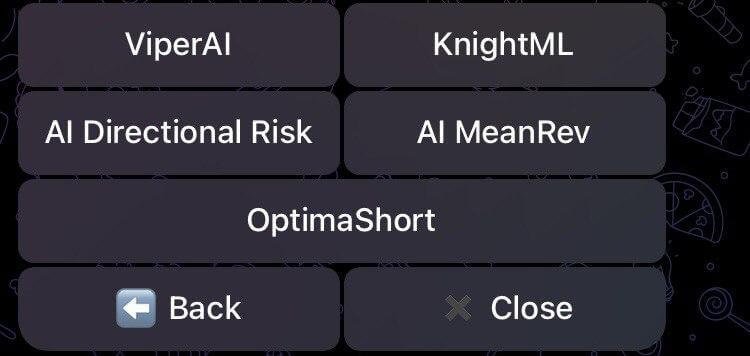

3. Pick an AI Model: Align your strategy with the capabilities of KnightML, ViperAI, or others.

Image 3: AI Model Menu

4. Execute Trades: Receive signals and act manually to open or close positions.

The bot delivers notifications directly to Telegram, ensuring traders stay informed and can respond quickly to market movements.

WAGMI with Bella Signal Bot

Bella Signal Bot makes crypto perps accessible to all, beginners and pros alike. Real-time notifications via Telegram ensure traders don’t miss any opportunity. While the built-in stop-loss mechanism protects investments by closing positions at preset thresholds, reducing risks in volatile markets.

The bot supports a wide range of strategies, from momentum tracking with ViperAI to reversal spotting with AI MeanRev, and operates 24/7.

The Bella Signal Bot has already attracted over 1,500 traders within a month of its launch, proving its value as a reliable trading assistant.

By integrating cutting-edge AI models with user-friendly functionality, Bella Protocol has built a tool empowering traders to navigate perpetuals trading with confidence and ease.