Can Intel Make An Impact on the Bitсoin Mining Market?

Stepping into the thriving blockchain and crypto mining business, Intel has announced its first effort with a bang. At ISSCC 2022 conference, the chipset giant unveiled an application-specific integrated circuit (ASIC) chipset dubbed Bonanza Mine (BMZ1) that would offer a thousandfold better performance per watt compared to popular GPUs for SHA-256 based mining. The Chipset maker has also rolled out a BMZ1 chipset-powered 3,600W mining rig to showcase its real-life implementation.

Could Intel BMZ1 make a difference in the ASIC chipset market?

Raja M Koduri, Vice President, Intel, asserted through a letter the company aim to contribute "energy-efficient accelerators" to contribute and boost the blockchain technology. Intel has set up a custom computing group as part of the company's Accelerated Computing System and Graphics business unit to offer custom silicon platforms to offer customized performance for blockchain and other supercomputing platforms, Raja added.

Critical Facts About Intel BMZ1

- Bonanza Mine, the latest Intel chipset, intends to accelerate ASIC performance and reduce energy consumption by optimizing three critical parts: optimizing micro-architecture and data-path arithmetic circuits, implementing die-voltage staking at the board level, and introducing a three-phase latch based clocking technique.

- Intel claimed the technique would significantly reduce 50 percent clock power during hash operations.

- The system software of Intel BMZ will detect outlier engines during ASIC operation and deactivate them to help active engines deliver the best frequency and thus optimize the system's hash rate.

- The new ASIC chipset will deliver three balanced, power-saving, and high-performance modes and offers an efficiency between 34.5-47.7 terra hash per second at 1863 - 2849 W with a mining efficiency of 54-60 Joules/Terrahash.

- Intel's assertion concerning the BMZ1 has been well appreciated by the major bitcoin mining companies, including Blockstream, Jack Dorsey's Blok, Hive Blockchain technologies, and GRIID Infrastructure.

The Present Scenario of The Bitcoin Mining Market

Mining crypto, especially Bitcoin, has remained fun since its inception. In 2009, a miner would receive 50 BTC for mining each block in its early days. But the fundamentals of Bitcoin halving shrank the reward in half every four years and reduced it to 25 BTC per block in 2013. In 2016 and 2020, the block mining reward was lowered to 12.5 BTC and then 6.25 BTC. But considering the massive soar of Bitcoin pricing, the mining reward is still enormous.

However, mining Bitcoin is quite complex and comprises many perspectives, including hardware investment, electricity consumption, cooling requirement, and mining difficulty. In the initial days, the Bitcoin mining difficulty was set to 1, which has moved to 26.64 trillion in 2022.

The Bitcoin mining complexity changes according to the hash rate or the consolidated volume of computational power on the network to mine a 1MB block in 10 minutes. The complexity is supposed to surge further as the industry experts hint that more miners from North America, Russia, and several parts of Europe would join the force. In addition, the constant upsurge of Bitcoin's price and its global acceptance would encourage many enterprises and individuals to start mining.

Following the announcement of the Bitcoin mining exodus in China last year, the unclaimed slump in hash rate was capitalized by a plethora of North American and Canada-based miners to make stellar profits. Besides many big players, individuals joined mining pools to share the mining rewards.

Many veterans and new miners oversee the mining difficulty as the uncertainty and risk factors around Bitcoin mining are slowly going down. Investors in Bitcoin mining consider it a regular business and invest more money to churn their share from the upcoming gold rush.

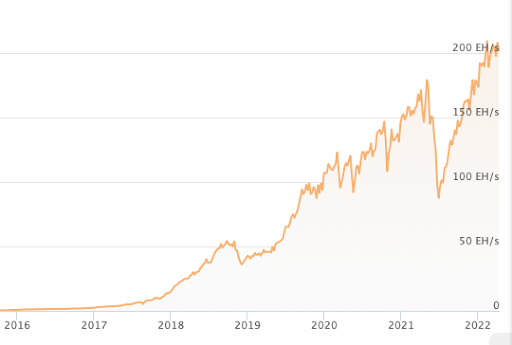

The rising hash rate describes the mushrooming of the Bitcoin mining community

Industry experts foresee the steady rise of the mining hash rate in a bracket of 300-350 EH/s by the end of 2022 from the present hash rate of 201.8616 EH/s at the current time of filing the story, which is roughly over a 50% increase in mining complexity.

Into the Future: The Mining Brawl

The increasing difficulty of mining hash rate foresees the large scale mining companies with more capital would rapidly fill the space by ingurgitating the smaller miners. Bigger scale bitcoin mining companies will intend to cut costs by implementing more higher efficiency mining machines at affordable prices. Because besides the higher throughput of the machinery, the miners would also have to follow the ESG (environmental, social, and governance) compliance in the coming days.

The trend of being carbon-neutral or renewable energy adoption among large-scale miners is already visible. They rapidly shift to solar, wind, hydro, and even nuclear energy for bitcoin mining. The miners would also look for more efficient machines such as AntMiner's latest mining rig, S19j XP, which can deliver 140TH/s at 3010W with a power efficiency of 21.5 Joules/Terahash. On the other hand, Intel is also expected to grab a large chunk of the market through its upcoming Bonanza Mine version 2 (BMZ2).

A latest SEC filing by GRIID hints Intel is all set to unveil its next-gen ASIC miner Bonanza Mine 2 (BMZ2) which would offer 26 power efficiency – Joules per Terrahash, in comparison to BMZ1's 54-60 Joules per terra hash. Of course, the BMZ2 will not be as power-efficient as the present market leader Bitmain S19j XP. But at a $5,625 price tag, Intel BMZ2 would undoubtedly challenge the existence of Antminer S19j XP, which is available at roughly $17,999.