Project Tokenomics: Problems and Solutions

The term “tokenomics,” or “token economics,” has become firmly established among the crypto startups. Bitnewstoday figures out what it really is, how to integrate it into the project properly, and what options of tokenomics exist.

The term “tokenomics” comes from a combination of the words “token” and “economy” and is a project token pricing system: how it is embedded in business processes and what functions it performs. The term is controversial and not very true, as the word “cryptocurrency” itself. Nevertheless, it became generally accepted. What is the fallacy of the term, explains economist Yevgeny ROMANENKO:

“The term (tokenomics), in my opinion, is artificial. Its target audience is those who create tokens within their start-ups and are trying to learn how to do it correctly, naturally, so that it does not look far-fetched. Example: if I create a business funded by equity or debt capital, I do not have such phrases as "stock economy", "bond economy", "entrance ticket economy" in my head (if it is assumed to be a business model).The economic meaning of security is obvious and needs no further explanation. Therefore, the phrase "token economy", or "tokenomics," leads me to a suspicion that the creator of the token does not clearly understand its economic meaning and feels the need to justify it for himself or for an audience of observers."

The problem of existing ICO projects

Tokens can have quite a lot of functions, depending on their purpose of use. Here are some of them:

- product / service use;

- access to the product / service;

- voting;

- property rights;

- control;

- reward;

- a discount;

- payment unit;

- profit distribution;

- security

Selecting the functions a startup can easily do without is one of the reasons for refusing to invest in it. It is worth mentioning that investment in crypto projects is very different from the classic venture or the IPO since crypto investor buys a token instead of a share in the company. The weak function of the token will not add advantages over competitors. And since the object of purchase is a token, it is important that it has a value.

Andrei FEDOTOV, founder of the TX Advisory consulting agency:

“Investors and users of the project should have the motivation to keep the token, and not to sell it a week after the listing, as it often happens. A year or two ago, there were quite a few projects from the media field that sold a service for tokens that you can buy for fiat, for example, a movie or concert ticket. Such projects have two drawbacks at once. The first is that such a token doesn’t need to be bought in advance, it is enough to buy a ticket one hour before the session, there is no motivation to keep it. The second drawback — there is no unique product. Very few people need a blockchain ticket if you can buy the same for the local currency at any cinema box office.”

You can add value to a token in several ways. Conventionally, they can be divided into artificial and natural. Natural are the functions listed at the beginning of the article (discount on the product, the voting rights, etc.) Artificial methods of stimulating the token price are described in the next chapter.

Ways to increase the price of tokens

The following method is used, for example, by the Binance exchange. It's all about buyback — repurchasing tokens from the market. The exchange directs a part of its net profit to buy BNB tokens from the market, which inevitably raises the price. The burning of tokens and the buyback are remotely similar, says the CEO and Founder at Credits Blockchain company Igor CHUGUNOV:

«The procedure of token burning is an effective tool to combat inflation and create favorable conditions for the growth of the price of a token. In essence, the operation resembles the practice of buying back a company’s shares when the supply is artificially reduced».

There are also options to defend against bounters who received tokens for free and sell them as soon as possible since selling at any price above zero brings them to profit. The share of tokens in the token-sale structure that goes to bounters is small — about 1%, and most of the top projects do without them. But 1% of all emitted tokens is quite a lot if we consider the mass sale scenario.

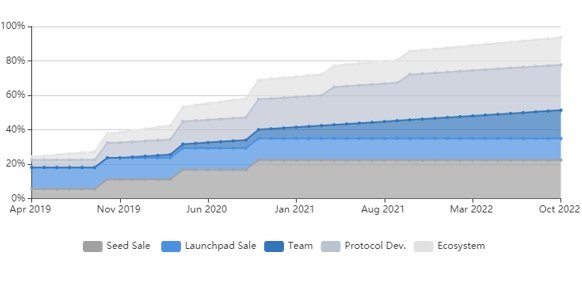

This in itself is capable of pushing the chart down, which will affect the entire market capitalization of the project. Freezing will help prevent abrupt inwarding of supply to the market. Freezing is usually used for the team and advisors, thereby stimulating to create a competitive product and at the same time showing the community that there is no reason to get rid of tokens because even those who created the project keep them. In this whole story with token freezing, it is important to achieve uniform unlocking. As an example, below is a graph of the IEO Harmony on Binance.

It is clearly seen that a quarter of the total volume is simultaneously on the market, the remaining tokens will be unlocked in three and a half years, and it is physically impossible to sell them, as they are frozen via a smart contract.

Buyback and burning have significant drawbacks. When scaling a project, adding new services or increasing the number of users, the same tokens will not be enough to cover all services. On the contrary, it is necessary to issue them additionally, and not to buy them out from the market and burn them (technically burning is sending tokens to a random unknown non-existent address from which they cannot be recovered). Simply put, if the current level of tokens can serve 10,000 clients, then when the client audience grows to 100,000, the number of tokens will have to be increased 10 times. Or it will be necessary to reduce the price by 10 times. Few people think about this since the main task of ICO is to attract money. The success of Bitcoin clearly showed that projects with a non-scalable domestic currency are not used as a means of payment, but are being accumulated in wallets, because their value increases over time.

Image courtesy of: The Biologist