Comparing Token Models: What Each Achieved in May 2019

First, it was the ICO, then it became the STO (the supposed ICO killers) and now it is an IEO. There is no shortage of vaguely similar three-letter acronyms in the Blockchain and Crypto space. But despite the literary similarity, each three-letter acronym represents a different fundraising model with its own characteristics and pitfalls.

Fundamentally, the three fundraising models allow organizations to raise capital directly from investors by leveraging the internet and blockchain technology.

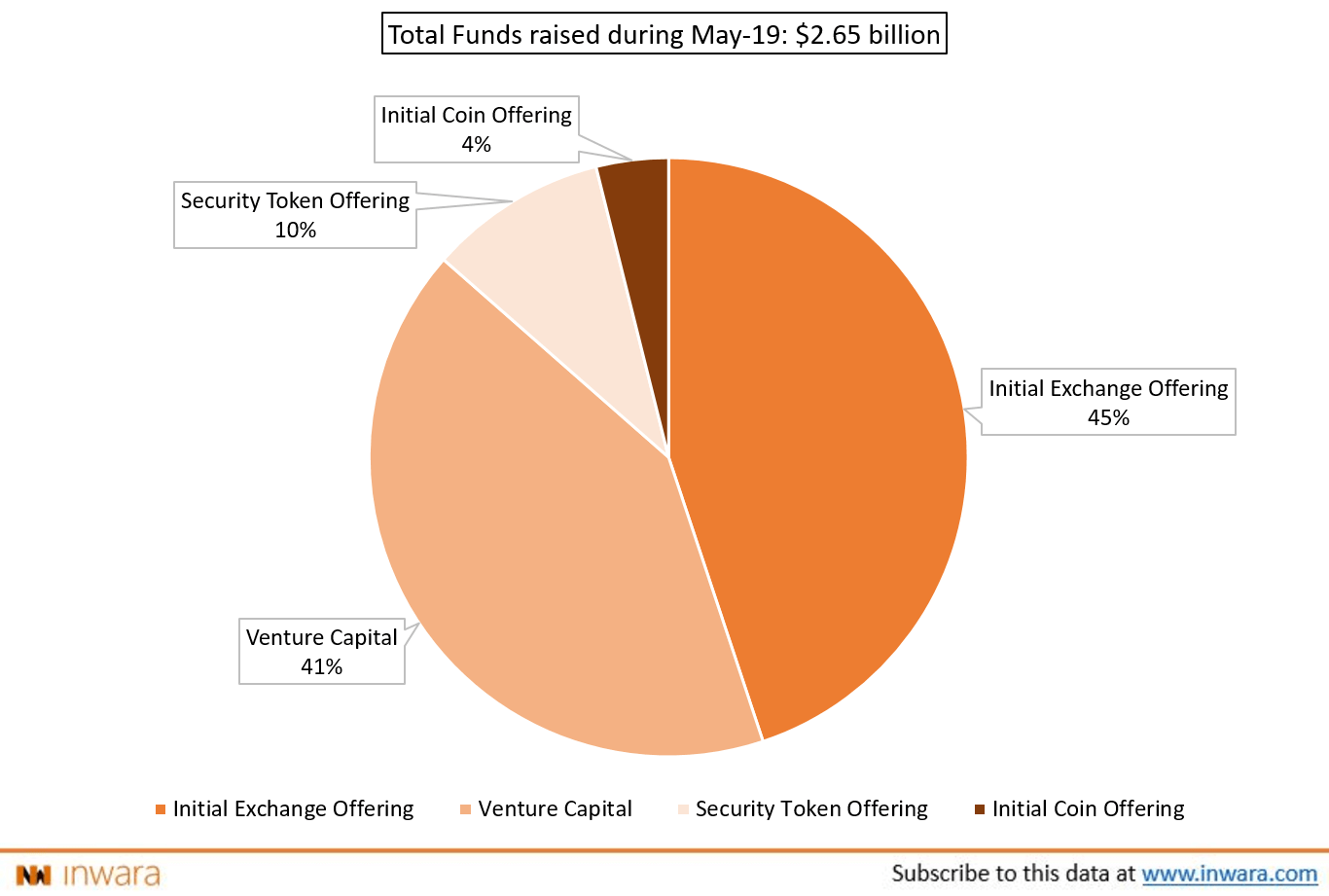

Over $1.5 bln was raised by entrepreneurs/organizations leveraging these more recent fundraising models — akin to 59% of the total funds raised in the blockchain and crypto space during May 2019, according to InWara’s monthly report. Interestingly, they take the majority of the pie with traditional VC funding raising 41%.

What are these fundraising models?

Initial Coin Offering (ICO) — One of the earlier crowd-based fundraising models. The concept was to issue cryptocurrency tokens or utility tokens which is sold online to investors in return for funds. The investor can use these “utility tokens” to gain access to the promised product/ service. The trouble with ICOs were the numerous ICO exit scams and investors quickly lost interest. For investor protection, ICOs faced stringent regulatory norms and in some cases bans in major countries like the US, China and South Korea.

Security Token Offerings (STOs) — As the name suggests, the STO offers the investor some security. But before we jump into what security tokens are, what’s a security?

The ‘well-known’ security is a financial instrument that offers ownership in an underlying asset. Similarly, security tokens are virtual currency backed by an underlying asset. This isn’t ‘revolutionary’, securities have been around for a while and with the advent of the digital age — investments in securities like stocks started receiving a digital certificate.

But critically, IEOs are launched by a third party organization ( usually, crypto exchange) rather than the project launching it themselves. These crypto exchanges essentially become “launchpads” for IEO projects. Imagine “Kickstarter” but for Blockchain and crypto projects. Crucially, though, here the promoter seems to make money independent of the performance of the underlying project (read: listing fees)

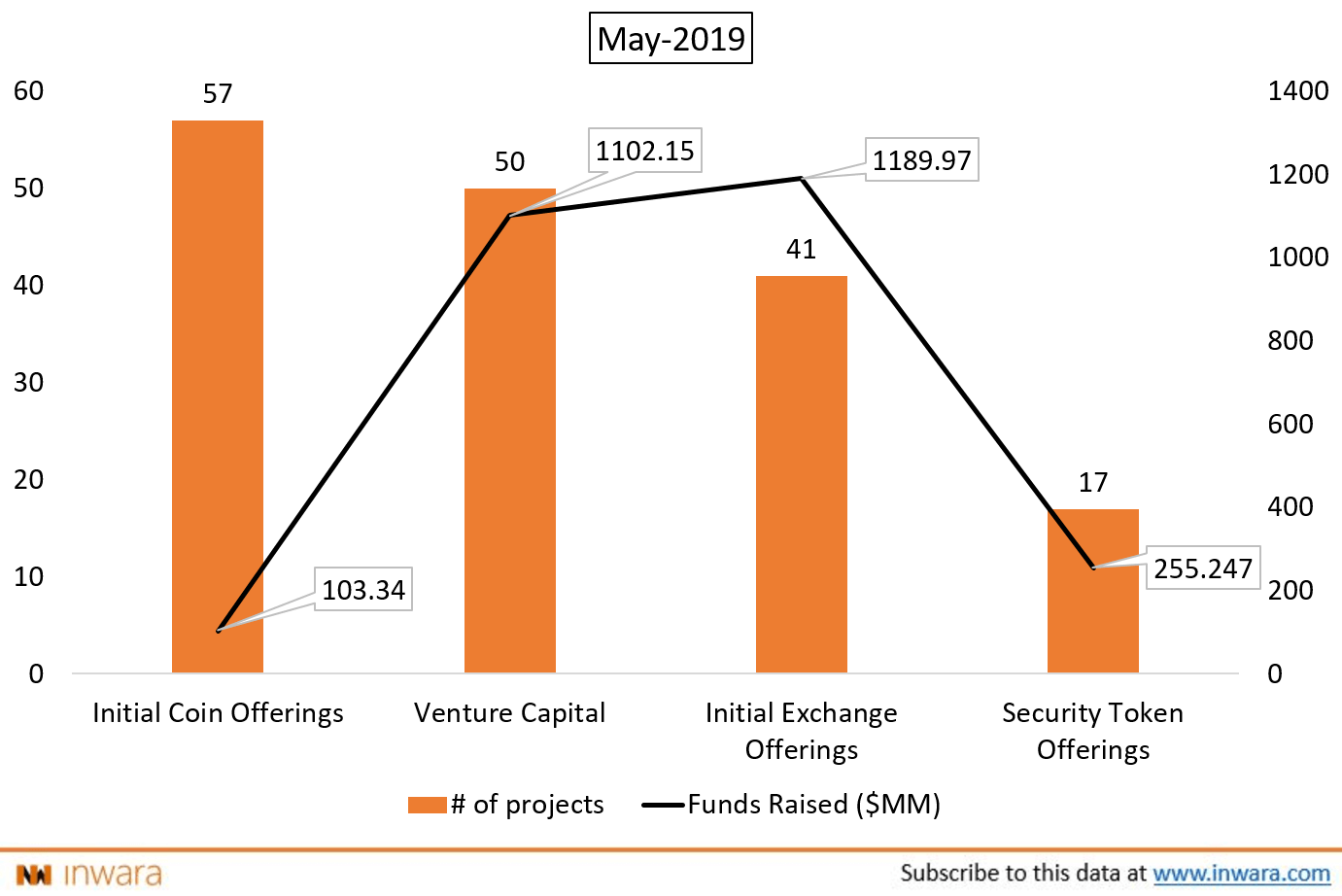

57 ICO projects managed to raise just $103 mln while $1.18 bln raised by IEOs and $255 mln raised by STOs, clearly indicating the public perception of ICOs.

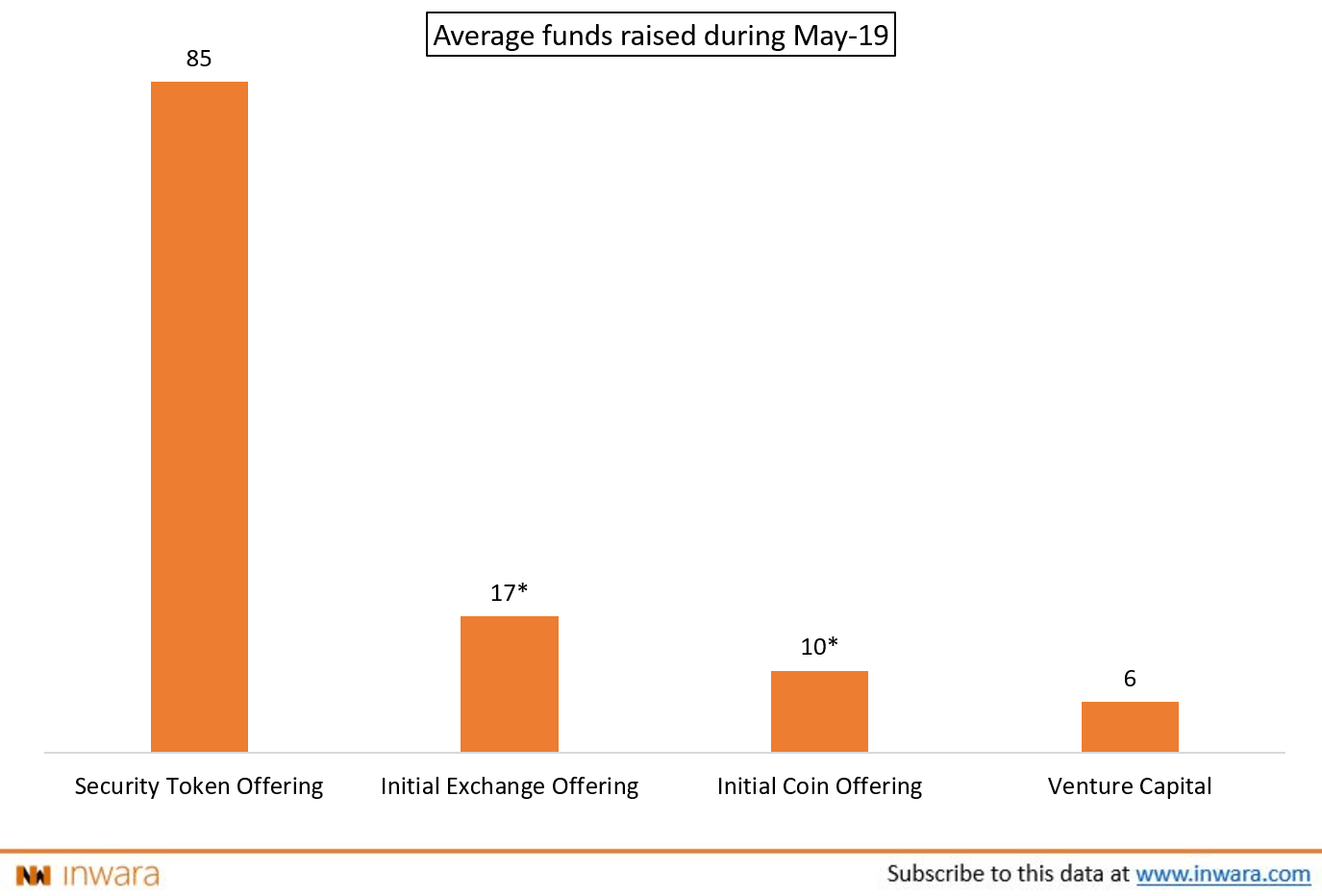

However, on average, STOs outperformed the other fundraising models. An average STO raised $85 million in May 2019 while the average IEO raised $17 mln while the average ICO in May 2019 could only manage $10 mln.

All data is taken from InWara’s monthly report: May 2019

Image courtesy of Coingape