Is It Time to Buy or Sell? EUR/USD Analysis Reveals Key Insights

In the ever-dynamic forex markets, trends often shift rapidly, sometimes catching investors off-guard. One such vital pairing that has seen its fair share of tumult is the EUR/USD. From cautious investors to daring risk-takers, everyone eyes this pair with interest, trying to decode its future trajectory. Today, we are going to dissect the intricacies of the EUR/USD and use the EUR/USD live chart technical analysis to provide a comprehensive understanding of this pairing’s potential opportunities.

A Look at the History

The Euro and the Dollar have always had a tumultuous relationship. Here are some key milestones and notable events in the history of the EUR/USD exchange rate:

-

January 1999: The euro was introduced as an electronic currency for financial transactions. The exchange rate at the time was fixed at 1 euro = 1.1743 U.S. dollars.

-

October 2000: The euro reached parity with the U.S. dollar for the first time, meaning 1 euro was equal to 1 U.S. dollar.

-

November 2000: The euro reached its all-time low against the U.S. dollar, dropping to around 0.8225.

-

October 2008: The global financial crisis caused significant volatility in currency markets, including the EUR/USD pair. The euro experienced a sharp decline against the U.S. dollar, reaching a low of around 1.2329.

-

March 2015: The euro reached its recent high against the U.S. dollar, surpassing 1.39, due to the European Central Bank’s (ECB) monetary policy measures.

-

June 2016: The United Kingdom’s Brexit referendum led to increased uncertainty in financial markets, causing the euro to briefly drop below 1.10 against the U.S. dollar.

-

November 2016: The U.S. presidential election resulted in the euro-dollar exchange rate dropping to around 1.05, as market participants anticipated potential policy changes under the new administration.

-

February 2018: The euro appreciated against the U.S. dollar, reaching a three-year high above 1.25, driven by positive economic data and expectations of tighter monetary policy in the eurozone.

-

March 2020: The outbreak of the COVID-19 pandemic caused extreme volatility in global markets, including the EUR/USD pair. The euro initially weakened against the U.S. dollar, reaching around 1.06, but later recovered as central banks and governments implemented various measures to support their economies.

-

Present: As of my knowledge cutoff in May 2023, the EUR/USD exchange rate was around 1.08, reflecting the ongoing fluctuations in the currency markets.

EUR/USD Technical Analysis: Understanding the Basics

Technical analysis is a technique that utilizes past price data and statistics to predict future price movements. The EUR/USD live chart technical analysis is an effective method to discern trends and make informed trading decisions. Here are some of its key components.

-

Price Charts. Traders typically use price charts to visualize the historical price movements of EUR/USD. The most common types of charts are line charts, bar charts, and candlestick charts.

-

Trend Analysis. Traders identify trends in the EUR/USD price movements, such as uptrends (higher highs and higher lows) or downtrends (lower highs and lower lows). Trends can help predict future price movements.

-

Support and Resistance Levels. Support levels are price levels where buying interest is expected to be strong, preventing the price from falling further. Resistance levels are price levels where selling pressure is expected to be strong, preventing the price from rising further. Traders use these levels to identify potential entry and exit points.

-

Moving Averages. Moving averages are used to smooth out price data and identify the overall trend direction. Commonly used moving averages include the simple moving average (SMA) and the exponential moving average (EMA).

-

Oscillators. Oscillators are technical indicators used to identify overbought and oversold conditions in the market. Popular oscillators used in EUR/USD analysis include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

-

Chart Patterns. Traders look for recurring patterns in the price charts, such as head and shoulders, double tops, or triangles. These patterns can provide insights into potential future price movements.

-

Fibonacci Retracement. Fibonacci retracement levels are horizontal lines drawn on a price chart to identify potential support and resistance levels based on Fibonacci ratios. These levels are often used to determine areas of price correction during a trend.

Current EUR/USD Analysis

As of May 19, 2023 EUR/USD pair continued to drop slightly, reaching $1.0760. The hourly chart indicates that this currency pair is still positioned below the 200-period moving average line (MA) on the H1 timeframe, which is currently at $1.0895. A similar situation can be observed on the four-hour chart. Considering these factors, it seems prudent to focus on a bearish direction in trading.

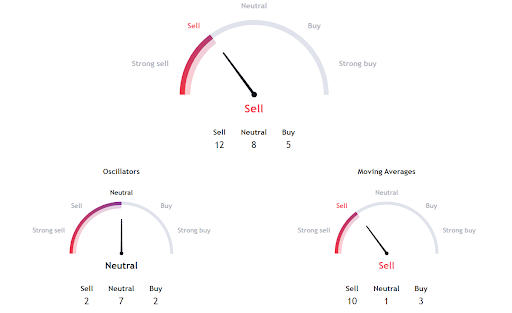

According to TradingView technicals on 1 month chart, EUR/USD pair shows mostly sell signals.

Fundamental Factors at Play

While technical analysis plays a significant role, understanding the fundamental factors affecting the EUR/USD is equally crucial. The forex market is influenced by a plethora of economic indicators like GDP, interest rates, unemployment rates, and political events.

Currently, the Federal Reserve’s stance on monetary policy, along with the European Central Bank’s actions, is shaping the EUR/USD trends. The ongoing geopolitical tensions on the global economy are other factors influencing this pair’s movement.

EUR/USD: Time to Buy or Sell?

Given the current market conditions, it is a challenging task to firmly say whether it is time to buy or sell the EUR/USD. From the technical perspective, the pair seems to be in the downtrend. The ongoing fundamental scenarios make it more intricate. Remember, the foreign exchange market is highly volatile, and currency prices can fluctuate rapidly. It is recommended to consult with a financial advisor or conduct further research to make an informed decision based on your individual circumstances.

Conclusion

The world of forex trading is not for the faint-hearted. It is important to keep in mind that the foreign exchange market is highly dynamic, and fluctuations can occur due to various economic, political, and geopolitical factors. Therefore, it is essential to continuously monitor the situation, adjust your strategy accordingly, and employ proper risk management techniques.

Remember, this article serves as a guide and should not be considered as financial advice. Always conduct thorough research and consult with a professional financial advisor before making any investment or trading decisions.