IEOs Popularity On the Upswing; Outdo STOs & ICOs In H1 2019

Initial Exchange Offerings (IEOs) have bested all other fundraising mechanisms including STOs and ICOs during H1 2019, according to Inwara's Blockchain and Crypto report - H1 2019.

Brushing up the basics, in case you’re not familiar with IEOs — you can think of them as the centralized cousins of ICOs. IEOs are token offerings launched exclusively on a cryptocurrency exchange(s), on behalf of the project that’s looking to raise funds.

During H1 2019, IEOs have been incredibly successful at raising funds, providing immediate returns to investors, offering an exit on an exchange and have also, and probably mainly, rekindled investor interest in the blockchain-based fundraising space.

Source: Blockchain and Crypto report - H1 2019

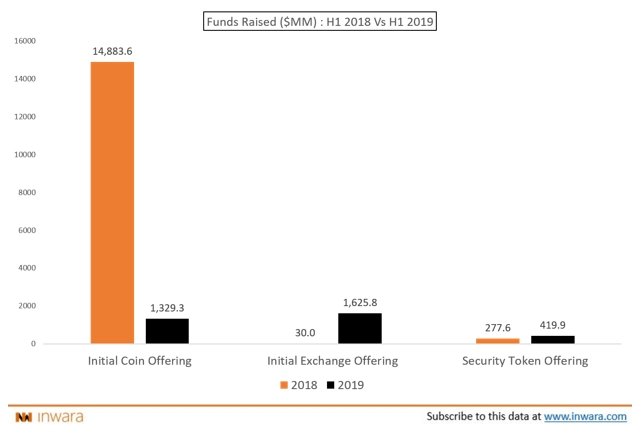

In H1 2019, IEO projects raised a whopping $1.625 billion, with a staggering growth of over 5000% YoY. This is reminiscent of the ICO hey-days and immediately draws comparisons considering the nascency of the investment vehicle. Even Security Token Offerings, despite their challenges towards achieving mass-adoption, managed to raise 51% more funds than the previous year.

However, the funds raised by Initial Coin Offerings (the mechanism that got the crypto ecosystem buzzing) has declined sharply by over 90% YoY. ICOs still managed to raise $1.3 billion, by no means a bagatelle. However, considering the ~$15 billion raised in H1 2018, the H1 2019 performance definitely pales.

Source: Blockchain and Crypto report - H1 2019

The little twist in the story? Bitfinex’s notorious LEO.

LEO’s contribution to the funds raised by IEO projects is $1 billion. Rather obvious when you look at the IEO funding trends.

Projects like LEO token are a rarity in the crypto space, much like how EOS was a rarity in the ICO space. But even excluding the funds raised by LEO token (as most good data scientists do!), IEO projects have managed to raise $625 million in H1 2019, outdoing the STO’s & VC’s contributions to space! So, IEOs, with their faults and dangers, have now become a force to be reckoned with.