How Terminals Automate Crypto Trading on the Example of Superorder

There are very few universal trading platforms out there with a direct focus on the new asset class of cryptocurrencies. Superorder is something of a new kid on the block in this respect, and it offers a new approach to crypto trading that is not available on most exchanges.

It is mostly based on the approach to codeless strategy building and overall simplification of trading. Below, we’ll investigate some of the pros and cons of this trading platform.

What is Superorder?

Superorder is a crypto trading terminal that specializes in:

- Cryptocurrency trading on several exchanges from one place.

- Customizable and fully automated trading strategies.

- Cryptocurrency trading bots for rent.

These are the three areas where this platform is differentiating itself – traders can easily create their own strategy in the Superorder builder, claimed to be like “playing with LEGO”.

Overview of Basic Concepts

Superorder is designed to make trading simple and streamlined without adding complexity but retaining functionality. The current methods for implementing trading strategies on terminals is needlessly complex.

With the Superorder LEGO-like model and clean interface, the process is quite easy-going. This can help new traders to learn and will preserve cognitive capital for experienced traders. Connecting your exchange account to the Superorder interface is a super easy task. You simply get API keys from your exchange and paste it into the Superorder terminal to get up and running. That’s it.

Cryptocurrency Trading Bots

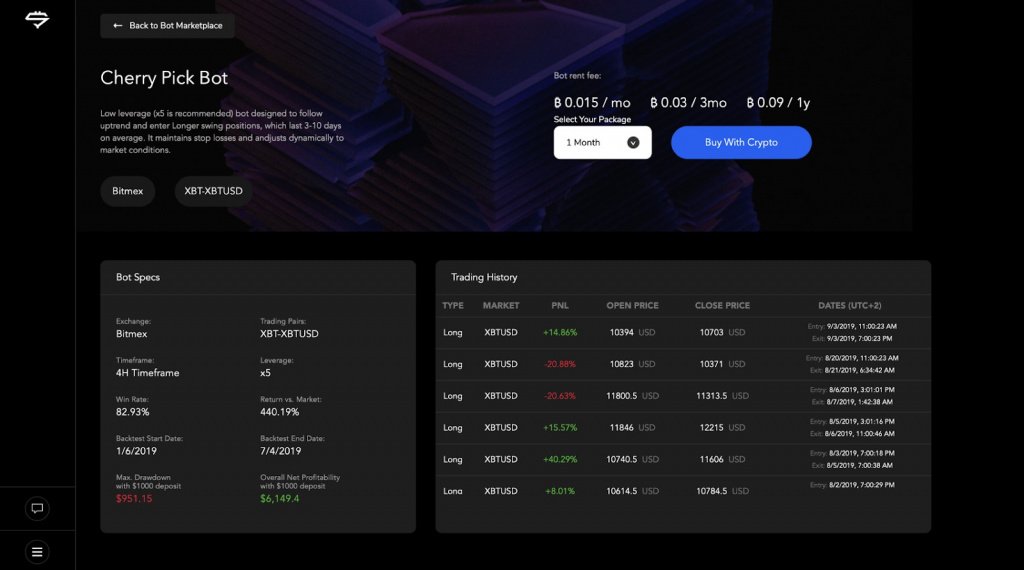

The platform also offers cryptocurrency trading bots for rent. You can look at the history and effectiveness of these cryptocurrency trading bots and select which one works for you. These bots are useful for both new and experienced traders.

The currently available bots include “Milk Scalper” (scalping-oriented), “Cherry Pick Bot” (for long trades), and “Happy Hammer” (for short trades). All of these customized bots can be rented, and the ones listed above BTC against the USD on the BitMEXexchange. Customers can see the net profit and market return of these bots, and determine whether the price is worth it. Of course, past performance is no indication for future success, but it is certainly a prime factor for placing trades.

Interface Elements

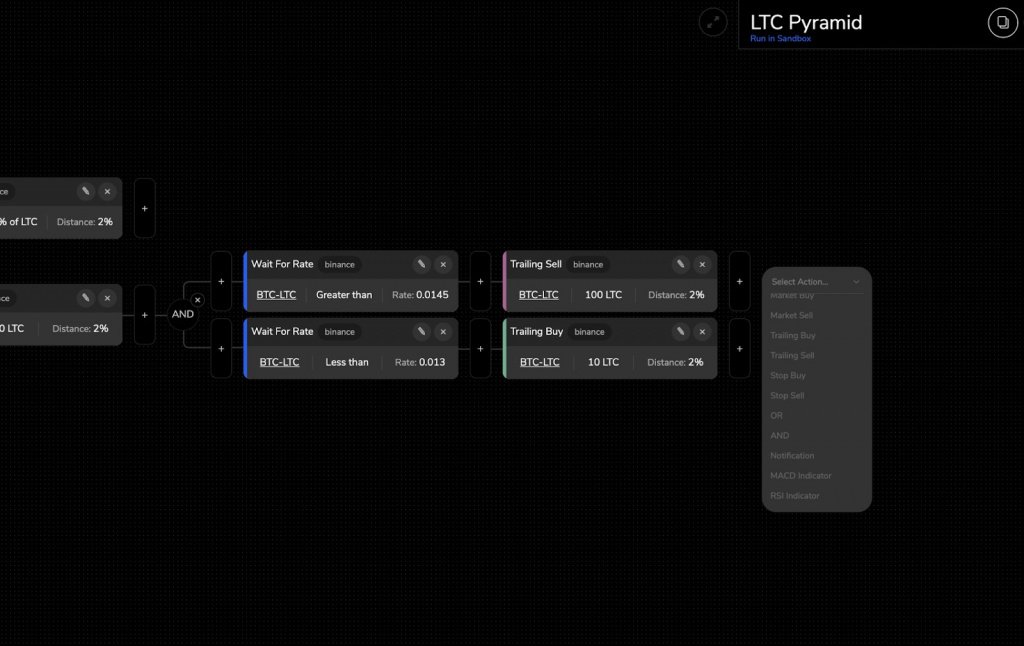

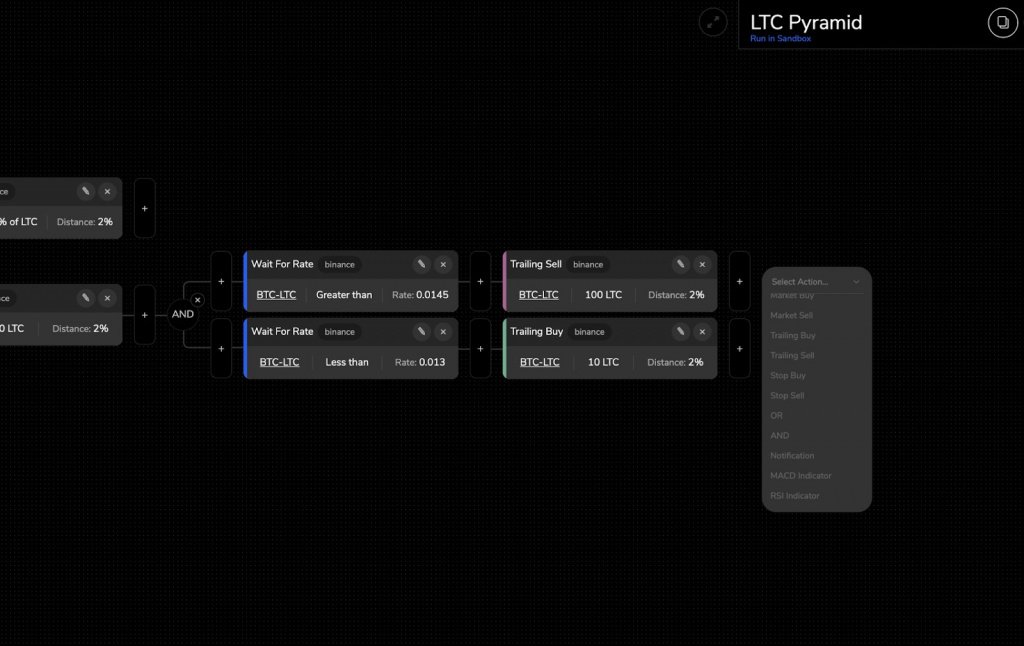

Superorder is perfect for both new and skilled traders. Users simply click on “create strategy” and are led on a step-by-step process to making their trade. The strategy can be modified or edited at any time, with the help of orders (Buy, Sell, Trailing, etc.), conditionals (Forks, Indicators), and Boolean operators (>, <, =, and so on). Strategies are “chained” together in the visual interface to provide a neater overview of how everything links together.

This visual approach to trading is something new, that is rarely seen with fiat trading exchanges. It actually provides a new way of conceptualizing trading strategies, which makes it easier to implement and modify. In a more general sense, the interface itself is smooth and well-designed.

The trading platform excels in its ease of use and customer strategy creation tools – it makes trading very easy and clear. The main issue is that it only connects to four exchanges right now, which might be a turn off for traders who prefer other exchanges, such as Coinbase.

The Distinctive Features

The most prominent feature of Superorder is the combination of a strategy building ideas and automation. The terminal lets every user create ultimate strategies without coding. Then, the platform watches prices and executes orders 24/7/365.

Surely, other features like crypto bots, customizable charts from TradingView, portfolio tracker, and Sandbox mode to test your strategies are worth attention, too.

Where it Stands Out

Most appealing about the Superorder platform is the LEGO building model with the links between trading positions. It is exactly the kind of novel design that helps new traders to understand the industry, while also making it easier for experienced traders to implement their strategies successfully.

Experienced traders will appreciate the simple design that still retains the sophisticated functionality of typical trading terminals. Existing models can be easily implemented for cryptocurrency trading.

Overall Conclusion

The platform is fast and super intuitive and delivers insights on the crypto market that is not available on more generic trading platforms.

It is certainly something new – there are few cryptocurrency-focused trading terminals that offer a similar level of functionality, and none that offer such a strategy-oriented model.