All I Want for Christmas: A Gift of $7B to Bitcoin Increase

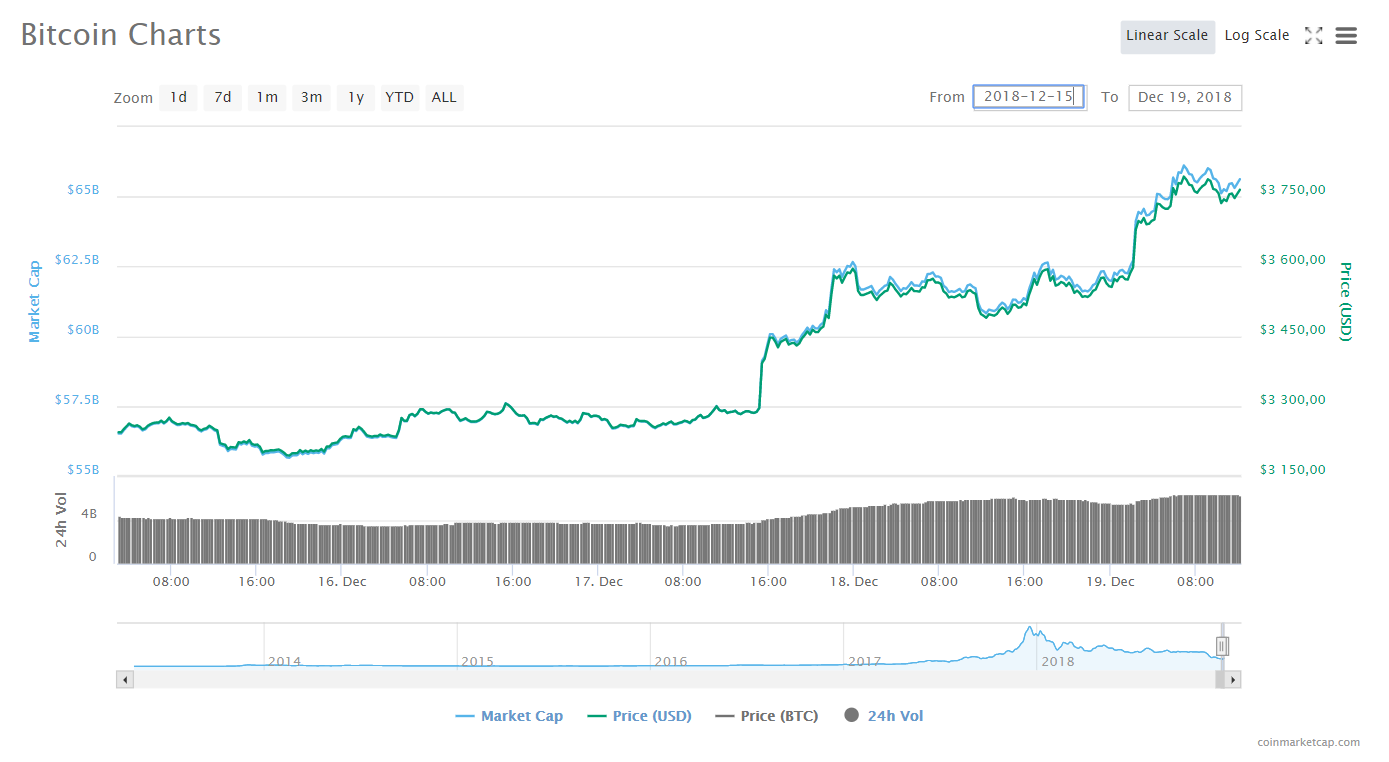

Christmas is in the air. If the whole last week Bitcoin was declining, this Monday it surprisingly began to recover and this positive dynamic has been gaining a momentum as today the main cryptocurrency has demonstrated the growth of more than 7%, exceeding the mark of $3,800. The jump was initially inflated by a sudden inflow of $2.8B in Bitcoin in just hour and a half. Later this Monday another $2B was poured, which led to the capitalization increase of 10% to $62.5B.

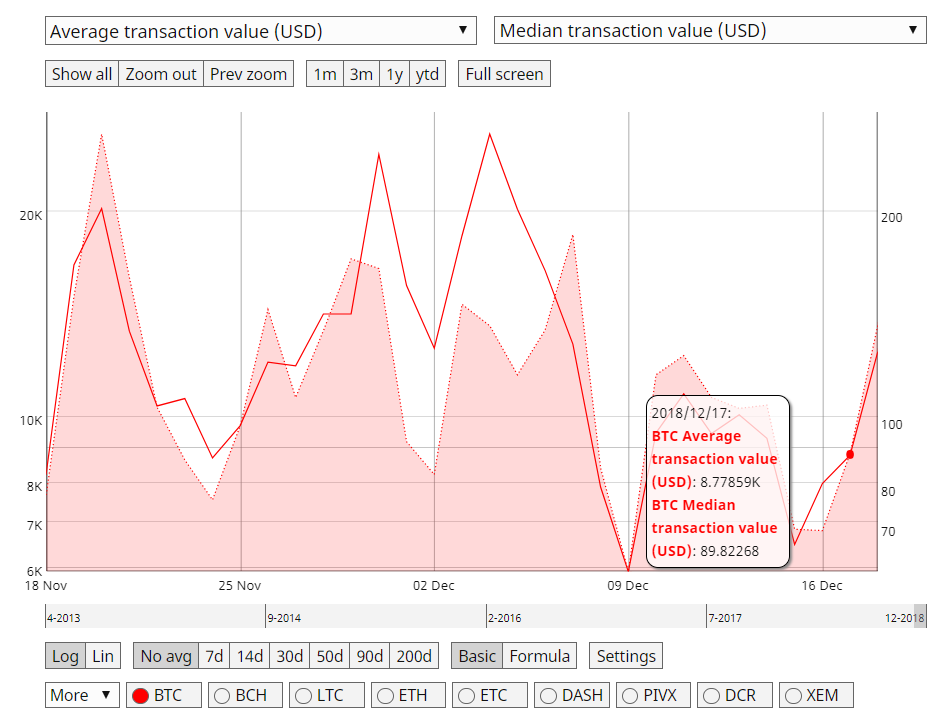

We could have assumed that crypto whales were the ones, who were behind those capital injections, however if we take a look at the transaction activity, it becomes clear that money came evenly as there was no significant spread between average and median transaction values and thus no transactions with extremely high value were proceeded.

So no one poured a big sum of money from one or few particular addresses. Taking into account that Bitcoin has been still climbing higher and higher since Monday, we can barely consider pump&dump in this case, although today from 4:39 a.m. to 5:39 a.m. (UTC) the BTC capitalization increased by another $2.2B.

Therefore it seems that the market itself could decide to support the falling currency from the drop below a psychological level: “Bitcoin is more than ever the driving force in the cryptomarket. Every investor is trying to gauge the bottom of the bear market and $3,000-3,300 seems like a potential mark hence this is an attempt of the bulls to regain control. Also a number of major financial institutions are moving in on the OTC market (according to Diar Bitcoin trading volume on the OTC desk of Coinbase increased by 20% in comparison with 2017 — ed. note)”, — points out our expert Stephane LAURENT, the Founder and CEO of the Chinese company that provides consulting services in the blockchain.

There was a reason to do so on the 17th of December especially. It was a big day last year when CME joined CBOE, opened trading of Bitcoin futures and the main digital currency reached its maximum: “Nothing special happened, except of the anniversary of the All-Time-High perhaps! Technical analysis shows the price was reaching a strong support line from where it pushed past the recent downtrend”, — believes our expert.

As we wrote earlier, the correlation with the recent state of the financial markets may play a role in the recent Bitcoin recovery. The Professor of the Islamic University of Istanbul Yücel KAMAR points out that there is “a chaotic-like circumstance in worldwide politics and economies: the trade war between the US and China, the current situation in Syria and Yemen, political conflicts both inside of the US and between Trump and the EU leaders, Brexit process, budget conflict between Italy and EU, etc. Moreover, Trump warns Fed not to raise interest rate anymore. All of these chaotic-like circumstances end up with an uncertain world, especially in an economic manner/ and cause high volatilities in the world financial markets & stock exchanges”. Hence these volatilities in the traditional financial sector and the Fed session dedicated to the rate hike, the demand for BTC could have started to rise as “people see BTC and other coins as alternatives for capital markets”, — concludes the professor.

However, are there any grounds to say that the reversal of the bear trend, that began on Monday, will keep on going? It’s too early to think so.

Institutional consultant and Bitcoin analyst Michael GRAUB expects the BTC price to grow only in the short term: “The trend is still down. I would expect the price to attempt to rally back to the 50 DMA before rolling back over to make new lows in 2019”. Stephane LAURENT sees Bitcoin ranging between $3,500-5,000, “where lies another resistance” over the next few weeks: “My personal estimate of a Bitcoin price low was $2,500 and I still believe that in early 2019 price will visit this average before initiating a definitive trend reversal.”

Another expert, the ICO advisor Jason FERNANDES believes the turning point may happen in April, when there is a deadline for tax declarations in the US: “Many investors are looking at large capital gains tax bills for profits in 2017 and they've been forced to hold their Bitcoin for at least a year in order to take advantage of lower long-term capital gains tax. Individuals who buy and sell Bitcoin in the same year are taxed on short term gains which can be as high as 39% whereas if they hold on to Bitcoin for more than a year before selling they're liable for long-term capital gains which can be as low as 15%.”

The beginning of the next year promises to be interesting with the expected Bakkt launch in the end of January and the SEC decision on the Van Eck Bitcoin ETF in the late February, that will not be postponed any longer: “If this plays out, it could be a pivotal moment in the history of Bitcoin”, — thinks Mr. GRAUB. He insists that the infrastructure around the world is being building, which includes all segments of the Bitcoin Network: “Only in the US Coinbase and Gemini continue to add more digital assets as well as Gemini has recently announced a new mobile app, that allows users to dollar cost averaging, which in my opinion is the best way for most investors to accumulate Bitcoin. One of the most exciting aspects of the infrastructure, that continues to mature, is the Bitcoin lending as BlockFi has received another round of VC funding. I continue to be bearish in the short term and I wouldn’t be surprised to see Bitcoin lower than $2,000 in 2019 for a brief amount of time. But Bitcoin is a long game, not a short game.”