The Impact of the Libra Announcement on the Crypto Space

Almost four weeks after the Libra announcement the buzz has died down and a more rational assessment can be made. I am commenting on this because, just like with Hyperledger or Stellar, the Libra Association includes big players, notably Facebook, with lots of funds, so Libra will create major waves in the crypto space almost independently of any other consideration. The Libra announcement was somewhat constrained and did not sound as boasting as sometimes marketing announcements are written:

“The Libra Blockchain is a decentralized, programmable database designed to support a low-volatility cryptocurrency that will have the ability to serve as an efficient medium of exchange for billions of people around the world.”

It talked about a decentralized database, a low-volatility currency and a medium of exchange. No fancy keywords or exaggerations there.

Impact on the Facebook Image

Entering the crypto space, although it has repercussions on the question of trust, as we will see below, has the appeal of high-tech. Creating a trading platform with a new “low-volatility” currency is also appealing.

General Impact on the Crypto Space

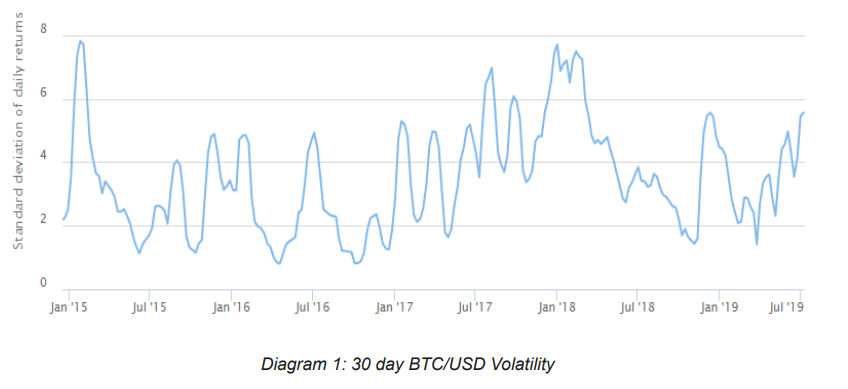

The Libra announcement is also great news for the crypto space in general, as another big player enters the field and adds its weight to dispel some of the fears that people have developed, after the Bitcoin debut, such as:

- thinking that all cryptocurrencies are volatile,

- equating using a cryptocurrency to gambling,

- thinking that most or all cryptocurrencies are illegal.

It is interesting that being a private distributed database, they could have announced support for thousands of transactions per second (tps). However, they are very cautious, announcing an initial 1,000 tps, as they are planning for a global service probably reaching much of the southern hemisphere. They also avoid comparing their network with current credit card networks and their performance, perhaps to promote the idea that their network will be decentralized and governed by an association of member companies.

However, the idea of governance by an association of trusted companies is not new. Some crypto networks are already functioning with that idea, notably R3, Stellar and Hyperledger. R3 being funded by several major financial institutions, Stellar being supported among others by IBM and Deloitte, and Hyperledger with partners such as American Express, Cisco, IBM, Intel, JPMorgan and NEC.

Thus, the announcement that Calibra, a subsidiary of Facebook, is just one of the initial 28 Founding Members of the Libra Association, on one side is not comparable yet to the cited examples, and on the other side it remains suspicious from the point of view of all those users of cryptocurrencies that do not trust any corporate or government entity.

Less Centralization

In both cases, I have also argued that decentralization is not sufficient to achieve peer-to-peer user interaction (See for example, here).

When the word de-centralization is used to indicate the sharing of authority by an owner, is it really solving the problem of control? In other words, if a subsidiary of Facebook is one of the players controlling the Libra network, does this make the network less subject to the control by one or a majority of its members?

In a private, permissioned network, where users trust their providers, “less centralization” may be all that is required. Financial institutions have been interacting under this principle since their inception and their users may see ‘a bit less centralization’ as substantial progress. However, the Libra announcement will not make an impression on those cryptocurrency users that are looking for a “trustless” alternative to the traditional banking system. That is a crypto network that does not require trusting intermediate entities. This market, currently consisting of about 100 million users, may not be the target of Libra, but it is almost doubling every year and it may dramatically increase if a scalable, second-generation public crypto network fulfilling the trustless requirements will seize the market.

Thus, we cannot really blame Libra for decentralizing control to a limited extent in a permissioned network, when the degree of decentralization in the first generation unpermissioned crypto networks is still very limited.

Low volatility

Libra announced that its currency will exhibit low volatility by using a reserve basket:

“As the value of Libra is effectively linked to a basket of fiat currencies, from the point of view of any specific currency, there will be fluctuations in the value of Libra. The makeup of the reserve is designed to mitigate the likelihood and severity of these fluctuations, particularly in the negative direction (e.g., even in economic crises). To that end, the basket has been structured with capital preservation and liquidity in Mind.”

The previous phrase sounds reassuring, but then we read that: “The reserve is managed by the Libra Association.”

The Libra Technical Directives

The Libra white paper mentions three main technical decisions:

1. Designing and using the Move programming language.

Move will be a programming language using smart contracts. Hopefully, Move will tighten up some of the security pitfalls present with smart contracts, but a final solution is far away from this approach. I have criticized the smart contract idea, its cost and its limitations (See, for example, here). Libra’s ‘move’ in my opinion is not a move in the right direction.

2. Using a Byzantine Fault Tolerant (BFT) consensus approach.

Libra’s plan is to use validator nodes. This means that they will use a first-generation (leader-based) consensus design. Libra aspires to become public and permissionless (more on this below), but such a plan would require a complete redesign. As I have also noted elsewhere (See, for example, this article) that the de-centralization of public crypto-networks using a leader-based consensus is not a solution to their current problems of scalability, throughput, security and cost.

3. Adopting and iterating on widely adopted blockchain data structures.

From the information provided the differences in data structure from current blockchain implementations do not seem fundamental. Are the Libra partners aiming to be uniquely innovative, or are they planning to copy others and do better marketing?

Validators

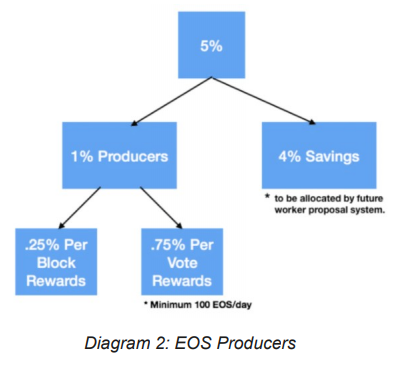

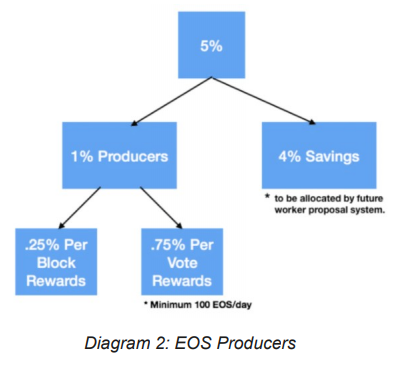

The Libra validators will have votes in proportion to their status (trusted founder, proof of stake, etc).

“Initially, the Libra Blockchain only grants votes to Founding Members, entities that: (1) meet a set of predefined Founding Member eligibility criteria and (2) own Libra Investment Tokens purchased in exchange for their investment in the ecosystem.”

This approach sounds very similar to what is currently used by EOS.

Future versions

The Libra plans for future version are not much more forward-looking. Ethereum had the idea of implementing the Proof of Stake (PoS) consensus years ago, and many other networks are striving to implement PoS. Considering the difficulties found by Ethereum, the expectations on Libra moving to PoS soon are low. Libra mentions:

“We aspire to make the Libra Blockchain fully permissionless. To do this, we plan to gradually transition to a proof-of-stake system where validators are assigned voting rights proportional to the number of Libra coins they hold.”

This is not a definition of permissionless. PoS by itself does not guarantee a permissionless crypto network. In fact, such a network would still require intermediaries (validators). If their plan is to change their design (move to PoS) and to implement gradual decentralization, why not to implement these ideas in the initial release and stabilize their design? Such a change will be more difficult once the product is released. Probably it is because there is no agreement on one PoS design and many PoS versions are being proposed. Thus, their announcement shows that they are aware that their consensus solution is not optimal and that they want to wait until the most acceptable version of PoS will surface.

Anonymity

Libra mentions:

“The Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity.”

Technically this is implied by their use of smart contracts. That is, smart contracts are uniquely identifiable, but their users are not. The inability to exchange data among uniquely identified users off the blockchain will cause space restrictions and higher cost for their blockchain, as with other crypto network implementations.

I also suspect that the various Security Commissions will not be happy about the inability of Libra to uniquely identify their users.

Conclusion

In conclusion, the Libra announcement can be classified as a good marketing move with no great technical innovation. As with any other design without a lot of added value, I suspect it will be profitable to Facebook only as a public relation initiative.

Of course, I could be completely wrong and Libra could overcome the challenges of producing a low volatility currency, becoming a competitive player in the permissioned arena and if their gradual decentralization objectives are achieved, becoming a player in first-generation, leader-based, “un-permissioned” crypto-networks. Such market success would create some urgency for government regulators, but would still be nothing to shout about, from the technical point of view.

About the author:

Giuseppe Gori is the CEO and Lead Designer at Gorbyte, a developing blockchain crypto network that is unpermissioned and uses a cooperative consensus mechanism that requires no miners/verifiers.

Image courtesy of Coindoo