In its latest report on Trends, Risks and Vulnerabilities, the European Securities and Markets Authority (ESMA) warns of potential threats to financial stability from cryptocurrencies and artificial intelligence, highlighting the need to develop a comprehensive policy framework to ensure these technologies are used in a safe and responsible manner.

Risks Associated with the Crypto Market

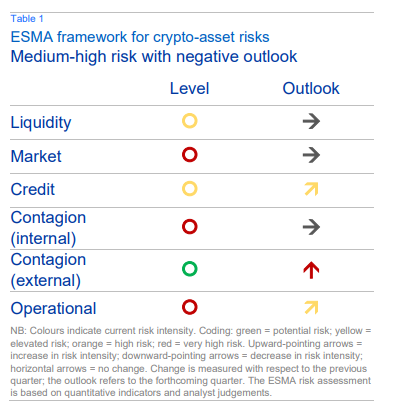

In terms of crypto assets, ESMA's risk assessment framework scores them along six dimensions and assigns each a risk level. According to the report, the crypto market risk, internal contagion risk and operational risk are “very high”, and are expected to remain so or even rise.

Source: ESMA Report on Trends, Risks and Vulnerabilities

The report states that market risk, or the risk that crypto valuations will decline, remains “very high”, along with internal contagion risk, or the risk that a single platform or protocol will fail and affect the wider crypto market. Operational risk is expected to increase in intensity, whereas market risk and internal contagion risk are expected to remain at the same level.

Even though this could impact the wider financial system, ESMA says there is little risk at the moment. It has warned, however, that without adequate rules and supervision, things could get worse.

Also, it pointed to high credit risk and liquidity risk in the crypto market, but with a predicted increase in credit risk and the same high level of liquidity risk.

Risks Associated with AI

ESMA has also identified the potential dangers associated with generative AI. Among these risks are those associated with transparency, accuracy, and reliability of information, and the risk of malicious actors manipulating markets with artificial intelligence. Lastly, the risk exists of a narrow pool of providers having a monopolistic grip on the best LLMs and AI models, which could pose operational and dependency problems.

Even though ESMA considers these two innovative technologies as threats, we are open to seeing how they complement each other and can alleviate these risks.

Since crypto-AI has emerged as a business model, the intersection of these technologies has been attracting an increasing amount of interest from investors. Crypto projects focused on AI, privacy, and identity have received $422 million in investment so far this year between January and June. It's interesting looking deeper into the problems these projects aim to solve.

Using Crypto to Solve AI Risks

One of the advantages of blockchain technology is that it can protect from the risk of inaccurate information posed by generative artificial intelligence. Cryptographic algorithms can provide a secure way to authenticate AI-generated content, which can help ensure that it is not manipulated or faked. They can, for example, identify fake news, verify photos and videos, and detect spam.

Additionally, through decentralized identifiers (DIDs) and self-sovereign identity (SSI), crypto can provide solutions to identity verification issues, where users can verify themselves with their private keys or store their identities on their devices, without the use of centralized databases.

ESMA also mentioned that AI may be centralized in the hands of a few big tech companies, a problem that crypto may solve as well. With decentralized AI research and development using decentralized data and computation marketplaces, crypto can prevent AI monopolization. In this way, AI services could become more inclusive, with users having a voice in their development.

Using AI to Solve Crypto Market Risks

Artificial Intelligence can be valuable in diminishing operational risks by helping with blockchain security. AI can, for example, be used to examine blockchain transactions for suspicious activity, recognize fraud, and analyze network problems, improving consensus protocols and smart contracts.

Artificial intelligence can also mitigate crypto market risks by providing more accurate predictions about market trends, analyzing sentiment, and identifying arbitrage opportunities. Additionally, AI can be used to monitor crypto exchanges, detect market manipulation, and provide better risk management.

AI can solve crypto market liquidity risks by analyzing large swaths of data to identify trends and detect market anomalies and suspicious transactions.

Conclusion

Despite the risks associated with crypto and artificial intelligence, these two technologies can be complementary. Crypto can provide solutions to AI challenges such as authentication, identity verification, and monopolization, while AI can be used to improve the security of crypto networks, detect market manipulation, and improve market liquidity. AI and crypto can be used together to create a more secure and efficient network with increased trust, better liquidity, and improved user experience.

______

About the author

Maria Carola is the CEO of StealthEX.io, an instant, non-custodial cryptocurrency exchange with over 1,400 assets listed. After graduating the University of Vilnius, Maria spent almost a decade in the crypto space, working in marketing and management for a variety of blockchain projects including wallets, exchanges and aggregators.

cryptonews.net

cryptonews.net