While market-making, order-flow, and trading platforms like DEXs find their product market fit with institutional crypto investors, Pump.fun appeals to the average retail trader via meme coins. The platform has shifted the dynamics of speculative trading in crypto markets and, as a result, lowered the barrier to entry for many users. Here’s what you need to know about the meme coin launchpad in 2025.

- What is Pump.fun?

- How does Pump.fun work?

- Why is Pump.fun popular?

- Pros and cons of Pump.fun

- The enigma of Pump.fun’s open-access model

- Frequently asked questions

What is Pump.fun?

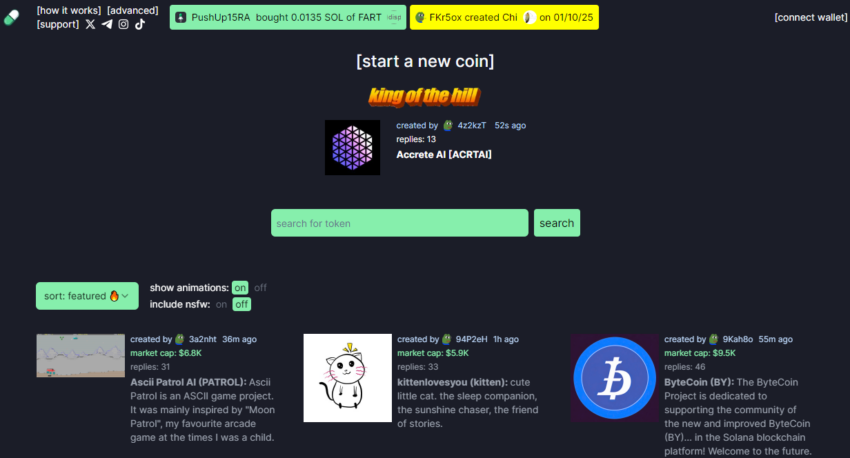

Pump.fun (pronounced pump dot fun or shortened to just Pump) is simply a launchpad for tokens. The platform is primarily for users looking to launch meme coins. It was created on Solana and has been active since January 2024.

While much of the information about Pump is hidden in a black box, the creator is pseudo-anonymous, goes by Alon, and often reveals information about the platform and its origin on social media.

Comment

byu/a1lon9 from discussion

insolana

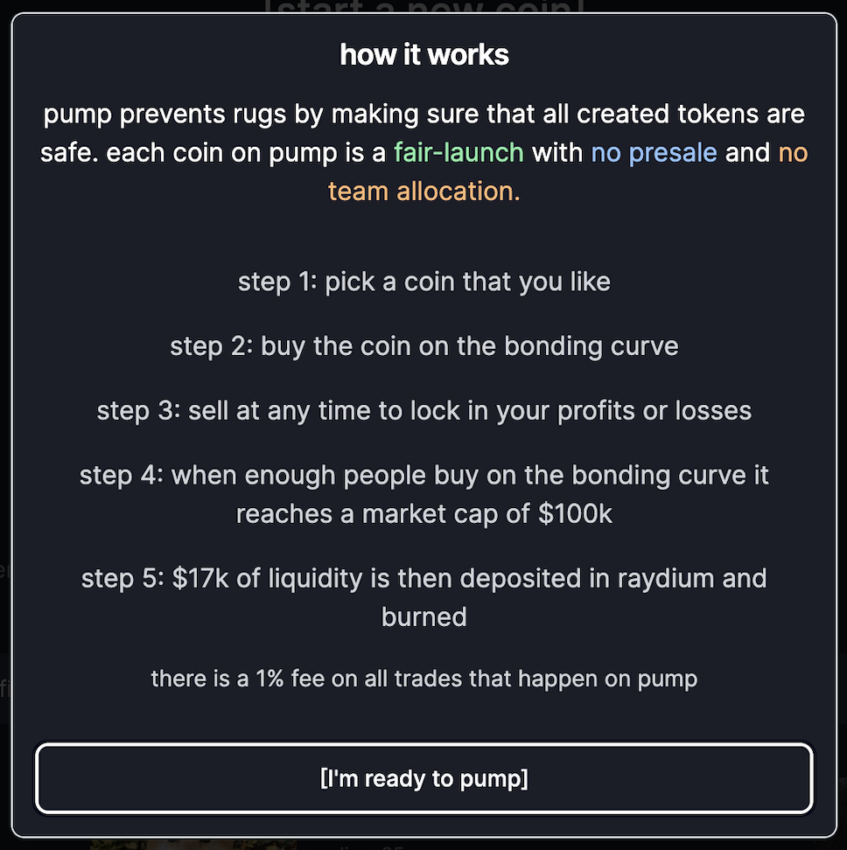

Alon, who is also a meme coin trader, created Pump.fun to prevent rug pulls. The aim is that all tokens created on the launchpad are safe. The platform ensures that each token on Pump has a fair launch with no presale and no team allocation. Alon states that there are three main problems with launching meme coins:

- There are too many rug pulls, and many people send their money to random wallets.

- There are not enough fair launches without predatory tokenomics.

- It is difficult to make a token, create a liquidity pool, and lock the liquidity pool (LP) tokens.

While there are many launchpads for tokens, both centralized and decentralized, Pump broke the mold with a lighthearted platform that lowers the barrier to entry for many token creators.

The problem with token launches

There are a multitude of prerequisites that users must typically fulfill before launching a token. These include:

- Programming knowledge

- Startup capital for liquidity

- Familiarity with decentralized finance (DeFi) concepts

Needless to say, many people find it difficult to enter this market. This restricts participation to a few tech-savvy people and projects with investment capital.

Furthermore, the proliferation of meme coins has caused market saturation and scams have made investing in this sector risky business.

How does Pump.fun work?

Pump.fun’s design is very simple. Users create an SPL token (Solana Program Library) without any code, and traders buy the token based on a bonding curve — more on this later. All trades incur a 0.5% trading fee.

Additionally, the platform charges an issuance fee, which is the cost of creating the token. At first, Pump set the issuance fee at $2, which the token creator was responsible for paying. However, changes brought in from August 2024 mean the first buyer of the token now pays this charge instead of the founders. 0.02 $SOL is the new issuance charge.

When a token hits a market capitalization of about 86 $SOL or $69,000, it is listed on Raydium, a popular Solana-based automated market maker (AMM). This event is known as “graduating.”

At this point, $12,000 of the token supply is burned, lowering the circulating supply and possibly supporting future price increases. A leaderboard that showcases tokens with exceptional trading volume monitors the “King of the Hill” title. To reach this title, a token needs about 45 $SOL in liquidity.

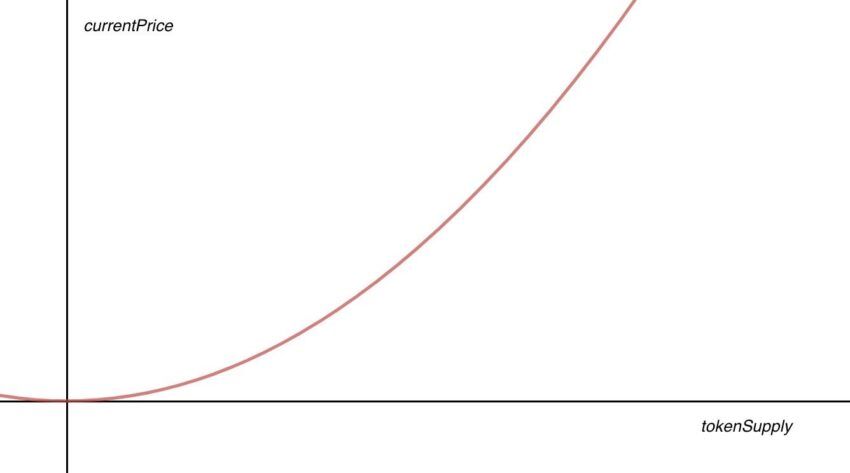

Step function bonding curve

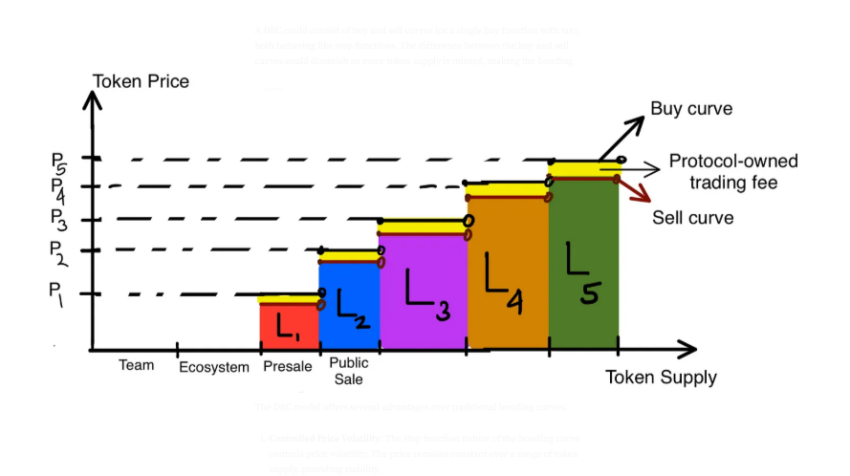

Pump.fun uses a unique bonding curve model to manage liquidity for the tokens it issues. The discrete bonding curve (DBC) behaves like a step function. It differs from a standard bonding curve in AMMs, which have a continuous price shift with token supply.

Bonding curves create a direct relationship between the token’s supply and its price. As additional tokens are created or removed, the price per token adjusts in accordance with a predetermined mathematical function.

Unlike typical AMMs, which provide liquidity evenly across all price levels using standard bonding curves, a discrete AMM (that uses a DBC) enables liquidity providers to concentrate their funds at specified price points, improving price efficiency and lowering slippage for large trades. In this model, prices fluctuate at regular points of token supply.

Why is Pump.fun popular?

As stated previously, Pump is extremely popular among retail traders.

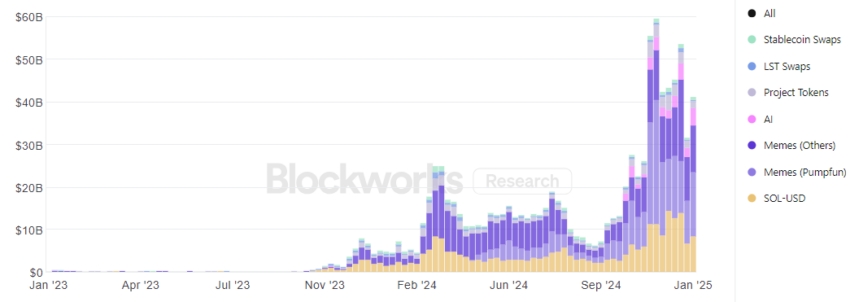

Pump.fun’s liquidity on Solana has skyrocketed rapidly, especially for meme coins. The platform leads the race in decentralized exchange (DEX) transactions on the network and was responsible for the vast bulk of all Solana DEX transactions in Q4 2024.

Users can trade meme coins more easily and affordably owing to Pump dot fun’s reduced transaction fees on Solana.

Many tokens launched on Pump have become extremely popular and have even found use cases outside internet virality. Some of the most popular tokens to come out of Pump Dot Fun include:

- Fartcoin (FARTCOIN): Launched by an anonymous developer, Fartcoin originated from a discussion with an AI agent called Truth Terminal. The AI determined that “Fartcoin” would be the perfect meme coin to resonate with humans.

- Peanut the Squirrel (PNUT): A token commemorating a viral squirrel named Peanut, who was euthanized by the New York State Department of Environmental Conservation (DEC).

- Mira (MIRA): The token was launched by an anonymous crypto trader to raise funds for Mira Chen, a four-year-old girl diagnosed with a rare brain tumour.

Pros and cons of Pump.fun

| Pros | Cons |

|---|---|

| Equitable token creation and management | Still subject to some rug pulls and scams |

| Launchpad for those with low capital | Often unsavory content |

| Reduced costs | Market volatility |

| Increased liquidity for meme coins |

This guide has covered most of the benefits that Pump.fun has brought to crypto and meme coin markets on Solana. To reiterate, these are:

- Lower barrier to entry for token creation

- Fair sale token launches with no venture capital or presale

- Limited rug pull risks

- Reduced slippage

- Low transaction fees

However, there are a few drawbacks and risks that you should remain aware of. These include:

Market volatility

Pump.fun lowers some of the risks associated with token releases, but market manipulation, rug pulls, and frauds continue to occur. The stability of the market can be impacted by these actions, leading to abrupt price fluctuations.

For instance, a 13-year-old “developer” made news when they created the QUANT token on Pump.fun and performed a rug pull, earning $30,000.

His rug-pull attempt was quickly met with a revenge pump, in which investors boosted QUANT to a high market cap of roughly $85 million. If the youngster hadn’t dropped out right away, he would have earned many millions.

Controversy

The platform has also received criticism after several violent and shady live streams on the platform were circulated on social media. Its livestream function was disabled soon afterward. The offensive streams included racist and vulgar content intended to generate controversy and boost the token’s price.

Some of these events included token creators who threatened to carry out violent crimes unless the price of a coin increased.

This type of content is nothing new to Pump.fun. There were many offensive and explicit tokens on Pump prior to the surge of risque live streams which were not subject to censorship.

The enigma of Pump.fun’s open-access model

Platforms like Pump.fun are a double-edged sword. This is part and parcel to the decentralized nature of crypto. While on one hand it creates a lighthearted experience for the average user to engage with crypto, it has also opened the door for those able to take advantage of it’s supposedly safe infrastructure.

The meme coin launchpad, which has been the object of both gains and grief, demonstrates that technology is net neutral. You should always practice good risk management, regardless of the safety measures.

beincrypto.com

beincrypto.com