Crypto AI agents are intelligent tools that simplify everything from trading to managing decentralized platforms, so you don’t have to sweat the small stuff. With AI agents taking the reins, users can focus on strategy while leaving the grunt work to algorithms built for blockchain precision. But how do they work, and what are the risks? Here’s everything you need to know about these trending tools in 2025.

- What are crypto AI agents?

- How do crypto AI agents work?

- Key components of crypto AI agents

- Top crypto AI agents you should know about

- Crypto AI agents vs. traditional crypto AI projects

- What are the challenges with crypto AI agents?

- What’s next for crypto AI agents?

- Frequently asked questions

What are crypto AI agents?

Crypto AI agents are like having a super-smart, crypto-native assistant. They use artificial intelligence to handle tasks on blockchain networks — analyzing data, making decisions, and taking action — all while you chill.

Need a trade executed without having to manually analyze crypto market predictions? Or perhaps you’re looking to optimize your decentralized finance portfolio with predictive analytics? These agents can do it without you lifting a finger.

So, what exactly are crypto AI agents, and how do they work? To properly understand these tools, you’ve must first to understand the underlying technology.

What are AI agents?

AI agents are like those apps that know you all too well. They observe, think, and act, without waiting for you to push a button; consider how Netflix predicts your next binge-worthy show or a fitness tracker nudges you to move.

The use of AI agents is steadily gaining traction among consumers. For instance, Salesforce research indicates that 39% of consumers are comfortable with AI agents scheduling appointments, and 32% of Gen Z consumers are already comfortable with AI agents shopping for them.

How do crypto AI agents work?

Crypto AI agents work by automating tasks on blockchain networks. They collect data, analyze it using artificial intelligence, and execute decisions without requiring constant supervision. It’s a three-step process: gather, decide, and act.

Think of crypto AI agents as the ultimate multitaskers. Imagine hiring an assistant who reads every crypto trend, knows when to invest, and can execute decisions faster than you can refresh your portfolio.

All you have to do is sit back and let them get to work.

What are the steps involved?

AI agents primarily use a three-step process.

1. Gathering information

First, crypto AI agents collect data — tons of it. This includes market trends, blockchain transactions, DeFi stats, and more. They’re like sponges, soaking up everything they need to make informed decisions.

2. Making decisions

Next, they analyze all that data. Using pre-programmed rules or advanced machine learning and predictive analytics, they decide the best course of action. Think of it like a GPS calculating the fastest route — it’s all about efficiency.

3. Taking action

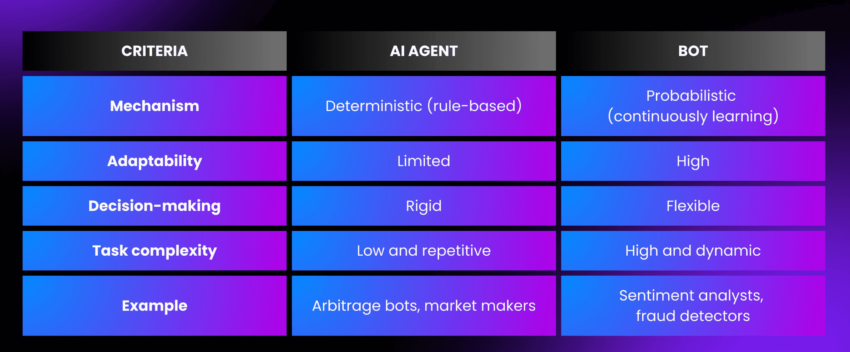

Finally, they execute. Whether it’s placing a trade, moving funds, or triggering a smart contract, they handle the action, so you don’t have to. While AI agents perform some of the same functions as AI trading bots, the former are much more advanced.

Key components of crypto AI agents

Crypto AI agents are built on a foundation of interconnected components. Here is how each component works in synergy:

Learning module

This is the brain of the agent, where it collects and processes data from blockchains, market trends, and DeFi protocols. Think of it as the agent’s research department — constantly analyzing past and real-time data to refine strategies.

For crypto AI agents, this module is trained to understand blockchain-specific datasets like smart contract interactions, token flows, and market volatility.

Decision engine

Once the learning module has done its job, the decision engine steps in. This is like like the agent’s personal strategist, analyzing the processed data and deciding on the best course of action. Whether it’s spotting arbitrage opportunities or reallocating funds, this module ensures the agent makes informed, logic-driven decisions.

Action module

This is where things get real. The action module executes the agent’s decisions, whether that means placing a trade, moving funds between wallets, or triggering a smart contract. It’s the executor of the system, ensuring every task is carried out efficiently on the blockchain.

Communication interface

Every good agent needs a way to report back. The communication interface allows crypto AI agents to interact with users and other systems. It handles status updates, notifications, and task confirmations. For example, it might send you an alert when it completes a trade or moves assets to a high-yield pool.

Security framework

In the blockchain domain, security is non-negotiable. The security framework ensures the agent operates safely, protecting user data, private keys, and executed transactions.

It uses encryption and multi-layer authentication to prevent breaches and unauthorized access. Without this framework, your digital assistant might be more of a liability than a helper.

Blockchain integration layer

This module connects the agent to blockchain networks, enabling it to interact with smart contracts, wallets, and DApps. It ensures the agent can function across multiple ecosystems, whether it’s Ethereum, Solana, or Base. Think of it as the bridge between the agent and the blockchain space.

Autonomous execution layer

What makes crypto AI agents unique is their autonomy. This layer ensures the agent can function independently, monitoring conditions and executing actions without requiring constant user input. It’s what turns a regular trading bot into a self-reliant crypto assistant.

Top crypto AI agents you should know about

Crypto AI agents are transforming the blockchain space, offering smarter ways to trade, manage DeFi portfolios, and even generate revenue. Here is a quick list of some of the top crypto AI agents list in 2025.

- Virtuals Protocol: Built on Base

- AI16zDAO: One of the better-known AI-powered Decentralized Autonomous Organizations with a DeFi focus

- Zerebro: Uses AI to optimize blockchain metrics

- AIxbt: Meant for traders who outsource analysis

- Truth Terminal: The one behind the Goatse Gospel

Now let’s check out each crypto AI agent project in detail:

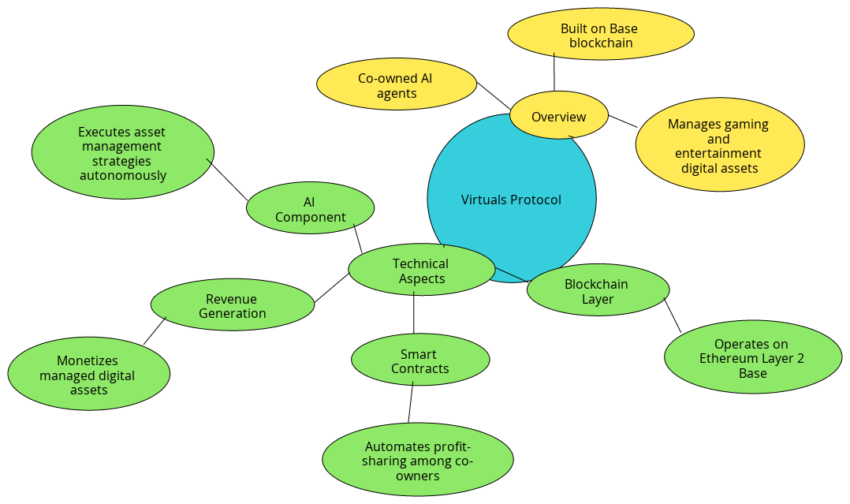

Virtuals Protocol

Virtuals Protocol is like the master agent for your other autonomous agents in crypto. Built on Coinbase’s Base blockchain, it helps you create co-owned AI agents that generate revenue from managing digital assets in gaming and entertainment.

Smart contracts handle profit-sharing among co-owners, so there’s no need to argue over who gets what. It’s like hiring a super-organized team leader for your digital managers — no spreadsheets required.

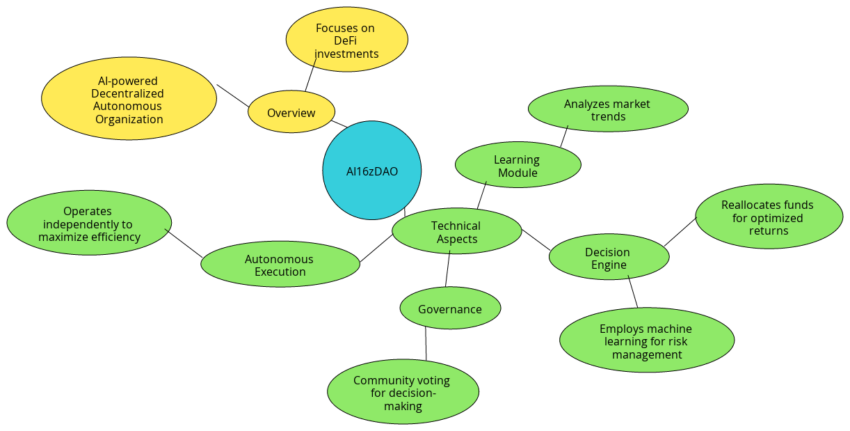

AI16zDAO

Think of AI16zDAO as your DeFi investment coach that never takes a day off. It’s an AI-powered DAO that manages assets autonomously, analyzing market trends and reallocating funds to maximize returns.

Risk management is covered with machine learning models. Governance? That’s where your vote comes in.

It’s like having a Wall Street portfolio manager — except it’s decentralized, doesn’t charge commissions, and doesn’t wear a suit.

Zerebro

Zerebro acts as blockchain’s personal trainer — pushing it to perform better, faster, and more efficiently. Using AI, it optimizes network scalability, allocates resources intelligently, and executes smart contracts faster than you can say “block confirmation.” Imagine your blockchain hitting the gym and coming out stronger, leaner, and ready to tackle anything. That’s Zerebro in action.

AIxbt

AIxbt is your trading sidekick who does all the homework for you. It monitors market data, analyzes trends, and executes trades — all while you focus on, well, anything else. It’s perfect for traders who love results but hate staring at charts.

Truth Terminal

Truth Terminal is an AI agent that blends cultural creativity with blockchain functionality. It’s best known for creating the “Goatse Gospel,” a quirky AI-generated narrative that inspired the meme coin GOAT. But it’s not just about memes — it leverages AI to produce viral content and innovative ideas that resonate with communities.

Honorary mentions

- Clanker: An AI-driven autonomous agent that simplifies the creation and deployment of ERC-20 tokens on the Base blockchain.

- Act I: The AI Prophecy (ACT): A project integrating AI agents within the blockchain ecosystem, focusing on autonomous systems designed to perform specific tasks with minimal human intervention.

Crypto AI agents vs. traditional crypto AI projects

The crypto space can become overwhelming. It is easy to mix up crypto AI agents with crypto AI projects. Let’s take a look at the difference to clear up any confusion.

Crypto AI projects are broad initiatives that integrate artificial intelligence into blockchain technology. They aim to enhance various aspects of the crypto ecosystem, such as improving transaction efficiency, enabling smart contracts-specific or any other form of web3 automation, or providing AI-driven analytics.

These projects often develop platforms or tools that leverage AI to offer new functionalities within decentralized ecosystems.

Crypto AI agents, on the other hand, are autonomous entities operating within these ecosystems. They perform specific tasks like trading, data analysis, or content creation, often without human intervention.

Think of them as AI-powered assistants designed to execute particular functions within the broader AI-enhanced crypto platforms.

| Aspect | Crypto AI projects | Crypto AI agents |

| Scope | Broad platforms integrating AI to enhance blockchain functionalities. | Specialized autonomous entities performing specific tasks within the crypto ecosystem. |

| Functionality | Develop tools and infrastructures for AI applications in crypto. | Execute particular tasks like trading, analysis, or content creation autonomously. |

| Examples | Fetch.ai (FET), SingularityNET (AGIX), Ocean Protocol (OCEAN). | Virtuals Protocol, AIxbt, Truth Terminal. |

What are the challenges with crypto AI agents?

Crypto AI agents may seem like the ultimate blockchain solution, but they come with their fair share of hurdles. Let’s break down the biggest challenges facing these autonomous tools:

Complexity of blockchain integration

Integrating crypto AI agents into blockchain networks like Ethereum or Solana can be a logistical nightmare. Different protocols and decentralized infrastructures require advanced interoperability solutions, making interaction a challenge.

Data reliability

AI agents depend on real-time data to make decisions, but the quality of blockchain data isn’t always reliable. From blockchain oracles that fetch external information to smart contracts prone to inaccuracies, agents must weed out potential data pitfalls.

Security risks

Operating autonomously makes these agents prime targets for cyberattacks. Hackers can exploit numerous vulnerabilities in smart contracts, gain access to private keys, or manipulate market trends to trick the agent. A strong security framework is non-negotiable.

Scalability issues

Blockchain networks often face congestion, leading to delays and higher gas fees. For crypto AI agents that depend on quick execution, these bottlenecks can hinder performance, especially on networks like Ethereum during high traffic.

Regulatory uncertainties

From the U.S. to the E.U., regulations surrounding blockchain and AI are constantly changing. Autonomous agents raise questions about liability and compliance, especially when they handle financial operations like trading or DeFi interactions.

Ethical considerations

Giving AI agents too much autonomy can lead to unintended consequences. If an agent executes a trade that causes market instability, who is responsible? Balancing autonomy with accountability is still a grey area.

What’s next for crypto AI agents?

The future of crypto AI agents looks promising as more blockchain networks, like Solana and Ethereum, integrate AI-driven web3 automation into their ecosystems. Expect smarter autonomous AI agents capable of handling complex DeFi strategies, crypto trading, and ecosystem management.

However, challenges like regulatory uncertainties and scalability issues will shape their adoption curve. As crypto markets mature, these agents could redefine how we interact with decentralized technologies, making blockchain networks more intelligent, efficient, and usable.

beincrypto.com

beincrypto.com