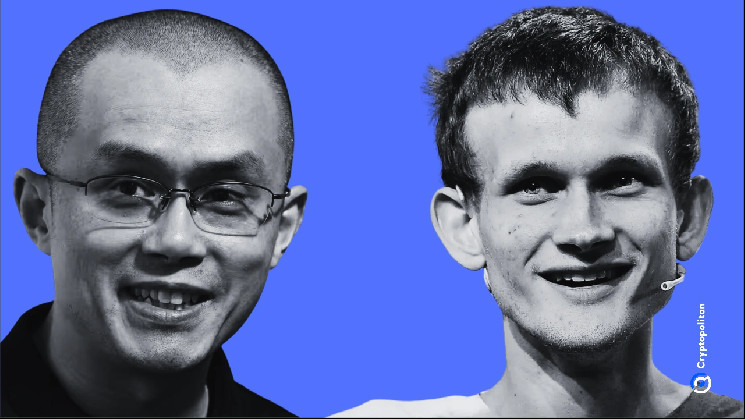

In an exclusive, intimate Binance Labs event that flew under the radar in Thailand, Changpeng “CZ” Zhao brought together two of crypto’s most notorious figures: Ethereum’s Vitalik Buterin and BitMEX co-founder Arthur Hayes.

It was just a low-key gathering with major players exchanging ideas. And when CZ dropped photos on social media of him with Vitalik and Arthur, the crypto community went wild. Fans didn’t even need more context—the images of these titans alone said enough.

“Imagine the questions asked at this incubation session. Jokes aside, many thanks to Arthur for coming and investing in the industry together,” said CZ humorously as he shared the Arthur picture.

CZ and Vitalik: From Las Vegas strangers to crypto powerhouses

The history between CZ and Vitalik goes way back to 2013, in the early days of crypto, when they met at a conference in Las Vegas. Back then, neither of them had the kind of clout they wield now, but they both shared a vision for a new world.

CZ was just beginning to make a name in crypto, and Vitalik, already a brainiac programmer, was working on the ideas that would lead to Ethereum. Their interaction was a simple one, but it planted a seed for what would become one of crypto’s most fascinating relationships—an unspoken mix of respect and rivalry.

Two years later, in 2015, CZ invited Vitalik over to his place in Tokyo. They talked about Ethereum, and while Vitalik was hyped on his vision, CZ was hesitant. He didn’t invest in Ethereum.

Maybe he thought he was playing it safe, but in a twist of irony, that missed opportunity drove CZ to launch Binance in 2017. He later admitted that if he’d jumped into Ethereum, he might never have created Binance.

His comment? “If I had bought ETH early on, I probably wouldn’t have felt the need to create one of the largest cryptocurrency exchanges.” Hindsight’s always 20/20, right?

The CZ-Vitalik dynamic has gone from cautious acquaintances to leaders of rival platforms, pushing boundaries while keeping a close, wary eye on each other.

In the post-FTX world, where the trust in crypto exchanges was tanking, CZ and Vitalik saw a chance to bring back credibility to the industry. In November 2022, as FTX collapsed, these two came together to propose a solution.

Their idea? Proof-of-Reserves—a transparency measure to let users know that exchanges aren’t just holding reserves, but are fully solvent. Vitalik suggested that proving solvency would be the real game-changer, not just showing reserves. CZ backed the move, adopting the model to reassure Binance’s users.

That collaboration was like a public truce. They set aside their unspoken rivalry for a common goal, and in true CZ fashion, Binance implemented Proof-of-Reserves, but not without Vitalik’s improvements. The measure wasn’t perfect, but it did make investors lose some of their concerns.

The Arthur Hayes angle: A shared history of legal battles and big ideas

Now, where does Arthur fit into this picture? The man has had a wild ride in crypto, riding the wave of high-leverage trading. BitMEX became a phenomenon, letting users trade with up to 100x leverage. But that level of risk didn’t just catch the eye of thrill-seeking traders, it also caught the eye of regulators too.

In 2020, U.S. authorities came knocking, charging Arthur with violating the Bank Secrecy Act. By 2022, Arthur had been sentenced to six months of house arrest and two years of probation. The man who made headlines for his trading genius was now on a leash, making different kinds of headlines.

CZ too has faced his own battles. In April 2024, U.S. regulators slapped Binance with a record-breaking $4.3 billion fine for AML (anti-money laundering) violations.

He got hit with a personal fine of $50 million and spent four months in prison.

“Unfair treatment”? Arthur speaks up for CZ

If anyone knows what it’s like to be targeted by regulators, it’s Arthur. He’s been vocal about what he sees as a double standard: crypto executives like himself and CZ facing the hammer, while traditional banks get off easy.

He called the treatment of CZ “absurd” and pointing out the hypocrisy of the U.S. regulatory system. He pointed out that while banks like HSBC have been caught in massive AML scandals, they barely got a slap on the wrist compared to what crypto platforms face. For Arthur, it’s a blatant bias.

Now let’s not forget that despite the camaraderie, these three giants don’t always see eye-to-eye on how the industry should evolve. Vitalik’s all about decentralization and transparency. He wants Ethereum to be the gold standard of blockchain—a platform that’s open, community-driven, and transparent.

But that vision doesn’t exactly align with the high-stakes world of Arthur and CZ, who are knee-deep in the business of trading and exchanges. Arthur, in particular, has criticized Ethereum’s move to proof-of-stake, calling it a “centralization risk.”

He’s skeptical that Ethereum can keep its place as the top smart contract platform with competitors like Solana and Cardano nipping at its heels. But interestingly, he told Cryptopolitan that Ethereum is better than them all, and that all the rest do is copy it. He also has a long-standing and mostly one-sided beef with Ethereum co-founder and Cardano creator Charles Hoskinson.

Vitalik, however, believes there is a need for blockchain to adapt, especially when it comes to scaling and user experience. His focus has always been long-term sustainability, even if it means going against the purist decentralization crowd.

cryptopolitan.com

cryptopolitan.com