Anyone who’s been around crypto for the past seven years is familiar with Teeka Tiwari. In late 2017, he emerged as the most powerful promoter of digital assets, and although he’s faded from prominence in recent years, anyone who experienced his pumps will never forget his fame.

They also might wonder if it was legal.

When Tiwari added a coin to his portfolio, it wasn’t unusual for it to suddenly rally on millions of dollars of buying within seconds and tens — if not hundreds — of millions of additional trading activity throughout the course of the day.

When he was at his zenith, every pick rallied without exception. Finding his new picks at the exact second he released them became so competitive that his website team hired sophisticated caching experts to handle inundating website traffic and to counteract trading bots.

The Teeka Tiwari effect

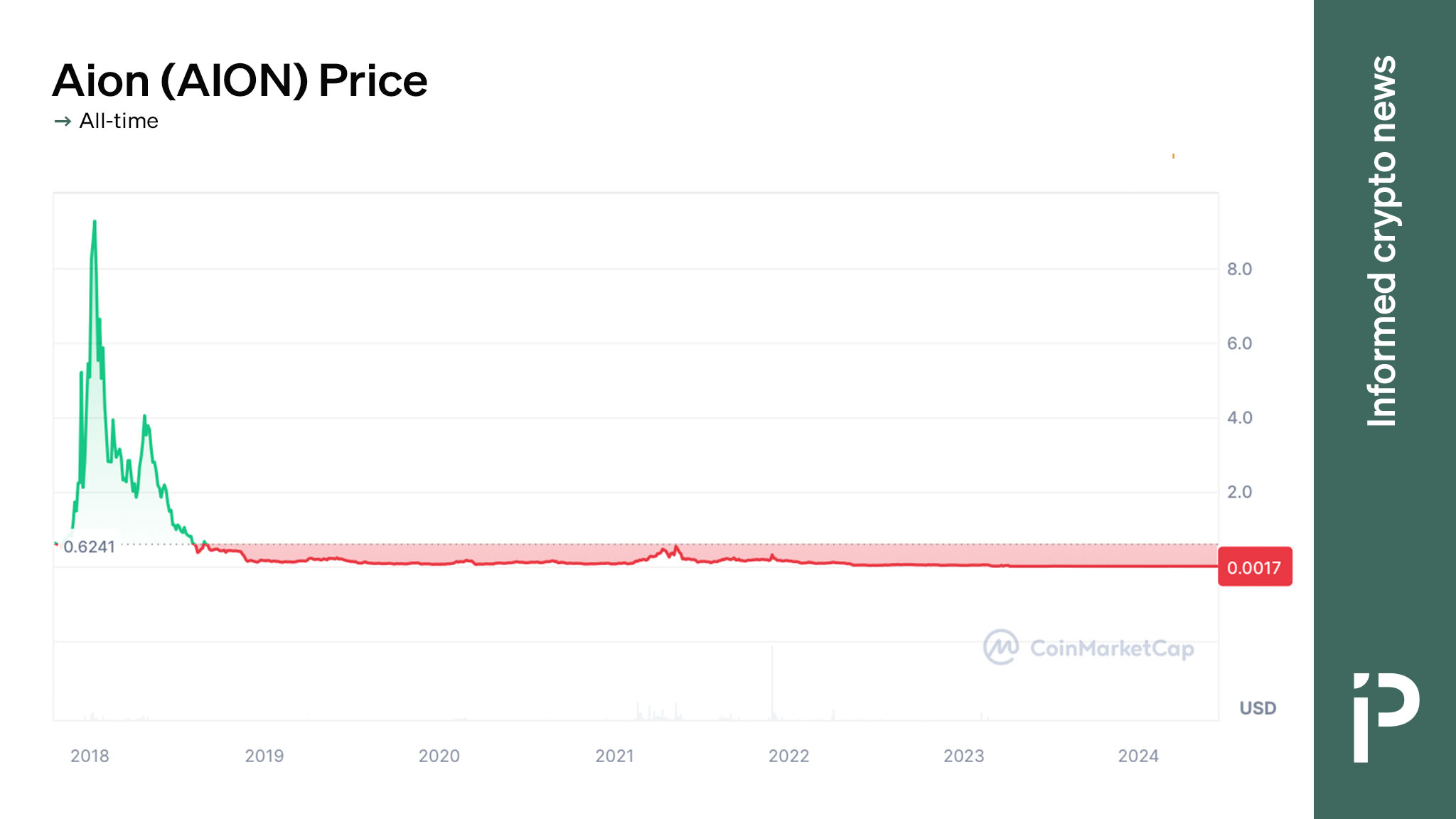

For example, Tiwari picked AION for his flagship crypto newsletter portfolio Palm Beach Confidential on March 15, 2018, at 4:00 pm New York time. One minute prior to his pick, the coin was trading around $2.40. One minute after his pick, it hit $4.90. After just 30 minutes, the token had added $20 million in trading volume yet had, predictably, retraced almost all of its gains.

Like most newsletter authors, Tiwari emphasized fundamentals and long-term thinking, but traders only cared about his initial, market-moving effect.

Consider another example. Tiwari picked POWR for Palm Beach Confidential on January 17, 2018, in an unscheduled, 2:42 pm announcement. Within five minutes, traders had somehow found their way to a computer screen to place an additional $1 million in trades and boost its price 22%.

Similar examples are too numerous to list. He added at least one new coin to his portfolio a month, and traders would carve out hours from their schedules to prepare and trade the event. He not only picked microcap coins but also top 20 coins like Cardano, Stellar, Ripple, or Maker. His recommendations would have immediate effects on even these larger coins.

Knock-off newsletters began to try to copy his success, with James Altucher launching Altucher’s Crypto Trader, and similar copycat bulletins springing up at Agora Financial, Stansberry, and other direct-response publishers.

Read more: Opinion: Roaring Kitty looks to have returned as a pump-and-dumper

‘Not Financial Advice’ (wink)

That Tiwari became the most powerful promoter of digital assets is a mix of luck and confluence. He was not a self-made celebrity but rather a product of a massive direct-response advertising campaign. His employer, Palm Beach Group, was one of several giant investment newsletter companies alongside other giants like Stansberry, Weiss, Mauldin, Angel, and biggest of all, Agora Financial.

Every piece of content published by a direct response publisher like Palm Beach intends to elicit an immediate and measurable response. Hence, direct-response. As opposed to evergreen or long-term approaches like branding, Agora Financial newsletter authors focused on actionable information.

Its most successful newsletters, like Tiwari’s Palm Beach Confidential, were investment newsletters. By and large, they provided an investment ‘pick’ — specific and publicly available assets — on a regular cadence. Authors would sometimes track these picks in a hypothetical portfolio but would always be sure to disclaim their legal liability by pointing out that these picks weren’t investment recommendations or financial advice.

Occasionally, its newsletters would reach a level of notoriety like Palm Beach Confidential and this fame might even allow the publisher to raise the price (in the case of Teeka Tiwari’s newsletter, to $10,000 per year).

In recent years, Palm Beach Confidential’s annual subscription is down 50%. With so much revenue growth, valuations at the biggest direct response publishers crested $1 billion.

Nevertheless, fame and influence eventually fade.

Read more: What’s happening with OneCoin scam’s biggest promoters?

What has happened since?

Nowadays, Tiwari no longer writes Palm Beach Confidential. Most of his crypto picks from 2017-2018 have declined to near all-time lows today, including SALT, AION, XEM, LOKI, WINGS, LSK, DGD, TNT, RCN, CND, LKK, BAT, OMG, STEEM, GFT, QSP, CRPT, DRGN, XZC, GRIN, BNT, FUN, and BTS.

Tiwari also got into legal trouble. The US Department of Justice (DoJ) charged Jonathan William Mikula, Tiwari’s analyst at Palm Beach Venture, for conspiracy to tout — and touting — unregistered securities for undisclosed compensation.

Although the DoJ didn’t charge Tiwari, the famous direct response newsletter author Porter Robinson wrote a letter to MarketWise workers, claiming, “Tiwari did the same when he engaged in his consulting arrangement that violated the company’s policies prohibiting conflicts of interest.”

On the civil side of the legal system, the Securities and Exchange Commission also sued Tiwari’s analyst, Mikula.

Tiwari has had run-ins with regulators before. In 2005, he consented to FINRA sanctions barring him from acting as a broker. Since that action, he left the broker-dealer business and worked at Tycoon Publishing, later acquired by Agora Financial. Tiwari also worked with Stansberry Research’s Tom Dyson at Common Sense Publishing, which later became Palm Beach Research Group.

A few months ago, in February 2024, Legacy Research’s editor-in-chief Kris Sayce emailed subscribers of Palm Beach, saying, “We parted ways with Teeka and are working on finding an alternative to the publications you’ve been receiving.”

Tiwari apparently left to start his own newsletter under his own name. He’s still promoting new crypto coins. He promises to “help you demystify cryptocurrency to make life-changing gains.” Gains, of course, only so long as you get out before they crash to all-time lows, like most of his picks.

protos.com

protos.com