Momentum shift

This time last year, the crypto narrative was completely different.

And — while we’re stuck in a weird sideways moment here — there’s no doubt that the market is more positive right now than it was a year ago, when Coinbase and Binance were reeling after the SEC filed lawsuits against both exchanges on consecutive days.

Folks were spooked, and rightfully so. We still don’t have as many answers as we might want, but we’re not seeing projects flee to other countries (to the same extent at least, though the three Wells notices served to Consensys, Uniswap and Robinhood have left a bad taste).

Blockworks co-founder Jason Yanowitz noted on Empire this week that roughly 37% of the speakers for last year’s Permissionless conference dropped out because they didn’t want to risk stepping on US soil.

Obviously, that’s not as much of a concern anymore, just based on recent industry events such as Consensus.

This leads me to one big question: How much damage has been done to crypto and where do we go from here?

Bill Hughes, senior counsel at Ethereum studio Consensys, said it’s caused the crypto space to mature “more slowly than it would have otherwise.”

“It has stifled innovation from the little guy, who is more concerned with being targeted by the government due to having only modest means, giving larger incumbent crypto firms a competitive advantage, especially ones that are overseas. The anti-crypto types are the same ones who decry competition problems with Big Tech, and undue foreign interests over sectors that are important to the US, yet they try to repeat history with their policy choices,” he continued.

Stani Kulechov, CEO of Avara — the company behind the Aave protocol — similarly told Yanowitz that the US “lost a lot of innovation” in the past couple of years.

It’s not all doom and gloom. Matter Labs CEO Alex Gluchowski, also a guest on Empire this week, noted that the crypto community in the US has managed to become a “powerful election force.”

In case you live under a rock: The recent bipartisan support for the FIT21 crypto bill, the pre-Biden veto rollback of the SEC’s SAB 121 rulemaking bulletin. But there’s also clearly partisan support, as former President Donald Trump adds crypto donations and allegedly claims he wants to be the “crypto president” (no proposed policies around crypto have been made public though).

Hughes seemingly agrees with Gluchowski, telling me that he’s still bullish on the US as a crypto hub.

“The US is still the best country to lead in this space, in terms of capital, talent and political philosophy. There’s good reason to believe the US will lead notwithstanding the efforts of loud, energetic detractors,” he added.

Kulechov said DeFi is “just better financial infrastructure” given that the technologies are “valuable” for the users, and ensure that corporations have to play fair when it comes to interacting with the tech. Key note for Kulechov here is that it doesn’t take power from the government itself.

Now, whether the US understands Kulechov’s point is a separate issue. But with the way that crypto continues to innovate — from SocialFi to infrastructure builds — the technology itself addresses questions and concerns that even non-crypto folks have. Such as wanting a social media platform that doesn’t control the data, and instead handing that power to the user.

Hughes summed it up perfectly: “We need a regulatory environment here where the tech can live and die on its own merits around the use cases that the market demands.”

— Katherine Ross

Data Center

- BTC and ETH both slipped 4% this morning, dragging the rest of the market down with them.

- Top-100 tokens are down 10% on average over the past week. NOT, AR, BEAM, ENA and FTM have shed 20%.

- ETH has kept up its inflationary streak, on track to add $1.8 billion in fresh supply over the next year, at current usage rates.

- Over half of all Bitcoin transactions are again tied to Runes, with half a million related transfers in the past two days.

- Bitcoin has seen more NFT volume in the past week than both Polygon and Solana combined at over $46 million. Ethereum is a close second with $40 million.

The other, other use case

Bitcoin has made money unstoppable. Blockchain really wants to do the same for social media.

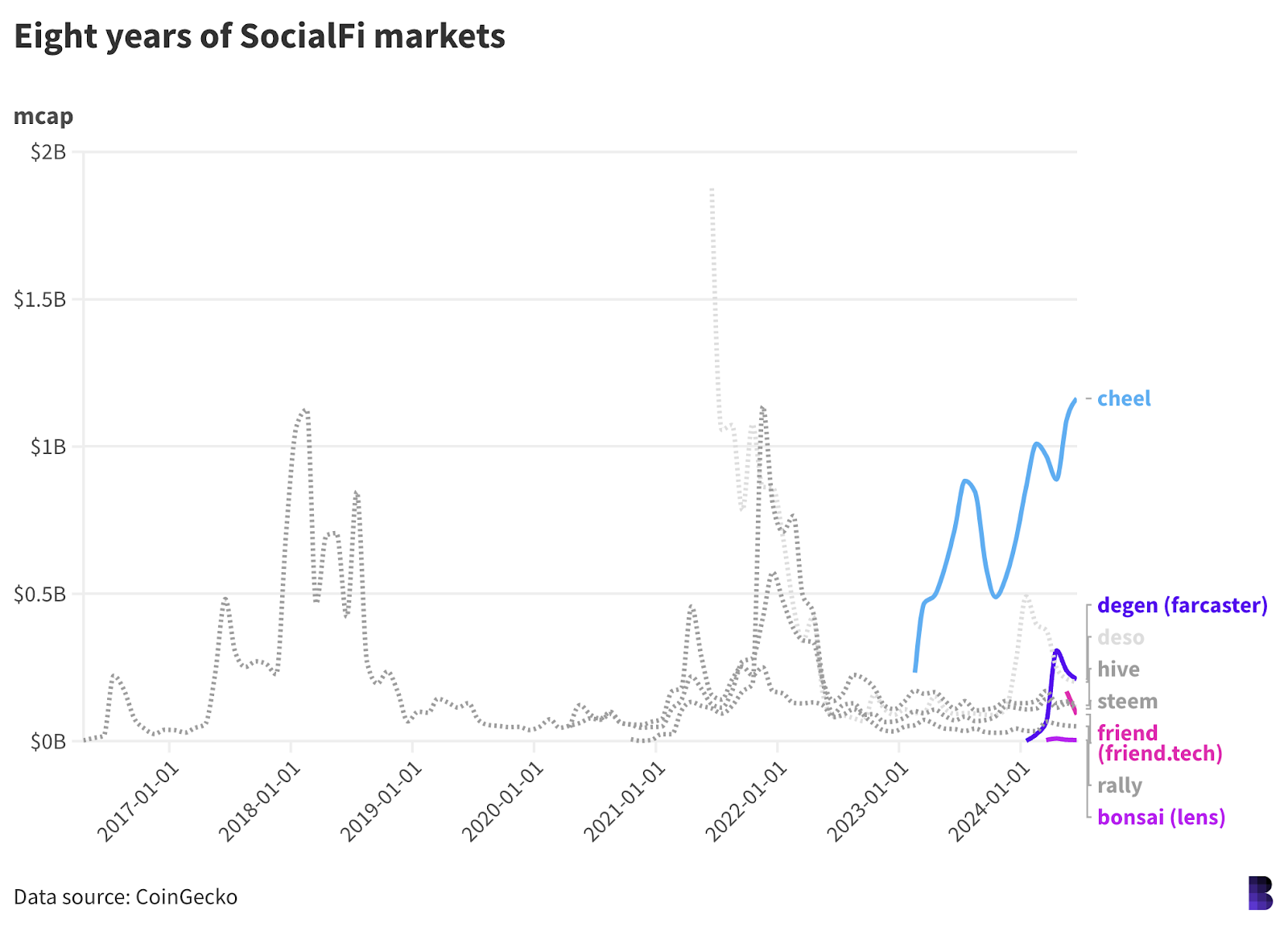

And it’s been like that for nearly a decade. Dan Larimer of EOS infamy launched layer-1 blockchain Steem to power a social media platform in 2016.

The fundamental idea was more-or-less akin to the Farcasters and Lenses we have today: build a platform for communities resistant to censorship (and downtime), while giving creators tools to monetize their content with crypto.

(Extra points if users can own a slice of the network through a token, or at the very least, gain exposure to its growth.)

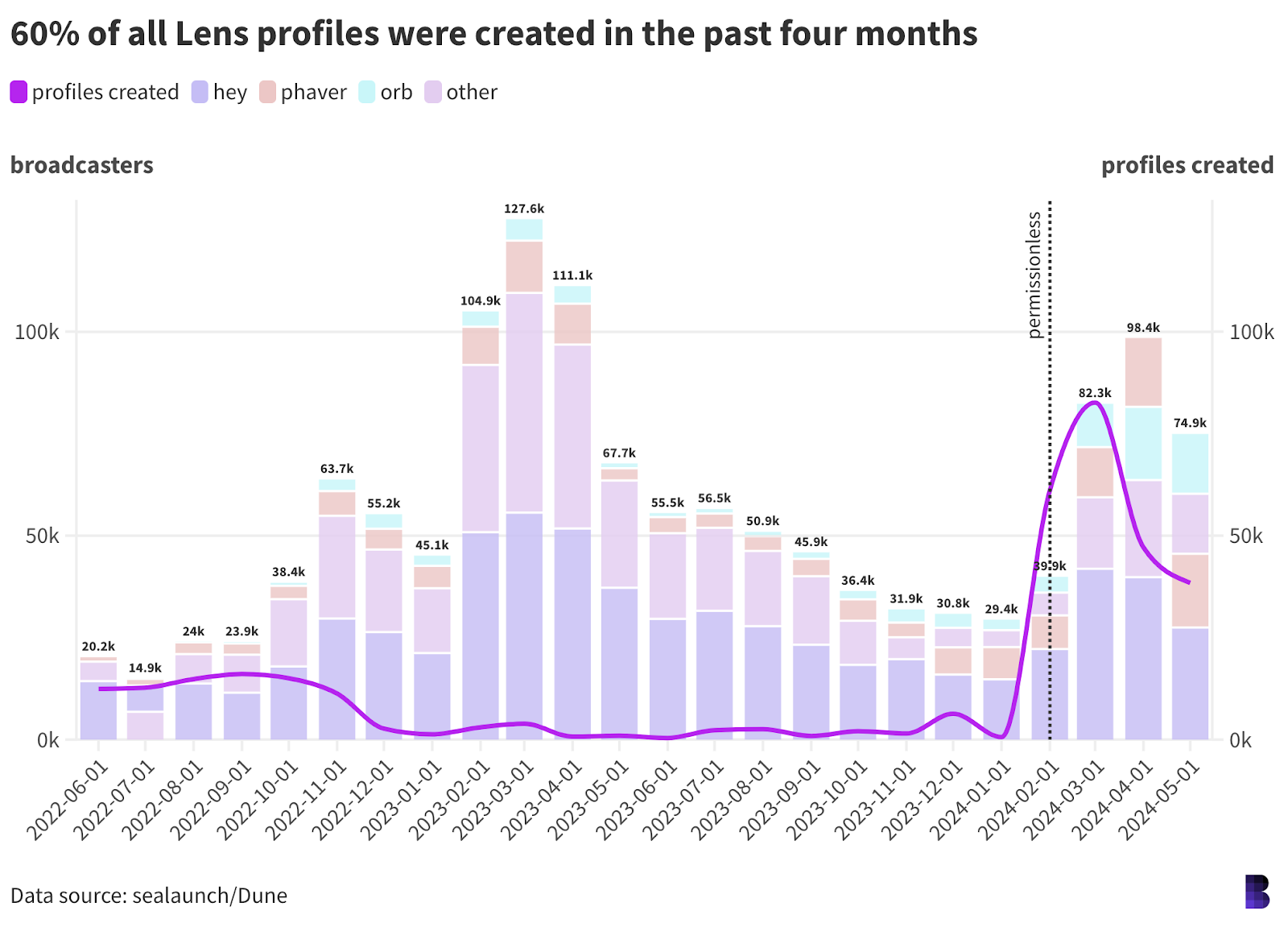

Lens is meanwhile helping to carry the torch. The number of monthly unique broadcasters — which includes addresses that posted, mirrored, commented or quoted on the platforms utilizing the protocol — is up 150% since January, going from under 30,000 to almost 75,000 last month. Lens went permissionless in late February.

With crypto-powered social media, it’s always a question of whether user activity is organic. Some of the most widely-used Lens apps have points systems and other incentive schemes to spark engagement, which does muddy the data. As would any activity resulting from anticipation of a future airdrop for a token tied to the platform.

Farcaster, another protocol for decentralized social media, is also plagued by doubts over how much of its onchain activity is “real.”

It’s really a moot point. Silicon Valley’s Rus Hannamen was adamant that Pied Piper should not make any money, or else limit its perceived potential: “If you have no revenue, you can say you’re pre-revenue… It’s not about how much you earn. It’s about what you’re worth.”

Lens and Farcaster’s noticeably absent native tokens are a lot like that: launching a cryptocurrency would only put a market value on their underlying protocols. Why risk token prices pumping and dumping alongside the ebbs and flows of user retention, as has been the case with friend.tech? Sounds like a distraction.

And without a token, users could still be attracted to use the apps built around the protocol in hopes that one day their activity converts to an airdrop. A win-win for everyone — as long as the user experience is enough to bridge the gap left by a lack of financial incentives.

No surprise then that both Lens and Farcaster have wound up with “unofficial” native cryptocurrencies in BONSAI and DEGEN, which their communities have adopted for tipping and other SocialFi apps.

It’s a nice compromise — the protocol has plausible deniability around the potential for a future “official” airdrop, while users can still farm any potential allocation and, hopefully, earn a separate community coin to boot.

But crypto is already a mess of hundreds (or even thousands) of blockchains and tokens. And if blockchain is the future of social media, it seems like it’s only going to get even messier, especially if the biggest platforms have multiple native cryptocurrencies.

It does put a certain dampener on the idea of a crypto-powered alternative to Twitter and Instagram. Perhaps the next billion users might be turned off by censorship-resistant social media if it takes tracking dozens of different tokens to use.

While not specific to the idea of tokens, I asked Lens/Aave founder Stani Kulechov about the user experience in a multichain future in a call earlier this year. He brought up the old-school telephone exchanges — warehouses of people switching over networks to connect your call.

“What blockchain is having now is its telephone exchange moment,” Kulechov said. “In the future, you don’t really think about networks at all. Funds and data integrity will stay between these networks and you basically verify data movements or movements of funds. ZKProofs are really an interesting way to do that.”

“We are living in really exciting times because we’re witnessing how the infrastructure is being built and all these changes. But once we go to the next step, we forget the bottlenecks and complexities that were in the past,” he said.

— David Canellis

The Works

- Tether CEO Paolo Ardoino said Tether’s investment arm plans to put over $1 billion to work in investments over the next year, Bloomberg reported.

- Uniswap Labs announced that it’s acquiring Crypto: The Game.

- Japan’s Metaplanet said in a statement that it bought over 23 BTC ($1.54 million) to add to its holdings.

- ZkSync plans to distribute 21 billion ZK tokens, Blockworks’ Macauley Peterson reported.

- DeFi Technologies switched to bitcoin as its primary treasury reserve asset with a purchase of 110 bitcoin, the company said.

The Morning Riff

Q: What does SocialFi mean for crypto?

SocialFi in 2024 really means identity.

The idea of fully standalone appchains tailor-made for social media and microblogging platforms is kinda over for now.

No more Twitters on the blockchain — where all posts, images, videos and other files are stored permanently.

Instead, builders are working to allow social media profiles to exist across multiple platforms at once, without trusting anyone to store it.

Less “monetize and store my content,” and more “assetize my online footprint.” A slight but important difference in value proposition.

— David Canellis

Look, no one wants their data used or held by Big Tech. Maybe it’s just my Instagram, but I’ve noticed more folks making stories about not wanting Meta to use their photos or art as part of its push to train a generative AI program. SocialFi fixes this.

Clearly, there’s a need for it which is always one of the big questions to ask whenever new tech is introduced. The mass demand should follow, but I’m not sure that folks are sold on switching over or coming to terms with the fact that there are more options for social media outside of the classic Big Tech plays.

There’s no doubt that SocialFi could set a new tone for crypto, and open up avenues we haven’t yet seen explored, where your data is well and truly your own. And there’s VC funding to boot.

But I’m not so sure I’m sold on it being the next big thing yet. After all, people never actually left Twitter, after complaining about Elon Musk’s acquisition so much.

— Katherine Ross

blockworks.co

blockworks.co