On May 14, Vanguard, a Pennsylvania-based asset manager with over $7 trillion portfolio, announced Salim Ramji as its new CEO. Previously an executive with a decade-long tenure at BlackRock, Ramji will bring extensive experience from his former employer. Ramji is set to begin his new role on July 8.

His appointment follows the announcement that current CEO Mortimer J. “Tim” Buckley is stepping down. This move is historical as it is the first time Vanguard has chosen a CEO who is not directly associated with its founder, Jack Bogle.

Salim Ramji to Lead Vanguard: What Does This Mean for the Company’s Future?

Regarding his appointment, Ramji expressed his admiration and respect for Vanguard. While acknowledging the changing investor landscape, he saw it as an opportunity for Vanguard to further its mission.

“My focus will be mobilizing Vanguard to meet the moment while staying true to that core purpose—remaining the trusted firm that takes a stand for all investors,” Ramji said.

In addition to Ramji’s appointment, Vanguard has promoted Greg Davis to president. Previously, he was the chief investment officer. Vanguard also named Mark Loughridge as its non-executive chairman.

Ramji’s leadership is particularly notable due to his background of overseeing the filing and logistics for iShares Bitcoin Trust (IBIT), BlackRock’s spot Bitcoin exchange-traded funds (ETFs). Additionally, he has been quoted about his interest in digital assets.

Read more: What Is a Bitcoin ETF?

Things are getting more interesting, given that Vanguard is skeptical of cryptocurrencies. In 2017, Bogle warned people to “avoid Bitcoin like the plague.”

Furthermore, in early 2024, Vanguard’s spokesperson stated that it had no plans to create a Bitcoin ETF of its own. BeInCrypto reported that Vanguard also blocked customer access to Bitcoin ETFs following the Securities and Exchange Commission’s (SEC) approval.

With Ramji’s arrival, the crypto community speculates that Vanguard will join the crypto ETF bandwagon like its competitors, such as BlackRock and Franklin Templeton. In response to the speculation, Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, shared his thoughts.

“I’m not sure that’s gonna change Vanguard’s stance but [Ramji] will be the CEO. Who knows. Door much more open now, [in my opinion],” he wrote.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

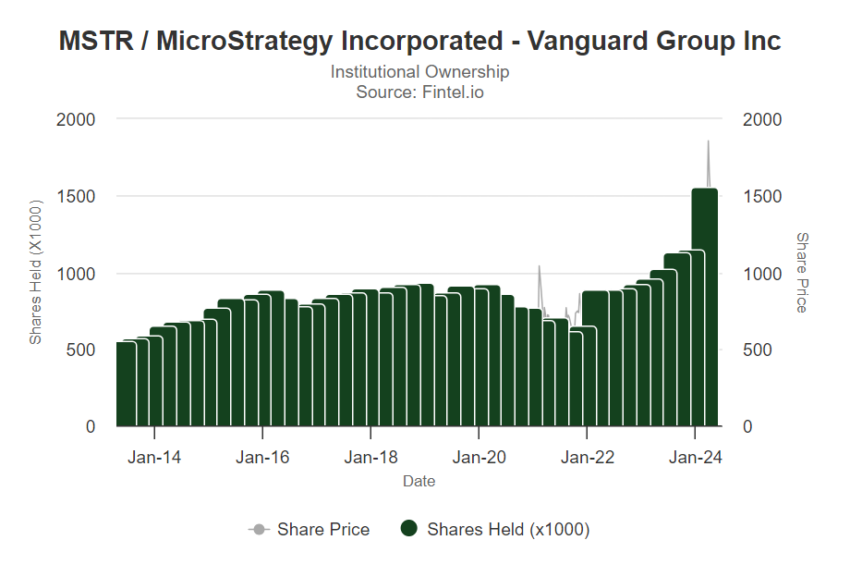

Despite its skepticism, Vanguard has indirect exposure to Bitcoin (BTC) by owning MicroStrategy (MSTR) stock. Fintel data reveals that according to the latest disclosed ownership, Vanguard owns more than 1.5 million MSTR shares, representing 10.35% of ownership.

beincrypto.com

beincrypto.com