After what has been a sensational month of November, the global crypto market has entered a much needed correction. As the majority of the market cashes out on lucrative gains, crypto investors may be wondering what is up next for the market in January.

For context, November saw triple-digit gains in some of the largest cryptocurrencies on the market. Solana was among the biggest gainers of the month.

December, on the other hand, was a mixed bag for some investors, and justifiably so.

Major currencies dipped in December, which was caused by a regular market correction brought about by the market “digesting” the amazing bullish month that was November.

Going into January, investors will be hoping to regain forces and potentially launch another bull run in the coming weeks.

The Crypto Fear and Greed Index now stands at a value of 67, indicating greed and heightened appetite for risk among investors.

Many industry insiders agree with the sentiment that a correction was necessary, such as Vivek Tripathi of bitcoincasinosreviews.com, saying that: "The market was already profoundly overleveraged and selling made sense. The question now is if the trend continues at a more stable pace in the coming weeks’’.

Top 5 Gainers

Continuing from the bull run of November, December also saw its fair share of positive action on the crypto market, with the likes of Solana and Avalanche, among others, continuing on their upwards trajectories.

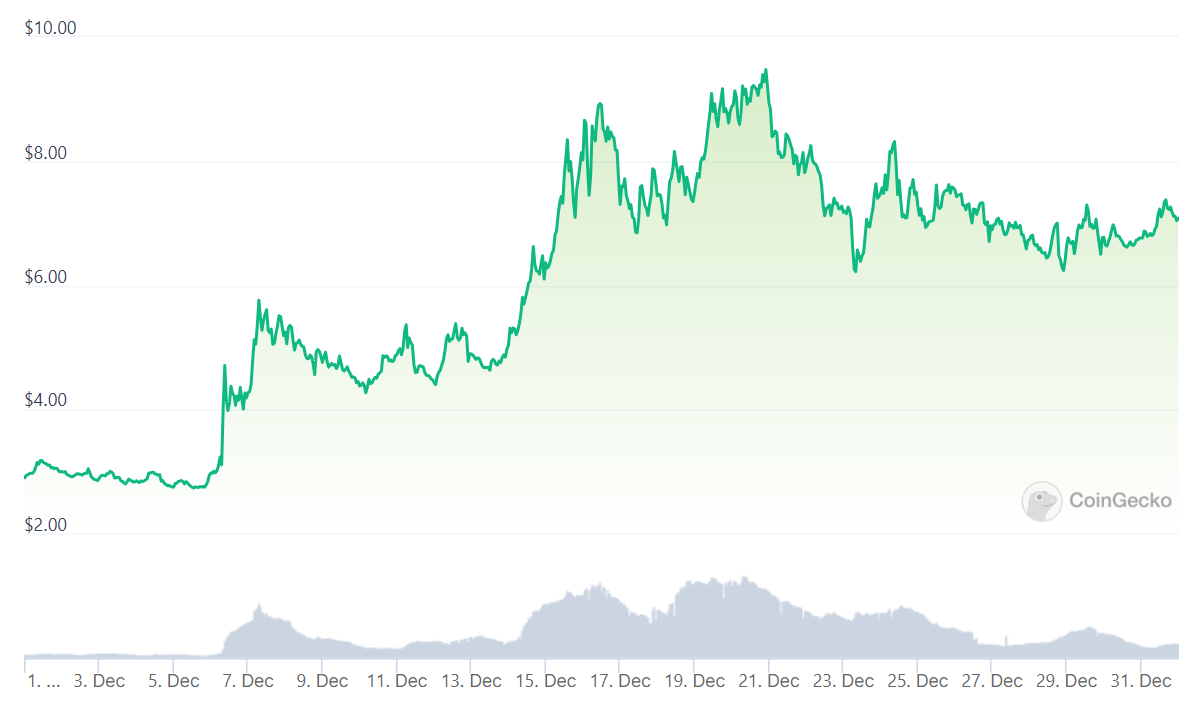

Internet Computer ($ICP) +165.05%

Internet Computer emerged as the clear winner of the month of December, gaining over 160% over the month, which was its single largest jump since its 2021 ICO.

A correction for $ICP seems to be imminent after such major gains, but the resurgence of the broader crypto market and major tailwinds could help the coin rebound sooner than anticipated.

When it comes to annual performance, $ICP has returned a healthy 250% over the past 12 months, which places it among the top-performing cryptos of the period.

Sei ($SEI) +151.7%

A relative newcomer to the crypto market, Sei has gained over 150% over the last 30 days of trading, which puts it firmly among the top gainers of December.

Only three coins managed to post triple-digit growth over the past 30 days and Sei was one of them, which marks the first considerable bull run on the coin since its ICO in August 2023.

A correction looks to be likely in January, as investors cash in some of their gains. However, this is likely to be far from the last major run for $SEI, as the project is still young and prone to changing market dynamics.

The late-December highs are unlikely to be close to the all-time high of $SEI, which is likely yet to come for the coin.

Helium ($HNT) +126.03%

The third biggest gainer on our list, Helium enjoyed a great period of trading in December, gaining over 120% over the month, which puts its annual returns at over 200%. HnT has long been a wild card for crypto traders, with massive swings in either direction. However, 2023 has proven to be positive for $HNT investors, who had the opportunity to triple their money with the coin over the year,

Whether Helium will be able to continue on its bullish tear in the coming months remains a mystery, but a healthy increase of interest from the market proves that the project has more wind in its sails.

Overall, the coin is still a long way’s off from its all-time high in January of 2022, down from $50 to $6 starting 2024.

Avalanche ($AVAX) +76.37%

Continuing on its bullish path vas Avalanche, which has more than tripled in value over the past year, netting over 75% throughout December alone.

This marks a truly inspiring year for $AVAX investors, as the coin has managed to break into the top gainers of the past 2 months and continues to deliver positive returns to holders. Going forward, a correction for $AVAX is likely, but the broad consensus for the coin remains positive in the long run.

Solana ($SOL) +67.66%

Another major crypto with tailwinds continuing from November was Solana, which has taken the market by storm in recent months. December saw $SOL surge by over 65%, which puts its annual returns to an amazing 670%, which was difficult to expect given the rough market conditions facing Solana at the start of 2023.

December saw Solana reach a triple-digit price point for the first time since late April of 2022.

Solana holders have closed the year out in style and will be hopeful of fewer headwinds in 2024, which will largely depend on the regulatory climate and monetary policy changes from around the globe.

Top 5 Losers

November saw plenty of speculation during the market boom and December proved to be a correction period for the affected cryptocurrencies, with some losing nearly half of their market values.

However, it must be noted that this sell-off was not strong enough to mark a turnaround from the prevailing bullish trend.

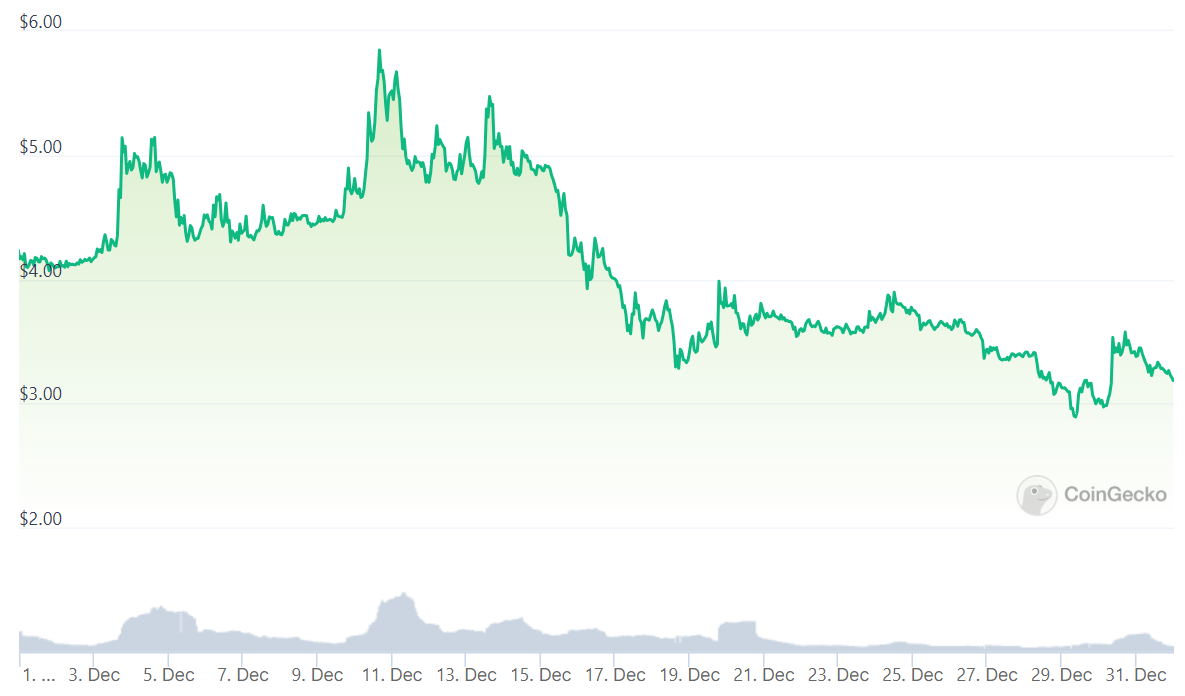

Terra Classic ($LUNC) −50.56%

Terra Classic, the renewal of the calamitous Terra/Luna project, has been subject to plenty of speculation throughout most of 2023.

The coin lost half of its market value over the course of December, which further adds to the notion that the November bull run on $LUNC was fueled by speculation, as opposed to inherent shifts in market perception towards the project.

Therefore, it is uncertain whether Terra Classic will be able to attract the necessary buying pressure to mark a comeback in January. If a major bull run is to continue, $LUNC may stand a chance to shed its nearly 20% losses over the past 12 months and go in the green over the period.

FTX Token ($FTT) −42.12%

Another product of speculation, the news of a potential revival of the FTX exchange sparked some interest in investors in November. However, concrete decisions are yet to be made, which has caused the speculative boom to be short-lived on $FTT.

The FTX Token has lost over 40% of its market value over the past month, which makes it the second largest loser of the period. Whether $FTT manages to improve its fortunes before the end of January remains to be seen, but investors will have little more than speculation to hope for in the short-term.

Kaspa ($KAS) −24.81%

Kaspa, which has been one of the biggest gainers over the past 12 months, $KAS had gained over 2,300% over the period. However, December has not been as fortunate for $KAS investors, as the coin lost almost 25% of its market value during the month.

This is not nearly enough to change the fortunes of the coin and holders are more likely to interpret this loss as a necessary sell-off before an eventual price stabilization. Due to its magnificent performance over the past year, $KAS investors will be more hopeful of the coin rebounding soon enough after the market fully digests the November gains and continues on its path to new heights.

THORChain ($RUNE) −16.81%

THORChain has enjoyed a successful year in 2023, gaining more than 280% over the period. However, the month of December saw the coin take a hit, losing roughly 17% of its market value.

Such a correction was to be expected, given the sharp rise witnessed in November. However, it is uncertain whether $RUNE has the buying pressure to pull it back into winning ways, or whether a further drop is to be expected. With a trading volume of over $370 million, $RUNE enjoys a healthy amount of liquidity and interest from the market, which could mean that the December correction was only a temporary bump in the road for $RUNE holders.

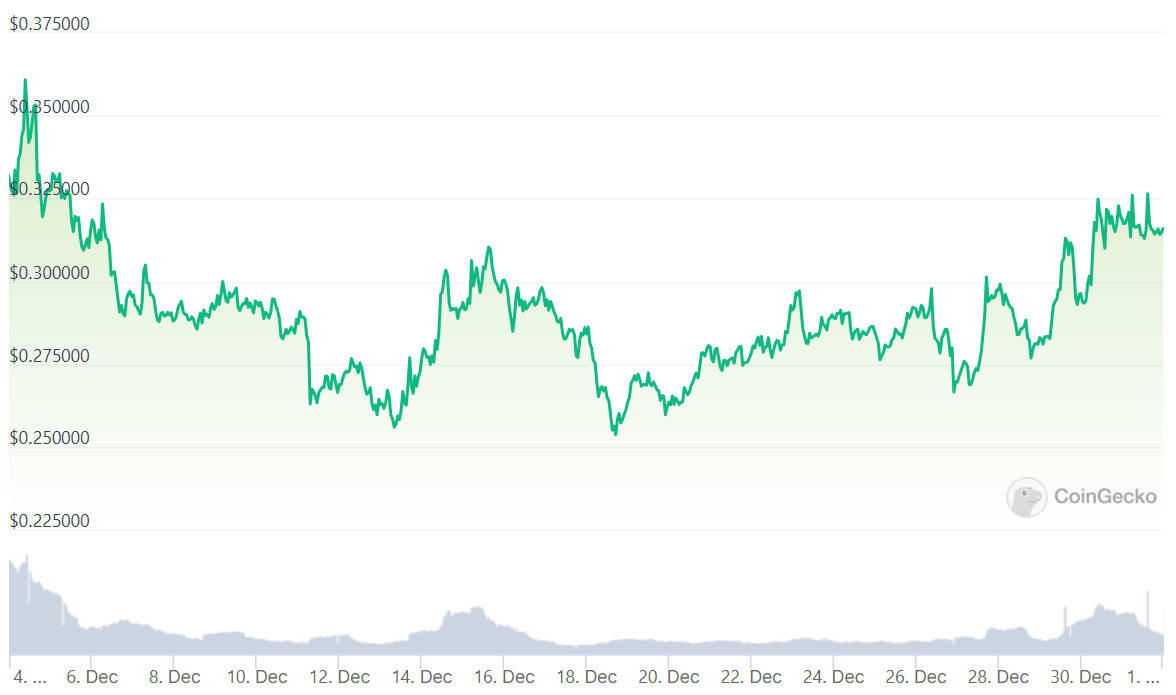

$IOTA ($IOTA) −16.59%

$IOTA has been a hit or miss over the last year. While the coin has gained over 40% in market value over the period, it has now lost roughly 17% in the past month. Compared to other competing coins, $IOTA’s returns lag behind, which can test the patience of even the most committed investors. This puts $IOTA in a tough position and major gains in the short-term seem unlikely. Going forward, $IOTA may encounter more headwinds, unless the broader market goes through another major bull run.

Conclusion

Some cryptocurrencies have managed to continue the bullish momentum from November all the way through December, such as Avalanche and Solana, which delivered amazing returns in November.

While a certain degree of correction did take place on the market, the broader bullish trend has persevered and investors will be expecting more action going into January.

Many analysts believe that the bull run is far from lower and the Fear and Greed Index reinforces this sentiment, as a value of 67/100 indicates a notable shift from the fearful and bearish sentiment that prevailed throughout most of 2023.

cryptonews.net

cryptonews.net