Giving gifts to friends and family is a cherished holiday tradition that includes sharing any wealth we’ve accumulated over the past year (sorry, Scrooge). It’s a way to show care and strengthen connection with loved ones.

Following that, cryptocurrency is a great gift option because offering crypto as a gift can be surprising, original, and rewarding for those who enjoy the potential for profit.

And, just think about what kind of gift bitcoin could have been, even a decade ago. Imagine gifting bitcoin or another cryptocurrency that could have grown dramatically in value. (Just look at the performance of our crypto-focused portfolio as an example of what’s possible).

While there’s no guarantee crypto will continue to grow at the same pace in the coming years, it’s still a nice gift because of its Store of Value (SoV) status.

In this article, we’re discussing how you can gift crypto to friends and family this holiday.

Gifting Crypto through an Exchange

Ease of Use: Easy

The most straightforward way to gift cryptocurrency is through a crypto exchange, such as Coinbase or Robinhood. If you don’t hold any crypto, you can easily buy some on one of these crypto exchanges by paying with a credit card.

Many exchanges provide a user-friendly interface. You must send the crypto to the recipient’s wallet address, which may come as a QR code or a string of letters and numbers.

Coinbase and Robinhood, in particular, enable users to gift crypto to an email address, which the recipient can later claim.

Pros:

- Beginner-friendly – exchanges provide a simple and intuitive platform for buying and sending crypto.

- Diversity – you can access hundreds of cryptocurrencies for gifting, and your recipient can also find ways to exchange those crypto without having to understand any significant technical knowledge.

- Fast transfer – direct transfers reach finality within seconds or an hour.

Cons:

- Security – centralized crypto exchanges hold funds online, which makes them the least secure option listed here.

- Fees – some exchanges may charge fees for buying or transferring crypto.

- Recipient address – in many cases, you must have the recipient’s address before gifting, which may diminish the surprise effect. The good news is that Coinbase and other platforms enable users to gift crypto to an email address.

Gifting Crypto Gift Cards

Ease of Use: Easy

If you’ve ever received a Visa gift card, a crypto gift card functions much the same. Crypto gift cards can be digital or physical and function like traditional ones, the only difference being that they’re loaded with crypto.

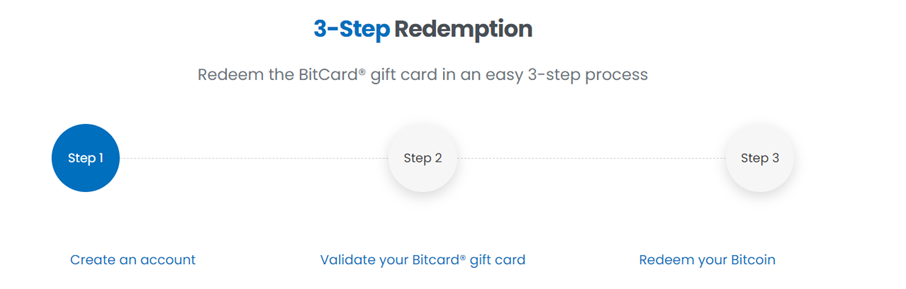

The gift card recipients can redeem the crypto in their wallet or use it to spend online. Some exchanges, like Coinbase and Binance, offer a convenient gift card option. Specialized services, such as BitCard, enable users to gift bitcoin in 150+ countries.

Pros:

- Tangible gift – physical crypto gift cards are ideal for those who prefer physical gifts.

- Ease of redemption – the redemption is simple – recipients can transfer the crypto to their wallet anytime.

- Versatility – the cards can be used for purchasing goods in crypto-friendly marketplaces.

Cons:

- Limited availability – not all cryptocurrencies may be available in gift card form.

- Platform dependency – some platforms, like Coinbase, require recipients to redeem their gift cards to Coinbase accounts only.

Gifting through a P2P Payment App

Ease of Use: Easy

Traditional peer-to-peer (P2P) payment apps, such as PayPal, Venmo, and Cash App, also allow users to buy and send cryptocurrency, which makes them an excellent option for crypto gifts. With PayPal, one can send BTC, ETH, LTC, and BCH to another PayPal user or Venmo account and other crypto exchanges.

However, you’ll have to go through a more elaborate KYC verification process and have a linked payment method. Also, most of these apps accept US customers for crypto transactions only at the moment.

Pros

- Convenience – many people use PayPal or Venmo, and using these options requires you to have the recipient’s email only.

- Versatility – the crypto can be used to make online payments, as PayPal is accepted as a payment option by millions of merchants.

Cons

- Cost – these P2P apps charge higher fees than crypto exchanges.

- Limited options – PayPal and similar apps support only a few crypto coins.

- Limited availability – only US users can use PayPal and Venmo for crypto transfers.

Create and Fund a Software Wallet

Ease of Use: Moderate

If you want your loved one to have more direct control over their crypto, you can set up a wallet for them and put crypto into it. Creating and funding a software wallet is more suitable for tech-savvy users and will require more hands-on knowledge from the recipient (knowledge that you might have to give them).

First, download a reputable mobile or desktop wallet, such as MetaMask or Exodus, and set up an account. The critical part is safely recording the seed phrase - a series of 12 or 24 random words required for wallet recovery.

After setting up, you can transfer the desired amount of crypto to this wallet. The recipient can access these funds by downloading the same wallet software and entering the provided seed phrase.

This can be an excellent opportunity to teach your friend or family members how to begin using crypto.

Pros:

- Full control – the recipient has complete control over their funds.

- DeFi access – if your friend is familiar with crypto, he can explore DeFi yield opportunities.

- Wide range of crypto – you can choose from thousands of cryptocurrencies.

Cons:

- Complexity – this approach requires technical know-how to set up and use the wallet.

- Responsibility – safeguarding the seed phrase is crucial; funds cannot be recovered if lost.

Read more about our favorite crypto wallets.

Give a Paper Wallet

Ease of Use: Difficult

Paper wallets are an interesting way to offer crypto. Paper wallets are cold wallets in which the secret keys of the wallet are printed out on paper for the user to hold. The tokens in that wallet are removed from the network and “stored” in the wallet, only accessible via the printed keys.

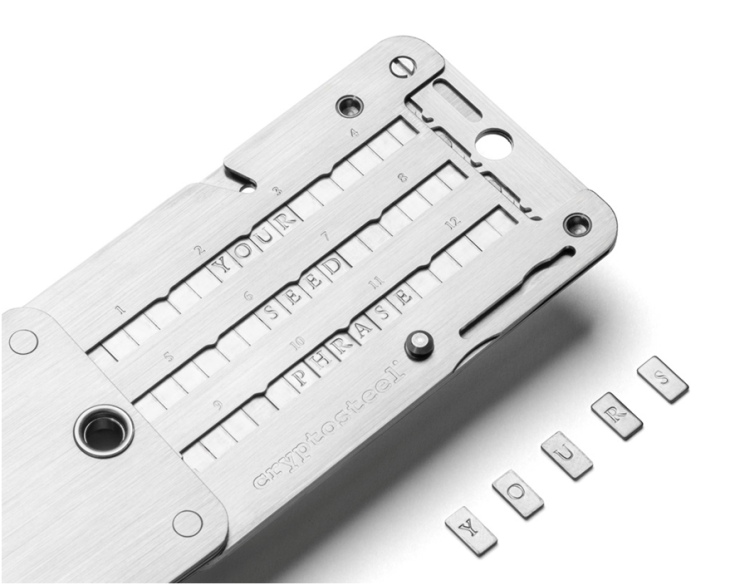

The name “paper” is a bit of a misnomer in that they can be made of paper, metal, or anything on which the keys are printed. For example, Cryptosteel offers cold wallets made of steel, which is far more resilient and solid.

A great aspect of this gift is that it is physical and personal (or, at least, personalizable). It can represent a more stable gift in that you’re essentially gifting a crypto wallet that the user can tuck away like an investment.

Pros

- Customizable – paper wallets can be personalized in every way possible.

- Security – paper wallets require more responsibility but are more secure because they store crypto offline.

Cons

- Complexity – beginners might not know what to do with paper wallets. They have the private key or seed phrase recorded on them, and recipients then have to move the crypto funds to some software wallet to use it.

- Responsibility – recipients must keep the cold wallet safe since losing it means losing all the crypto funds.

Give a Hardware Wallet

Ease of use: Difficult

A more popular form of cold storage is a hardware wallet, such as the one provided by Ledger or Trezor. These devices hold the crypto funds offline and can be connected to their native or other apps via the USB port.

Before gifting a hardware wallet, you should buy the device online, set it up, and put some crypto. The whole process may require several days, including the delivery.

Pros

- Security – hardware wallets are regarded as the most secure wallets, although Ledger recently experienced a massive security breach.

- Control – with hardware wallets, users have full control over their crypto holdings.

Cons

- Cost – you must pay between $50 and $200 for a hardware wallet alone.

- Complexity – these wallets require some knowledge to set up and use.

- Responsibility – as with paper wallets, hardware wallets must be stored in a safe place.

Read more about crypto hardware wallets.

What About Taxes on Crypto Gifts?

In the US, cryptocurrency gifts are subject to similar tax rules as stocks or bonds. For 2023, gifts below $17,000 are exempt from gift tax; for 2024, the exemption limit is raised to $18,000. This exemption applies until the recipient decides to sell the crypto. Filing a gift tax return using Form 709 is necessary for gifts above these amounts. This includes cumulative smaller gifts that exceed the annual exemption limit.

Read more in our crypto tax guide.

Investor Takeaway

The joy of giving can surpass that of receiving. Gifting crypto to loved ones is an original gesture and an investment in their financial future. Whether you opt for crypto exchanges, gift cards, payment apps, or more secure options like software and hardware wallets, each method offers unique benefits.

While bitcoin's significant growth over the past five years highlights crypto's potential as a valuable gift, it's important to remember the tax implications for gifts above stipulated amounts. Don’t give more than you are prepared to spend, and remember that you’re giving someone an investment, not cash.

Gift them a great investment. That’s the gift that keeps on giving.

bitcoinmarketjournal.com

bitcoinmarketjournal.com