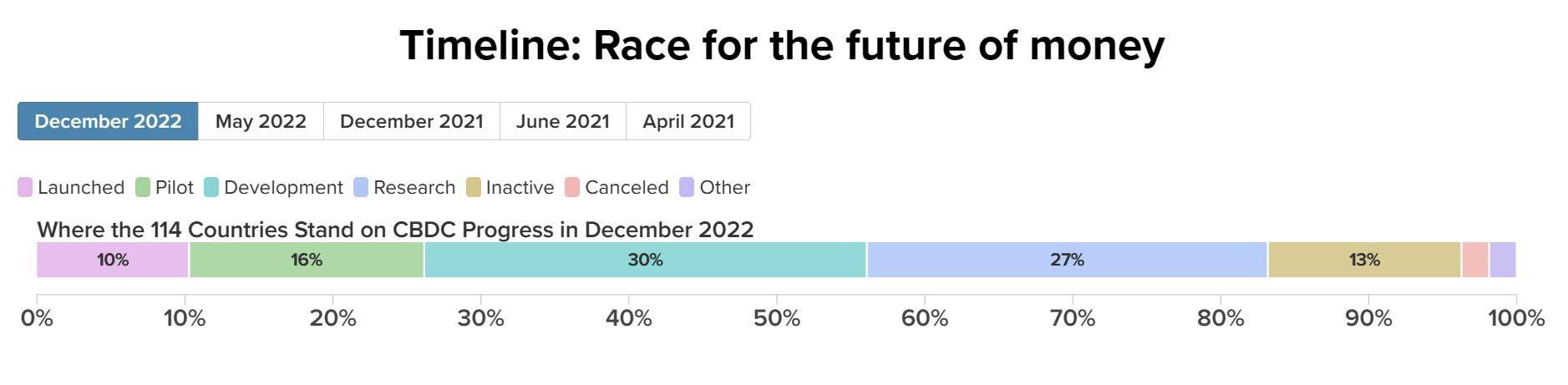

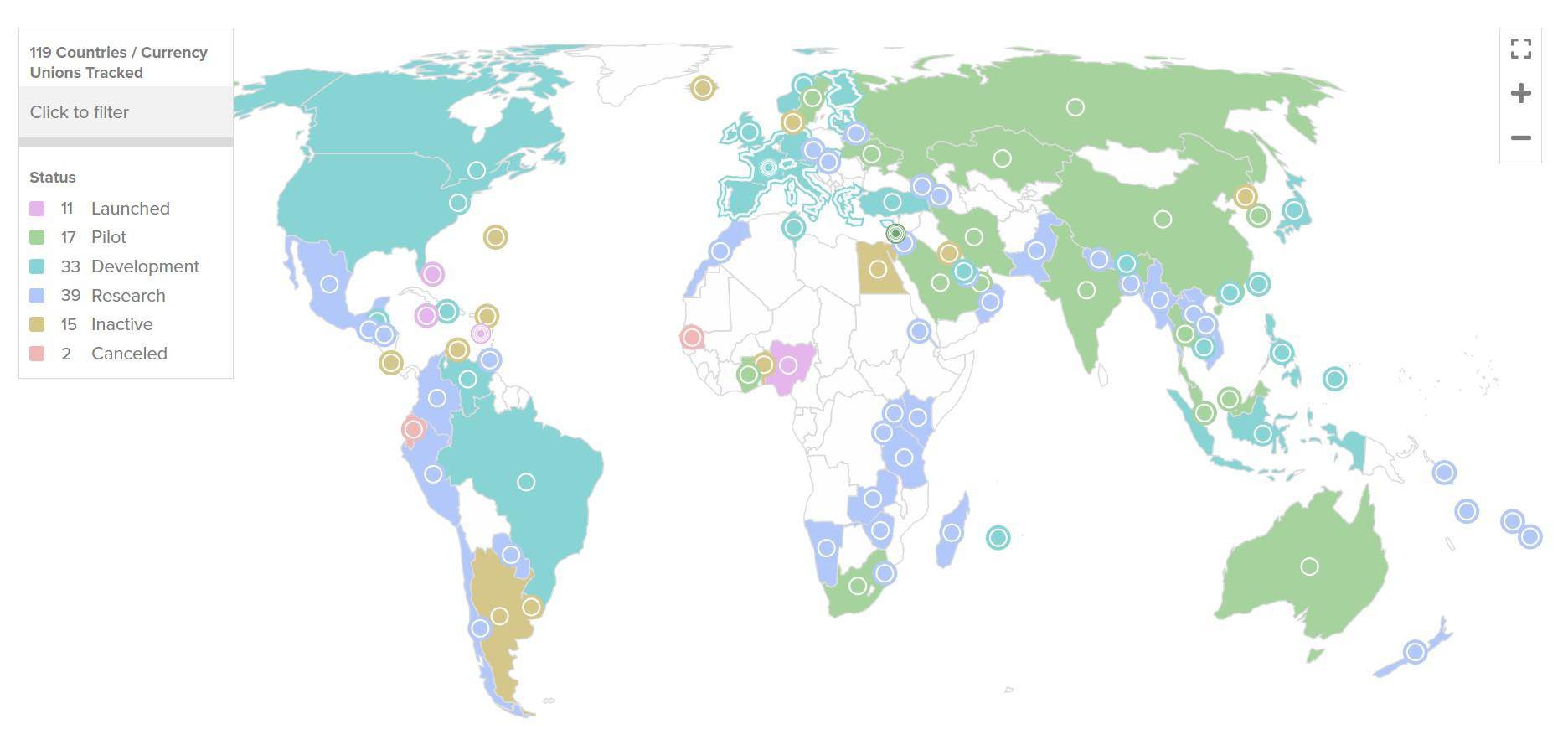

Executive Summary: According to the Atlantic Council’s Central Bank Digital Currency (CBDC) tracker, 114 countries are exploring a CBDC. Among them, 39 countries are in the research phase, 33 are in the development phase and 11 have already launched.

This represents over 95 percent of global GDP. (No country wants to be left behind.) In this guide, we comprehensively unpack the latest developments with CBDCs and the opportunities for crypto investors.

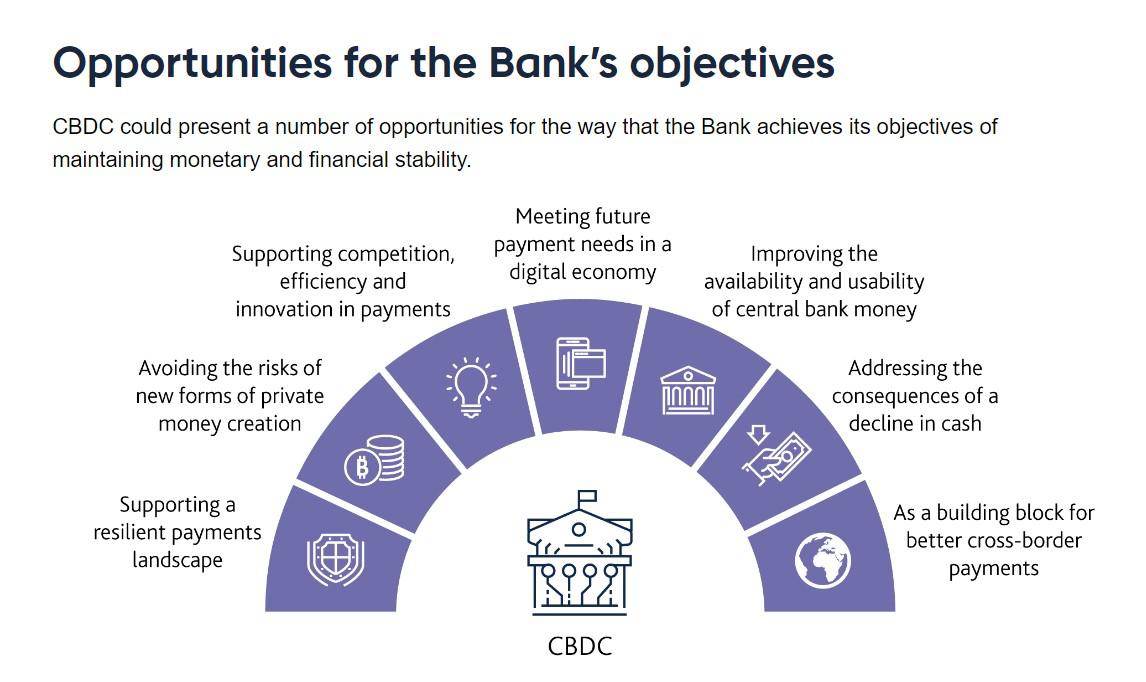

CBDCs have been a hot topic in recent years. Countries are looking at digital currencies as a solution to challenges posed by an increasing usage of digital payments and cryptocurrencies.

Central banks are attempting to extend what central bank money can do, accelerating the transition from paper money to digital money.

Let’s dive deeper into what CBDCs are, how they differ from mobile money and cryptocurrencies, progress made by major countries, and what all of this might mean for investors.

What is a CBDC?

CBDCs are nationally-issued digital currencies controlled by central banks.

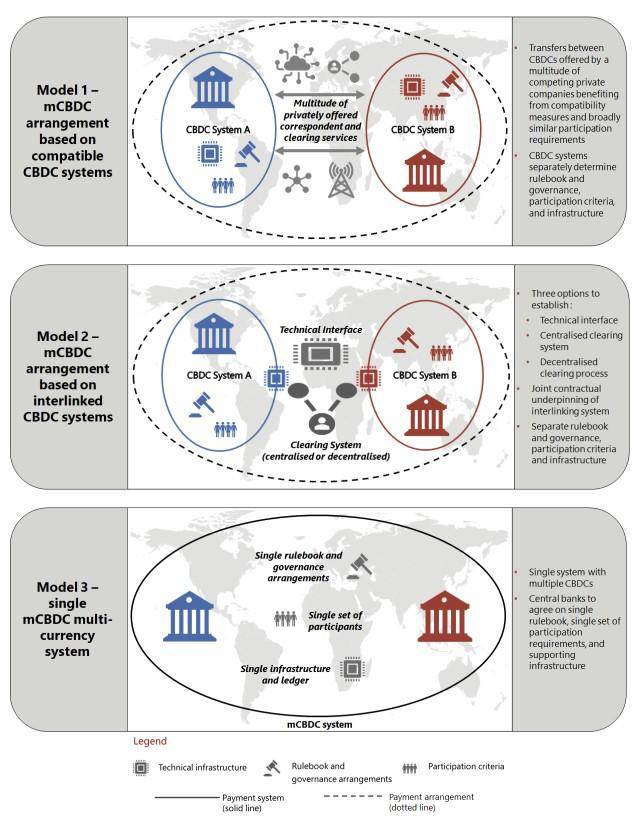

There are generally two forms of CBDCs: retail CBDCs, which are the currency issued to the general public, and wholesale CBDCs, which can be defined as money intended for related wholesale transactions like interbank transfers.

The design of CBDC systems can either be token-based or account-based.

A token-based design is similar to crypto, in that users have to verify the ownership of the tokens using private keys. Whoever has the token in their wallet is presumed to own them.

In an account-based design, intermediaries will have to identify the identities of the transacting parties and maintain a record of balances.

In terms of distribution, central banks can either directly distribute the currency by allowing users to create an account with them, or they can delegate the distribution to existing commercial banks.

A CBDC is not a cryptocurrency. Cryptocurrencies are not regulated, not stable in value, and not backed by the government. Stablecoins are the digital assets closest in nature to CBDCs, but are still significantly different since they are usually issued by for-profit private companies.

Put another way, a CBDC is simply a digital fiat currency (read more in our Guide to CBDCs).

CBDCs vs. Mobile Money

Liability of the central bank: One of the big differences between CBDCs and mobile money is that the latter is a liability to private financial institutions, while CBDCs are a direct liability to the central banks. Until CBDCs, physical cash has been the only way for an everyday consumer to use money that is a direct liability to the central bank.

Issued by the central bank: A CBDC is a nationally issued digital currency, a new financial instrument that will either coexist with or replace physical money, while mobile money simply uses digital systems to manage traditional account balances.

Intermediaries: Mobile money requires intermediaries in the form of banks or financial institutions to facilitate transfers and payments. CBDCs can be designed to operate peer-to-peer, more or less eliminating the need for intermediaries.

CBDCs vs. Cryptocurrencies

Crypto was designed to be decentralized, eliminating the need for a single point of authority. In contrast, CBDCs are entirely centralized, with the central bank acting as the central authority that oversees and facilitates transactions.

Secondly, cryptocurrencies are volatile assets. Their values are determined by investor sentiment, while CBDCs are designed to mirror the value of their fiat equivalents, therefore providing a stable digital currency.

Crypto issuance and creation are controlled by algorithms and network participants, whereas CBDCs are issued and controlled by central banks (like physical cash).

Cryptocurrencies are private money since they are issued by private projects and protocols. Due to this private nature, there are cases where the general public won’t have access to a cryptocurrency due to issues in purchasing or redeeming the private currency. CBDCs will be public money, fully available to the general public in the same way as banknotes today.

Which Countries Use CBDCs?

CBDCs in the US

The development of a CBDC in the US has been slow in recent years compared to other major economies. That said, the US Federal Reserve made a significant announcement late last year, revealing it is developing a wholesale CBDC prototype to test whether blockchain technology can deliver fast and safe payments. The test revealed that blockchain-enabled cross-border payments can indeed be faster and safer.

There haven’t been announcements regarding retail CBDCs, though the wholesale CBDC test project progressed to the next stage with the goal of reducing settlement risk.

CBDCs in the UK

The UK is considering whether or not it should issue a CBDC. Early last year, the Bank of England reiterated that it had not yet made a decision on whether to introduce a CBDC. This year, the Bank of England announced that it will be moving forward with its CBDC research work. In a statement, Chancellor of the Exchequer Jeremy Hunt said,

“While cash is here to stay, a digital pound issued and backed by the Bank of England could be a new way to pay that’s trusted, accessible and easy to use…That’s why we want to investigate what is possible first, whilst always making sure we protect financial stability.”

CBDCs in the EU

The European Central Bank initiated the digital euro project in June 2021 and has since been in an investigation phase into retail CBDCs. Mid-2022, in a blog post authored by the bank’s President Christine Lagarde and executive board member Fabio Panetta, they said,

“It is too early to decide on the details of the design. We expect to complete the investigation phase of our digital euro project in the autumn of 2023.”

Two months earlier, Panetta had hinted at the possibility of a digital euro being issued within the next four years.

CBDCs in China

China’s CBDC plan is in a much more advanced stage. Its digital yuan, the e-CNY, has been in the trial phase for a little over two years. The country’s central bank released the financial statistics report for 2022, which revealed that as of December 2022, there were 13.61 billion e-CNY in circulation, roughly equivalent to $1.9 billion. Several months earlier, the People’s Bank of China also reported that transactions using China’s digital yuan surpassed 100 billion yuan ($13.9 billion).

China is far ahead of other world major economies in launching CBDCs, though according to Xie Ping, a former official from the People’s Bank of China, e-CNY’s testing and rollout campaign has not performed as expected. He said in a conference:

“The cumulative circulation of the digital yuan in the two years of the trial has been only 100 billion yuan ($14 billion)…The results are not ideal.”

Comparatively, the total amount of currency in circulation was 10.47 trillion yuan at the end of 2022, indicating the eCNY accounts for less than 1% of the total currency in circulation.

Potential CBDC Investment Opportunities

Blockchain Partners

With many countries moving forward with the development of CBDCs, there are blockchain projects that may benefit from partnerships with banks, and investment opportunities that may arise as a result.

Projects such as Chainlink (LINK) may come in handy in connecting centralized enterprises with the blockchain, and enabling CBDC transfers across public and private networks.

SWIFT, a messaging network that financial institutions use to securely transmit instructions through a standardized system, recently partnered with the crypto project, as the financial messaging system plans on a global CBDC network.

Projects like Hyperledger have a number of technologies already being deployed in CBDC projects. Also, Layer 1 projects such as Algorand (ALGO) are keen on establishing themselves as leaders to issue retail and wholesale CBDCs.

It has also been suggested that stablecoins could take the place of CBDCs. If a regulatory framework could allow fully regulated banks to issue stablecoins backed 100% by deposits, it might not be necessary for central banks to issue a CBDC.

This scenario could potentially benefit Circle’s USDC, if a partnership were formed. (See our piece on How to Invest in Circle.)

Traditional Companies

Traditional companies have also been a part of the development of CBDCs. Companies such as IBM have been actively involved in testing CBDCs, and they are confident with their position in the space:

“Given the current exposure of IBM in the capital market and ecosystems, it is likely that IBM will have the opportunity to support this transformation towards CBDC, embedding a combination of IBM Technology and IBM Consulting.”

Other authority firms like Microsoft are also likely to be central in the development and deployment of CBDCs. The technology corporation has previously partnered with other firms to assist central banks in safely testing their CBDCs.

Technology and consulting firms like Oracle and Deloitte also offer solutions for governments embarking on a CBDC journey. If the development and adoption of CBDCs properly take off, these firms stand to benefit.

Investor Takeaway

The CBDC space will be a fruitful one to watch in the coming years, especially with countries working hard to avoid being left behind.

However, governments move slowly. CBDCs still have to overcome technological hurdles, not to mention user adoption hurdles. But the countries (and their public-company partners) that do the best job introducing CBDCs will be poised to see incredible financial growth in the years ahead.

Subscribe to Bitcoin Market Journal to keep up-to-date with all the developments in the cryptocurrency and blockchain space.

bitcoinmarketjournal.com

bitcoinmarketjournal.com