While the crypto industry at large generally looks forward to policy for clarity on things like what is a security and what isn’t, and also (hopefully( focus on weeding out bad actors like former FTX CEO Sam Bankman-Fried, regulations are seen as a necessary evil. That is, except in climate activist circles. Here, people in crypto are enthusiastic about how policy and regulation could become generative in their ability to accelerate the demand for and use of blockchain solutions.

In the context of the regenerative finance (ReFi) space, which I recently proclaimed would have a real breakout year in 2023, I believe policy and regulation, primarily outside of crypto regulators, will actually be a major stimulant for innovation and adoption of ReFi solutions globally.

Boyd Cohen is CEO and co-founder of Iomob, the developers of WheelCoin, a Move2Earn game that rewards users for moving green. This piece is part of CoinDesk's Policy Week 2023.

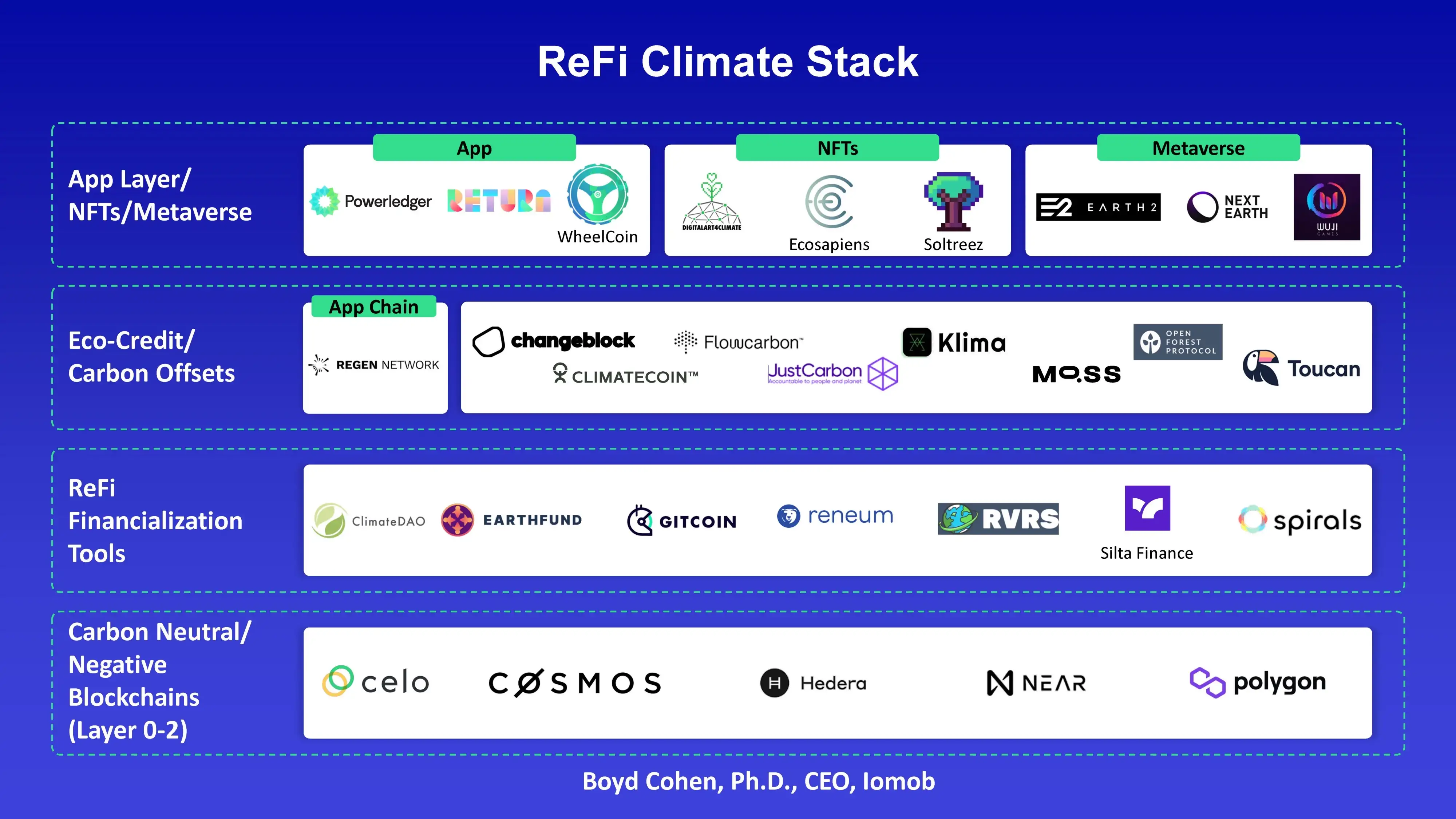

In order to explore how policy and regulation could stimulate ReFi adoption, I recently sketched the ReFi Climate Stack as a visual tool to frame the way teams are leveraging crypto rails to advance climate action.

(Boyd Cohen/Iomob)

As is the case for most blockchain stack frameworks, the ReFi Climate Stack is best utilized going from the base and moving up to the app layer.

Blockchain layer 0-2 policy support

One of the biggest achievements of crypto in 2022 was the ambitious and successful Ethereum migration from the energy-intensive proof-of-work (PoW) consensus mechanism to the energy-efficient proof-of-stake (PoS) mechanism. The Merge, as it was affectionately known, raised more awareness among the public at large and policymakers around the world of the energy and carbon emissions of PoW blockchains such as Bitcoin. Indeed, most blockchains are based on PoS. In 2022 we witnessed regional and national jurisdictions including the New York State go as far as placing moratoriums on new bitcoin mining operations due to the environmental impacts and energy consumed by miners.

Blockchains such as Celo, Cosmos, Hedera, Near and Polygon have been racing to prove their carbon-neutral, or even carbon-negative, credentials in order to appeal to a range of actors who care about sustainability and climate change.

Emerging ReFi projects looking to deploy on crypto rails increasingly cite the carbon commitments of the layer 0 through layer 2 they are building on as a key factor in their decision. It is only a matter of time before this starts to find its way into legacy and Web 2 enterprise decisions as well as government evaluations of blockchain use cases.

Take, for example, major energy companies, all of whom have some type of blockchain activities under way. These same energy companies are increasingly subject to regulations on carbon emissions. When deciding which base layer to build on, you can bet every single energy company (and every other company in industries subject to carbon regulation) will seek out blockchains with low carbon credentials.

The same goes for any government initiative aiming to leverage blockchain for operations and service delivery. The number of use cases for blockchain in government are growing by the day. ConsenSys published a report on this topic highlighting the application of blockchain for smart cities, central banking, validation of citizen credentials, tracking vaccines as well as loans and student grants and for payroll tax collection. It is impossible to imagine a world where governments would not make the carbon emissions of the underlying blockchain a key criteria in their public tender and their eventual decision-making.

Thus, the broader movement to regulate carbon emissions of commercial and public action will generate real opportunities for blockchains at the base of the stack who take a lead on carbon neutrality.

ReFi financialization tools

Several blockchain projects have launched to support the funding of ReFi projects because they represent a type of public good. The open-source development platform Gitcoin was among the first to do this. Now operating as a decentralized autonomous organization (DAO), Gitcoin leverages quadratic funding – a form of crowdfunding – to democratize financial support of impact projects (off-chain and on-chain). Gitcoin relies on matching funds from larger donors, including governments seeking to support and fund ReFi projects that align with their own ambitions for the public good.

I am confident we will continue to see local, regional and international agencies and groups such as the United Nations embrace ReFi to help accelerate sustainable development goals. The funding may frequently flow via on-chain tools dedicated to democratizing the process while ensuring transparency of the funding choices as well as the outcomes of the use of funds.

Eco-Credits and Offsets

The carbon-offset industry, which has exceeded $270 billion annually, is increasingly coming under scrutiny due to the perception that a lot of it leads to greenwashing, and that many offsets are generated and retired with insufficient transparency. Dozens, if not hundreds, of ReFi projects have been born in the past few years designed to leverage crypto rails to solve the coordination and transparency problems among the different stakeholders such as project developers, investors and demand partners such as corporations, governments and end users of voluntary offsets.

KlimaDAO alone has helped facilitate the removal of 18 million tons of carbon dioxide (CO2), equivalent to removing nearly 4 million cars from the road annually, on-chain data shows. Climate change policy is growing in the face of worsening impacts from climate change, and it is undeniable that a growing number of enterprises will be required (or pressured by stakeholders) to get their act together. While this will place more pressure on enterprises to reduce their own carbon emissions from operations and their supply chains (something ReFi can also help with), the use of on-chain tools to transparently engage in carbon markets will accelerate as well.

App layer

As the layer closest to end users, ReFi can play its part in helping to onboard the next billion users by creating engaging apps, non-fungible tokens (NFT) and metaverse products that make going green fun. Yet, where I predict the most interest and attention from policymakers at this layer of the ReFi Climate Stack is actually on the metaverse. As ConsenSys highlighted in its report, smart cities are an area of increasing interest for governments and blockchain projects.

Within smart cities, digital twins and the metaverse are very hot. Singapore was one of the first to make a big investment in digital twin technology (off-chain) but Dubai is making the most waves in terms of embracing the metaverse as a formal part of the city’s strategy to become the global mecca for the metaverse, generating $4 billion for the local economy and creating more than 40,000 jobs by 2030.

One of the main drivers for smart cities embracing the metaverse is to engage in hyper-realistic planning of new public and private infrastructure projects. By creating a digital twin of an entire city in 3D, planners are able to evaluate the implications of a new highway, a new train line and new commercial real estate projects on traffic, on quality of life and carbon emissions, too.

Furthermore, cities embracing these metaverse projects can more transparently share the potential impacts of future infrastructure with citizens by inviting them into the metaverse environment and to get citizens opinions or even enhance the model by viewing how citizens anticipate engaging with the resulting infrastructure.

The market for digital twins including for cities themselves has been estimated to be worth $86 billion by 2028. As such you can bet we will see many existing and new metaverse companies go after this market to help policy makers modernize infrastructure investment decision-making.

Conclusion

ReFi is going mainstream and policy and regulation could very well serve as an accelerant to the ReFi boom I predicted for 2023. Beyond 2023 as well, the market opportunities for low-carbon blockchains, for solving coordination problems with respect to public-goods funding, for bringing transparency to carbon markets and for embracing ReFi apps and the metaverse are likely to grow exponentially. Maybe policy is not bad after all.

Explore What’s Next at the Consensus 2023 Crypto Policy Forum

The Crypto Policy Forum, at the annual Consensus gathering in Austin, Texas, convenes leaders from government and the crypto and blockchain community to discuss, debate and determine where the affairs of the state should start and end within the Web3 economy.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

coindesk.com

coindesk.com