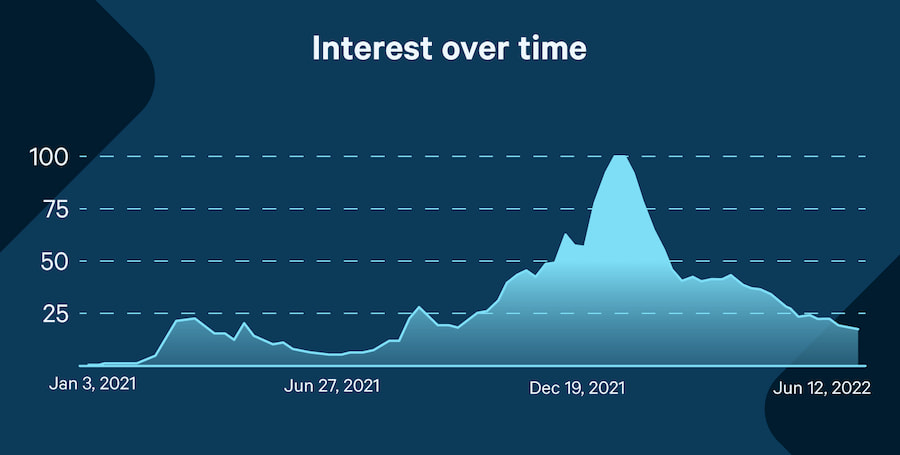

In 2021, the term non-fungible token (NFT) began to spread throughout crypto forums and beyond, and as a result, a number of people began to gain an interest in them.

Even though 2021 was a good year for NFTs, people’s natural curiosity waned. They are not as interested in this new technology as they were a year earlier, according to the findings of a new study shared with Finbold and published by DEXterlab on July 21.

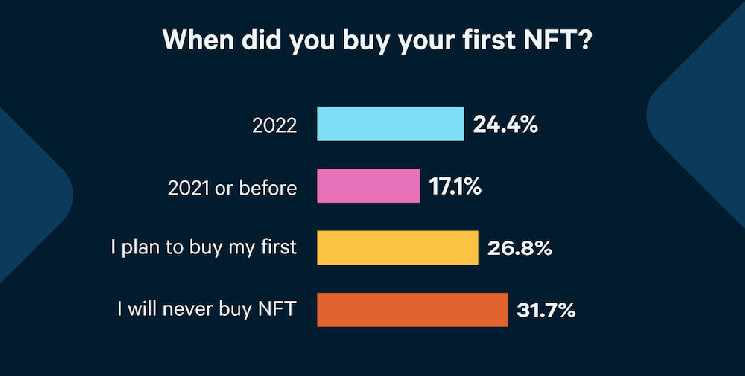

DEXterlab carried conducted a survey in the form of Twitter polls in order to gain a better understanding of the current state of NFT adoption in July. The research indicated how many individuals who have never purchased an NFT want to do so in the future. 26.6% of survey respondents indicated they intend to purchase one, while 31.7% of crypto enthusiasts claimed they would never buy an NFT.

Furthermore, the results indicate that 17.1% of individuals purchased their first NFT in 2021 or before. Despite a considerable decline in “NFT” keyword searches in 2022, the statistics show that there were more first-timers this year than in 2021, as 24.4% of respondents claimed they purchased their first NFT in 2022.

Crypto bear market impacts NFTs too

The international economy has not had a productive year in 2022. The Federal Reserve was forced to implement stringent price control measures due to persistent inflation. Traditional markets are experiencing panic as a result of uncertainty. As stock prices continue to fall, this is affecting cryptocurrencies since both markets have been closely correlated.

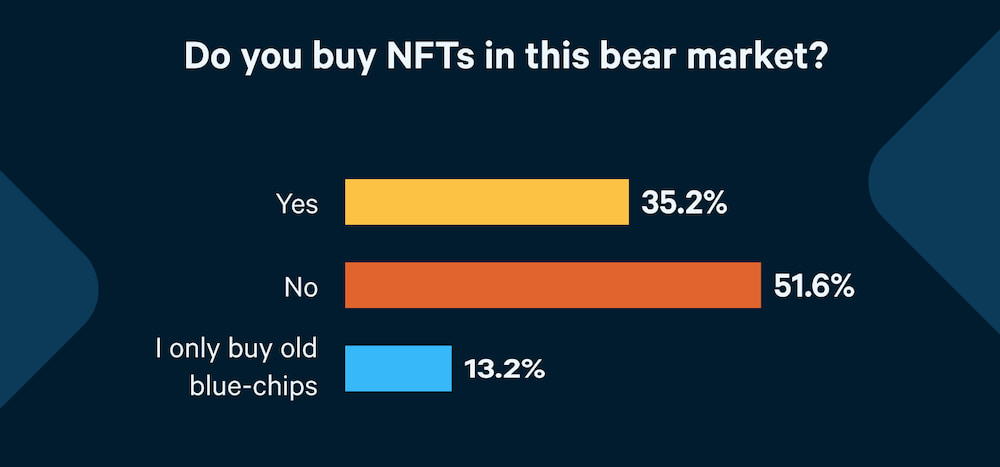

In general, during a bear market, individuals are exiting their positions until confidence returns to the macroeconomy. Only 35.2% of applicants replied yes when asked whether they bought NFTs in the bear market. Moreover, half of the individuals who participated in the survey, or 51.6%, had a pessimistic outlook on the future and are not investing their money in NFTs at this time.

A substantially smaller number of individuals are investing in higher-tier NFTs known as blue chips. Such NFTs are from well-known collections such as Bored Ape Yacht Club, Cryptopunks, DeGods, and many more. The pricing of blue-chip NFTs may vary anywhere from t.housands to perhaps hundreds of thousands of dollars.

Even though the majority of blue-chip NFTs lost more than half of their value in USD, just 13.2% of people who participated in the survey believe that investing a large amount of money in blue-chip NFTs is an opportunity rather than a danger.

Users feel comfortable owning NFTs during a bear market

DEXterlab wanted to know whether or not individuals felt comfortable owning NFTs despite the bear market. The belief among those who believe NFTs are a generally secure asset is rather strong; 46.5% feel comfortable maintaining their NFT portfolio. 53.5% of those who participated in the survey felt that possessing NFTs is hazardous.

It’s possible that non-fungible tokens are now at the same stage of the adoption curve as other cryptocurrencies, and that over the next few years, we’ll continue to see an increasing number of individuals entering the NFT space.

In spite of the fact that people’s interest in searching for NFTs has decreased in 2022, the fact that more individuals acquired their first NFT in 2022 as opposed to 2021 provides support for the notion that adoption will continue to go up. Notably, Finbold had reported in an earlier study that over 64% of people buy NFTs just to make money.

In addition, the fact that a sizeable number of investors continue to feel comfortable keeping NFTs despite their values falling is a hint that these investors believe the NFT bull market will revive in the future and that NFTs are not dead.

finbold.com

finbold.com