Looking at the 30-day data, we see 156,050 sales with USD 208.25m in total and USD 62.22 in primary sales. NBA Top Shot saw a nearly 75% decline in sales over the past month, according to evaluate.market.

"There’s less volume on the [USD] 500 - [USD] 2000 moments than there was in Jan, which is crazy, considering the user base is probably 5-10x," argued one TopShot user. "Gives you an idea of the type of "collector" currently on the site."

just setting up my twttr

— jack (@jack)

Another notable aspect of this downturn is what some have described as its 'silence,' given that most people were not aware a crash is happening. Commenters like crypto engineer 'tuba' are arguing that, once sellers realize that there are no more buyers for their NFTs, they may adjust prices -80% overnight, and "it may take them weeks/months to realize this, so the markets are much less reactive."

Meanwhile, looking at the Google trends data, the searches for 'NFT' saw a massive jump in February this year, reaching its peak in March. It has since been on a decline.

"With NFTs, the risk of oversupply is especially acute, because there is no one in charge, and the barriers to issuance are so extraordinarily low — you can literally create a new NFT in a matter of minutes," wrote author James Surowiecki. "And, unlike comic books or baseball cards, NFTs don’t fall apart or get discarded. In other words, the only thing we really know about NFTs is that there will be more of them a month from now than there are today." Still, those few "truly rare or inherently appealing" items may hold their value, he added.

But when it comes to the arguments that NFTs are a bubble, Chris Wilmer, a University of Pittsburgh academic who co-edits a blockchain research journal, is quoted by Bloomberg as saying that it's "not meaningful to characterize a concept as a financial bubble. [...] NFTs' aren't in a bubble any more than 'cryptocurrency' is a bubble. There will be manias and irrational exuberance, but cryptocurrency is clearly here to stay with us for the long term and NFTs probably are too."

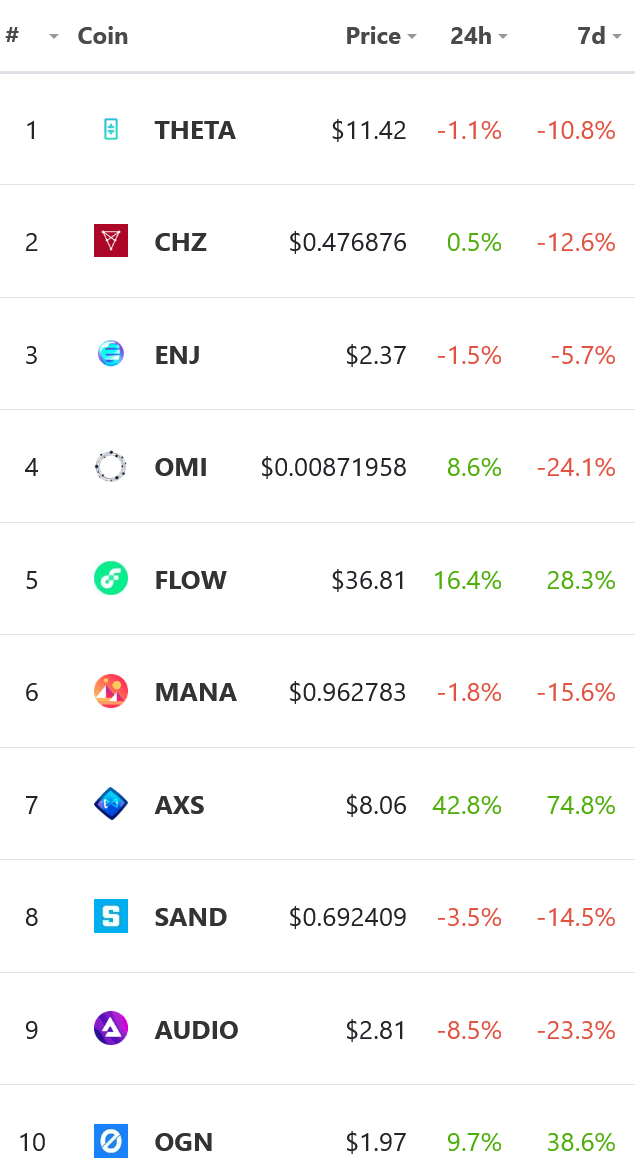

In the meantime, many NFT-related tokens are now correcting their strong gains this year.

Top 10 NFT coins by market capitalization:

____

Learn more:

- NFTs Are Selling for Millions, But How Do You Tell a Diamond From a Dud?

- How NFTs Go MIA: Marketplace Suppressions & Unreadable Token Standards

- Consider These Legal Questions Before Spending Millions on NFTs

- Money Laundering Might Taint NFTs Too, Prepare For Tighter Controls

- Why Would Anyone Buy NFT – A Link To A JPEG File?

- Check These 4 Make-Your-Own-NFT Platforms

- Non-Fungible 2021: Prepare Your NFTs For DeFi, Staking, and Sharing

cryptonews.com

cryptonews.com