The non-fungible token ($NFT) market showed early signs of recovery after a steep sell-off wiped out about $1.2 billion in market capitalization during the crypto market crash on Friday.

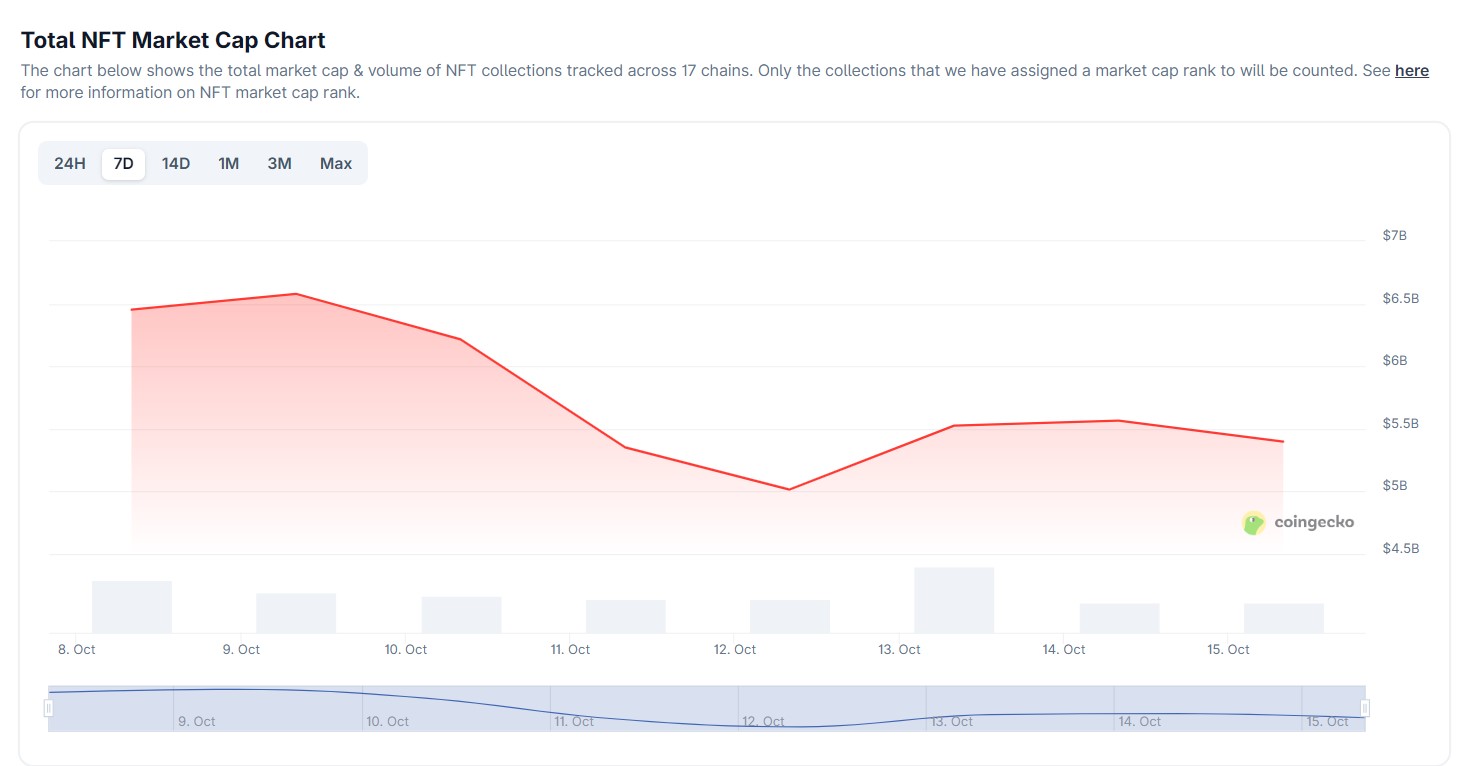

According to CoinGecko data, the sector’s overall valuation fell from $6.2 billion on Friday to $5 billion on Saturday. This erased almost 20%, or about $1.2 billion, in market capitalization for digital collectibles across all blockchain networks.

The sector experienced a rapid recovery as crypto markets rebounded. On Sunday, NFTs reached $5.5 billion, marking a 10% gain following the crash. At the time of writing, the overall market cap was almost $5.4 billion.

The sell-off highlights the $NFT sector’s sensitivity to wider crypto volatility. With the market dropping sharply on Friday, $NFT floor prices followed suit as liquidity dried up and speculative demand went down.

Top $NFT collections remain in the red

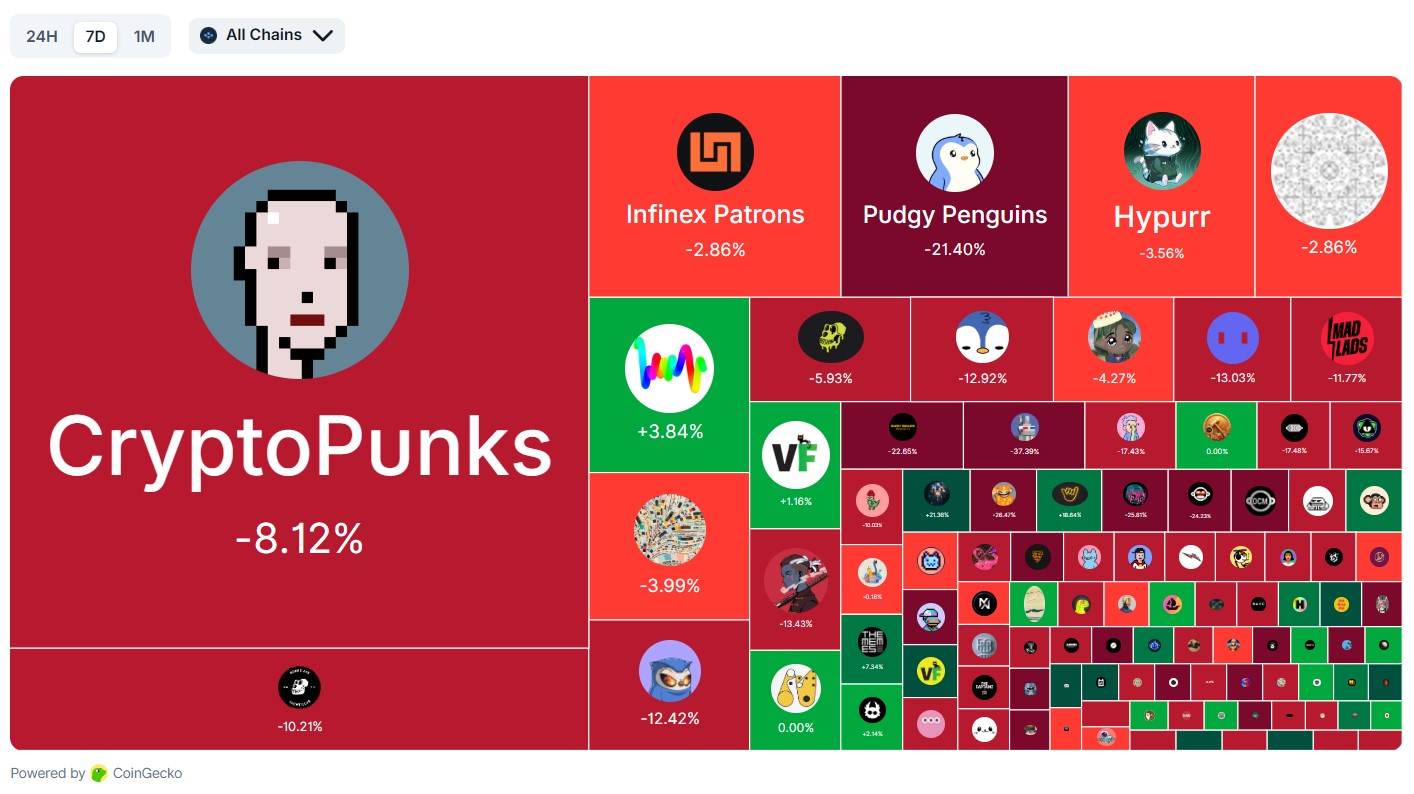

Despite the partial recovery, many top $NFT collections are down over seven- and 30-day periods.

Top Ethereum-based projects, such as the Bored Ape Yacht Club (BAYC) and Pudgy Penguins, are still down 10.2% and 21.4%, respectively, over the past week. Collections like Infinex Patrons and Fidenza by Tyler Hobbs recorded double-digit losses on the monthly charts.

CryptoPunks, the top $NFT collection by market capitalization, is down by 8% on the weekly charts and nearly 5% on the 30-day $NFT performance chart.

While most of the top 10 NFTs are down, some collections showed a slight recovery on the 24-hour charts. This includes Hyperliquid’s Hypurr NFTs, which posted a 2.8% gain in the last 24 hours, and the Mutant Ape Yacht Club (MAYC) collection, which posted a 1.5% gain.

The slight recovery hints that, despite the crash, buyers may be selectively returning to the market.

Related: Judge tosses lawsuit against Yuga Labs over failure to satisfy Howey test

Crypto products recover after Friday market crash

On Friday, Bitcoin plunged to $102,000 in the Binance perpetual futures pair as US President Donald Trump announced a 100% tariff on China as the country attempted to place export restrictions on rare earth minerals.

As the markets crashed, the sector saw liquidations of up to $20 billion, outpacing previous crypto market crashes, including the FTX collapse.

CoinGecko data showed that the overall crypto market capitalization dropped from $4.24 trillion on Friday to $3.78 trillion on Sunday, a nearly $460 billion wipeout in two days.

The market recovered to a valuation of $4 trillion on Monday. At the time of writing, crypto markets are valued at $3.94 trillion.

Despite the market crash, crypto investment products attracted billions in inflows.

On Monday, CoinShares reported that crypto exchange-traded products (ETPs) saw $3.17 billion in inflows last week despite the flash crash on Friday. This highlights the funds’ resilience to market panic caused by the liquidations and the sell-off.

Magazine: Digital art will ‘age like fine wine’: Inside Flamingo DAO’s 9-figure $NFT collection

cointelegraph.com

cointelegraph.com