Ever since the Federal Reserve’s meeting minutes were released, the larger digital asset market has witnessed a downward spiral. The minutes revealed that the planned interest rates hikes for 2022 may occur faster than initially predicted. Despite the growing anxiety in the market, Non-Fungible Tokens (NFTs) have continued to thrive, proving themselves resistant to current market pressures.

NFTs Move Against the Crypto Market’s Trend

$NFT’s have continued to perform better than the overall market trend in 2022. Data provided by NonFungible.com show a steady increase in trading volume since January 1, when daily sales reached over 15,000 items.

Top projects like the Bored ApeYacht Club (BAYC) and Pudgy Penguins have seen their floor prices continue to grow significantly. The BAYC, in particular, has seen renewed interest since rapper Eminem purchased Bored Ape #9055 for 123.45 Ether.

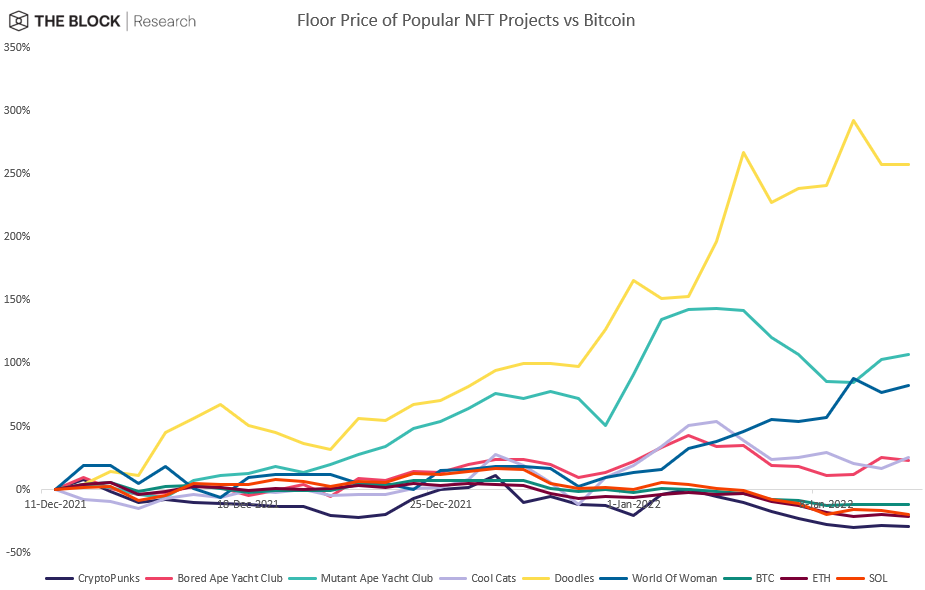

Statistics reveal that the Bored Ape floor price has risen by 9% over the last seven days. Meanwhile, Mutant Apes’ floor price fell by just 1.8%, following a 54% increase over the previous 14 days. Another project, Doodles, also recorded a 47% rally in its floor price, while World of Women grew by 56%. At the time of this report, Bitcoin and Ether have fallen by double digits throughout the same time frame.

Despite the rising floor prices, other aspects of these $NFT projects have not enjoyed significant growth. For BAYC, its market capitalization receded by 11.2%, while its volume has fallen by 39.93% over the past seven days. Meanwhile, the market volume of CryptoPunks and Mutant Ape Yacht Club have plummeted by 43.5% and 58.5%, respectively.

NFTs have continued to gain growing institutional adoption within the crypto space. The exclusive, scarcity-driven value attached to them, together with the increasing functionality and application in play-to-earn games, has continued to drive demand for such digital assets.

For these reasons, comparing them with cryptocurrencies may not offer any significant insight due to their inherently different nature. This also explains the current sentiments in both markets.

Join our Telegram group and never miss a breaking digital asset story.

OpenSea On Track to Set Trading Volume Record

Dominant $NFT marketplace like OpenSea, with a 97% market share and a $13 billion valuation, is set to break its record for monthly sales. According to Dune Analytics, the platform has recorded $2.1 billion in $NFT trade volume since the turn of the year. This is more than half of the $3 billion total recorded in August 2021—the highest month on record.

At its current pace, the $NFT platform is on track to reach a trading volume of $6 billion at the end of January. A significant variable contributing to OpenSea’s record pace is the number of active users. Currently, at 260,369, it is swiftly nearing the all-time high of 362,679 set last month.

The new PhantaBear collection, which has sold 17,124.79 Ether ($53 million) in the last seven days, is driving current trading volume on OpenSea. BAYC is in second place with 16,657.78 ETH ($51.5 million). Historical data from Cryptoslam shows that the Doodles collection is the top seller across all $NFT platforms with $56 million in sales. However, it is ranked third on OpenSea, for trade volume.

In summary, the growth recorded in the world of NFTs may serve as an indicator of market demand. However, if the general market sentiment remains fearful and asset prices continue to fall, NFTs could eventually feel the impact.

Do you think NFTs will continue to go against the current market trend, or do you see it falling in line? Let us know in the comments below.

tokenist.com

tokenist.com