OpenSea will rebuild its platform from scratch and offer a new version in December. The NFT market has opened a waiting list for its new site.

OpenSea will take a step back and rebuild from scratch. A new version of the leading NFT marketplace is coming in December. Devin Finzer, co-founder of the marketplace, announced the new upcoming version that has been cooking for a while.

We've been quietly cooking at @opensea

To really innovate, sometimes you have to take a step back and reimagine everything

So we built a new OpenSea from the ground up

Sails up in December ⛵️ https://t.co/HaU1bDm29S

— Devin Finzer (dfinzer.eth) (@dfinzer) November 4, 2024

OpenSea has been talking about building version 2.0 for the past year. At the end of 2023, the platform laid off half its staff in a bid to restructure itself, but also as a result of the stagnant NFT market.

The upcoming launch of the new OpenSea version also renewed the expectations of launching a native token. Until now, OpenSea has not hinted at tokenizing, or promising an airdrop for its activity.

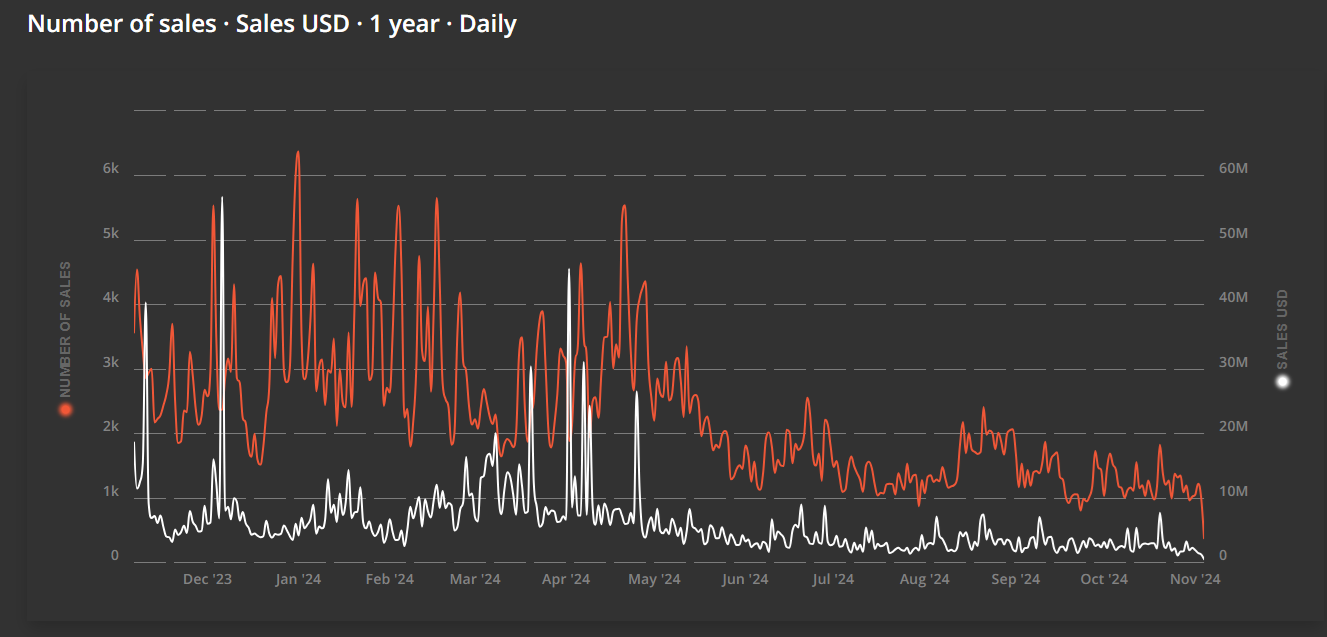

Just before the announcement of a new website, OpenSea activity spiked briefly. The platform still serves more than 6K daily users, with a turnover of $820K daily. Based on DappRadar data, the average NFT price on the marketplace is $130, while Blur carries more expensive NFT with an average price of $1.12K. Magic Eden has also taken away some of the volumes from OpenSea.

In October, NFT trading was just above $136M, slightly higher than the preceding month. In the whole of 2024, volumes on Ethereum have been sliding. The addition of Bitcoin-based Ordinals did not offset the slide in Ethereum. Solana-based NFT saw a recovery in October. The overall number of unique NFT buyers also increased in 2024. The NFT market gained another boost from Base, which added low-cost or free NFT as part of its on-chain expansion.

The entire NFT market reached its lowest point since 2021 in September and sparked hopes of a recovery. In the whole of October, NFT sales reached $356M in volumes, though with a significant share of wash trading and an overall loss of $22M for the period.

The age of exorbitant NFT sales seems to be over. However, there may be a way for livelier trades, as NFT avatars and social media presence are not entirely forgotten. Punks still sell for as much as 25.50 ETH and retain a floor price above 25 ETH. The highly valuable collections are often held by experienced traders, who are willing to wait and hype up the scarcity again.

In-game NFTs like Axies are still changing hands and have in-game utility, as well as personal collectible value.

NFT aims to recover sales activity

NFT marketplaces have since taken a hit as both collections and in-game uses kept declining in popularity in 2022. Even the top collections like Punks and Bored Ape Yacht Club lost ground and moved to a much lower floor price. In the past year, NFT managed to rally during times of general demand for crypto assets.

Punks and other top collections continue to be active, and some communities retain their NFT avatars. NFT sales have been slowing down for the past quarter, both in terms of raw deals and value. OpenSea and Blur compete for the top position, though the leading platform is still at the top with a higher number of deals. Blur still carries a higher Ethereum value, with its more expensive items.

Punks, BAYC, Pudgy Penguins, Azukis, and Milady Maker remain staples in the NFT space. Several contenders like Bitcoin Puppets also outperform temporarily. BAYC even continues with new mints, remaining a popular brand for crypto traders.

NFT recovers after meme token hype

The NFT market served as a precursor of the meme token hype. However, the images and avatars were too confusing and too expensive for mass adoption. The main idea to hold for the long term was also somewhat similar to meme communities.

For NFT holders, their investment was not divisible, and they could not buy a fraction of an NFT. For that reason, the rush to meme tokens surpassed NFT mints. Additionally, NFT trading relies on centralized marketplaces and auctions.

In the past, NFTs have been linked to additional airdrops, so it may be possible to link NFTs with meme assets.

cryptopolitan.com

cryptopolitan.com