Sales volumes of non-fungible tokens (NFTs) recorded a more than 37% increase to $277 million in the seven-day period ending April 11. Six of the top 10 collections with the largest sales volumes were Bitcoin-based NFTs. Some experts attribute the renewed interest in NFTs to the rise of real-world assets and NFTs with built-in utility.

Wash Volumes, Transactions Decrease

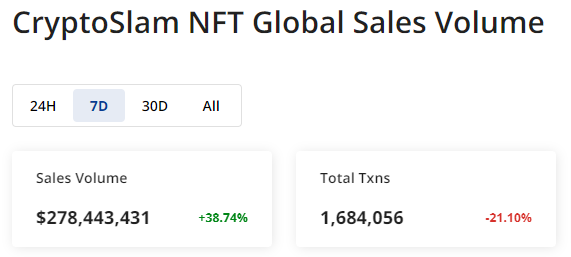

According to the latest data from Cryptoslam, the seven-day sales volumes of NFTs as of April 11 were $277 million, a more than 37% increase from the sales recorded in the previous period. During this period, the Uncategorized Ordinals compilation led the NFT collections ranking by volumes with sales of just over $10 million. PUPs BRC-20 NFTs were ranked second with sales nearly topping $4.5 million.

In total, six Bitcoin-based NFTs were among the top ten collections with the largest volumes. Two Solana-based collections, one each for Avalanche and Mythos, completed the top ten collections for the seven-day period under review. Bored Ape Yacht Club (BAYC), ranked 11th, was the highest-ranked Ethereum-based NFT with sales volumes of $794,500.

Meanwhile, the Cryptoslam data further shows that despite the surge in sales volumes, the number of transactions decreased by 21.65% to 1,676,393. In the same period, both wash volumes and wash transactions fell by 28.03% and 32.13%, respectively.

NFTs With Built-in Utility

As reported by Bitcoin.com News, NFT sales volumes had been declining before the uncharacteristic surge. Some experts believe the rise of real-world assets and NFTs with built-in utility may explain investors’ renewed interest in NFTs. Alina Krot, CEO of 10101.art, also linked the renewed interest to NFT innovations promising even better returns.

“Owning such NFTs grants access to exclusive communities, events, or in-game items, making them more attractive for individuals. Also, innovations, such as collective ownership of NFTs and integration with the Metaverse are drawing investor interest by offering new financial opportunities with a potential for higher returns,” Krot said.

Regarding the general decline of the NFT market, which has led some traditional companies and institutions to scale back or abandon NFTs, Krot attributed the cool-off to what she termed as oversaturation. The CEO added that as the NFT market matured, prices fell back to more realistic levels.

Looking ahead, Krot said the NFT market is anticipating a revolution in real-world assets, where art tokenization will become the trend.

Are NFTs about to stage a comeback? Let us know what you think in the comments section below.

news.bitcoin.com

news.bitcoin.com