The recent report by blockchain analysts Flipside unveils a comprehensive view of the fluctuating crypto world in 2023, marked by significant user growth and evolving trends.

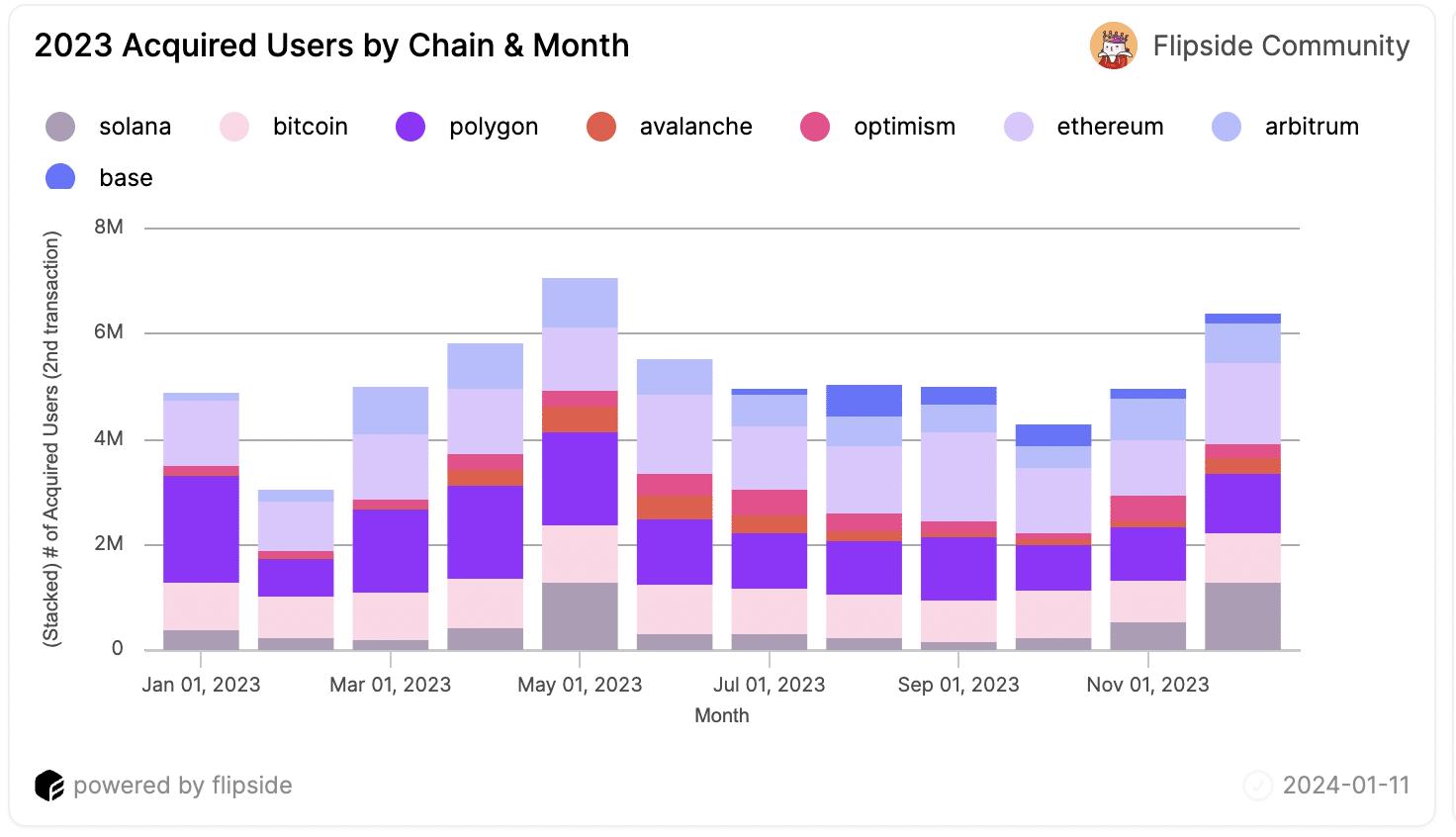

According to the report, 2023 witnessed a peak in acquired user volume in May, recording over 8.8 million accounts active across multiple chains. This synchronized growth trajectory across most chains suggests that broader market sentiments continue to steer crypto adoption.

A significant observation is the activity of super users, defined as wallets with over 100 transactions. These users predominantly engaged in DeFi-related transactions rather than NFTs. However, a trend reversal is evident on L1 networks like Ethereum (ETH), where selling NFTs was more common, indicating a shift of $NFT investments to more cost-effective L2 networks.

Flipside also reported that 2023 marked the rise of new DEXs and $NFT marketplaces, but user activity remained concentrated on a few leading platforms such as Uniswap and OpenSea.

This concentration, driven by network effects like asset liquidity, underscores the relative immaturity of the crypto market compared to traditional finance. Super users also showed varying preferences for secondary and tertiary DEXs, with a notable tilt towards selling NFTs.

You might also like: Coinbase introduces creation of AI-generated NFTs

EVM users predominantly interacted with a single chain, with a notable 86.9% sticking to one network. However, a substantial segment explored multiple L2s, particularly between Polygon and other EVM-compatible layers, indicating a growing comfort with cross-chain interactions.

The report anticipates the next bull run to be driven by diverse defi activities, challenging existing L2s to lower costs and enhance user experiences. This competition is expected to propel EVM adoption. The emergence of new chains catering to specific user needs is likely, leading to more specialized ecosystems and use cases.

Read more: Chainlink debuts price feed oracles on Polygon zkEVM