While the broader crypto market appears to be moving toward a potential bull-market phase, the non-fungible token ($NFT) sector, led by collections like CryptoPunks and Bored Apes, is experiencing a contrasting trend.

The Nansen $NFT-500 index, which gauges the valuation of the top 500 NFTs, has seen a 50% decline year-to-date when measured in Ether ($ETH) and a 16% drop in US dollar terms.

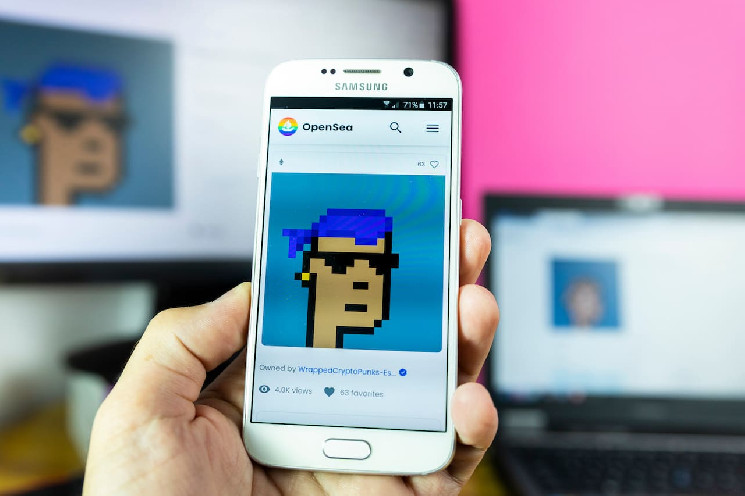

Meanwhile, the Blue-Chip 10 index, an index focused on only the most popular $NFT collections like CryptoPunks and the Bored Ape Yacht Club (BAYC), is down by 44% in $ETH terms and 1.7% in USD.

Negative correlation between $NFT and $ETH prices

In comments given to CoinDesk on Thursday, Nick Ruck, chief operating officer of ContentFi, attributed the subdued $NFT market performance to the negative correlation between $NFT prices and the price of $ETH.

He noted that NFTs have survived their initial market cycle but haven’t witnessed a new technological breakthrough or significant user interest, unlike popular decentralized finance (DeFi) protocols such as Uniswap.

Despite the overall dip, there are signs of growth in the $NFT market, particularly in NFTs based on utility in gaming rather than simple so-called JPEGs, and in the Bitcoin Ordinals space.

“Bitcoin ordinals is not only a breakthrough for Bitcoin utility, but also a hub that brings communities together,” Ruck said, while noting that a number of entities from outside the crypto sector are currently exploring ways to get involved in the Ordinals craze.

“[…] everyone found a common ground and wants a piece of it,” he said.

cryptonews.com

cryptonews.com