Top $NFT developer Yuga Labs will reduce its workforce and focus on its core initiatives. The move comes amid the record market downturn currently battling the broad $NFT space.

In an Oct. 6 mail, CEO Daniel Alegre explained why the company needed to restructure in light of the prevailing market conditions.

Yuga Labs’ Restructuring Plan

The CEO pointed out that the team had spread too thin by working on numerous projects, particularly those outside its expertise.

“I realized very quickly that there were a number of projects that, while well-intentioned, either spread the team too thin or required execution expertise beyond our core competencies.”

“The restructure today impacts US team members, and we are actively reviewing the impact on our international teams,” Alegre said.

Read More: 9 Best Crypto Demo Accounts For Trading

The exact number of affected employees was undisclosed. Furthermore, the company intends to provide comprehensive support to affected employees, including severance packages and recommendations.

Meanwhile, The CEO emphasized a strategic shift towards prioritizing partnerships and advancing key projects like Bored Apes. These endeavors will center around community development, particularly the Otherside project and various Web3 initiatives powered by Yuga Labs.

Alegre outlined plans to commemorate the crypto art legacy through educational resources and integrate Meebits and 10KTF into the upcoming 2024 gaming venture, Otherside.

Yuga Labs co-founder Greg Solano, speaking on the development, stated that the company moved to ensure its “long-term success.” Solano said the company maintains a workforce of over 120 employees, all of whom are now concentrating on specific priorities.

$NFT Volume At Record Lows

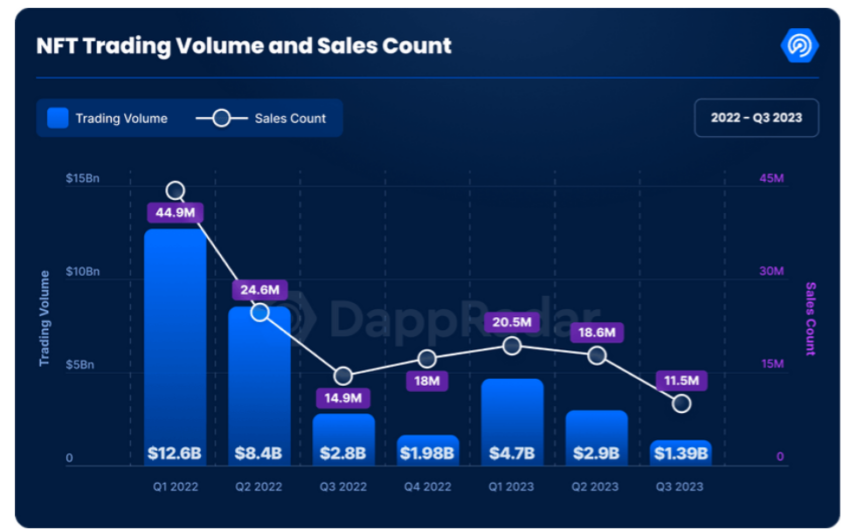

Yuga Labs’ recent actions align with a significant decline in $NFT trading activity. According to DappRadar, trading volume has dropped to its lowest point since the first quarter of last year.

The sector recorded $1.39 billion in volume across 11.5 million transactions, a sharp contrast to the $12.6 billion and 44.9 million trades in Q1 2022. Per DappRadar, this decline reflects an ongoing trend throughout this year.

Also, DappRadar’s analysis suggests a shift in consumer preferences from high-value collectibles and profile picture NFTs to those with practical utility.

The data indicates a rising interest in NFTs serving practical purposes like membership passes, etc.

“Consumers are gravitating towards NFTs that offer genuine value like membership passes or other functional benefits.”

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

beincrypto.com

beincrypto.com