Non-fungible tokens (NFTs) emerged as the poster children of a digital renaissance. With the hype reaching its peak during the 2021 bull run, the NFT market saw nearly $2.8 billion monthly trading volume in August 2021. But by July 2023, the tune has changed drastically.

Indeed, weekly traded values plummeted to around $80 million, marking a significant contraction. Amid this backdrop, recent research brought to light a startling reality. Most NFTs are trading at a market cap of zero Ethereum (ETH), rendering them “worthless.”

NFTs Become “Worthless”

The meteoric rise of NFTs was hailed as a novel frontier for the cryptocurrency industry. However, as the dust settles, the market is now in a bear run. Many NFT projects scramble to find buyers amid a somber outlook on future values.

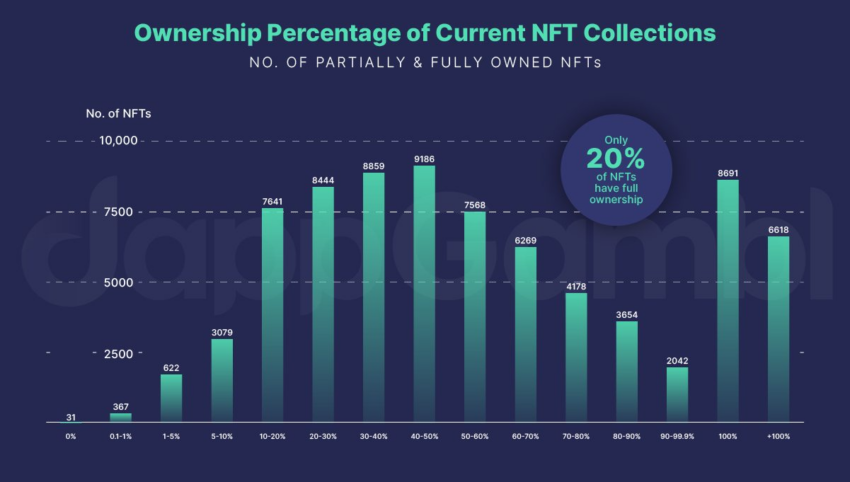

The data, derived from an extensive analysis of over 73,000 NFT collections, unveils a sobering narrative contrasting sharply with the stories of million-dollar deals and overnight success. Indeed, of the analyzed NFT collections, a meager 21% were fully claimed or had over 100% ownership, leaving 79% unsold.

“Almost 4 out of every 5–have [NFTs] remained unsold. This situation is telling of a significant imbalance between the creation of new Non Fungible Tokens (NFTs) and the actual demand for these digital assets,” the report reads.

Read more: Where To Sell NFTs: Top 15 NFT Marketplaces

This imbalance between the flurry of new NFTs and the actual demand represents a pivotal issue of oversupply, creating a buyer’s market. In such an environment, discerning investors are increasingly scrutinizing the uniqueness, potential value, and narrative behind NFT projects before taking the plunge.

“95% of people holding NFT collections are currently holding onto worthless investments. Having looked into those figures, we would estimate that 95% to include over 23 million people whose investments are now worthless,” the report reads.

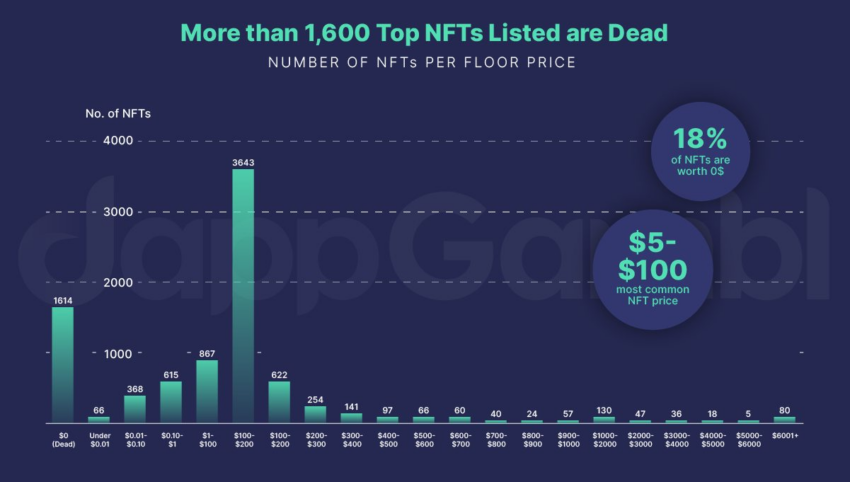

Drilling down into the cream of the NFT crop, a closer examination of the top 8,850 NFT collections, as listed on CoinMarketCap, unearthed a continuation of this disquieting trend.

Even among these successful projects, 18% have a floor price of zero, while only 1% command a price above $6,000. This reality is far from the ballyhooed million-dollar deals that once dominated headlines. Subsequently spotlighting the nature of value in a market driven by speculation and fleeting trends.

Read more: 7 Most Common NFT Scams

MacContract on Ethereum, a project boasting a floor price of $13,234,204.2 but with a paltry all-time sales of $18, exemplifies a glaring disconnect between listed prices and real-world transactions. Such chasms expose the speculative vein running through parts of the NFT market. Essentially, listed prices often lack tangible demand or trading history.

This trend, indicative of speculative and hopeful pricing estranged from actual trading dynamics, could potentially mislead new or uninformed investors.

Are NFTs Also Dead?

The investigation also threw a spotlight on the environmental footprint of NFTs. The energy consumed in minting the assets of 195,699 NFT collections with no apparent owners or market share equated to a carbon footprint comparable to the yearly emissions of 2,048 homes.

As the narrative around sustainable digital technologies grows louder, the NFT space is under the scanner. Particularly, NFTs that lack apparent utility or genuine artistic value.

The emergence and subsequent downturn of NFTs embody a cautionary tale of hype cycles in the crypto market. As speculators set out on a quest for the next gold rush, the question remains whether these NFTs lacked a genuine use case, rendering them dead.

Read more: How To Start NFT Trading: A Step-by-Step Guide

Amid the allure and the glitter, the tale of NFTs is a stark reminder to creators and investors. It is an example of meaningful value and the perils of speculative frenzy.

beincrypto.com

beincrypto.com