The segments of non-fungible tokens (NFTs) and play-to-earn applications (P2E) suffered the most in the latest bearish recession. Data analysts tracked the crucial metrics of the Ethereum ($ETH) $NFT sphere to discover the scale of the collapse it faced.

From $5.1 billion to $568 million: Ethereum $NFT segment registers its worst month since FTX collapse

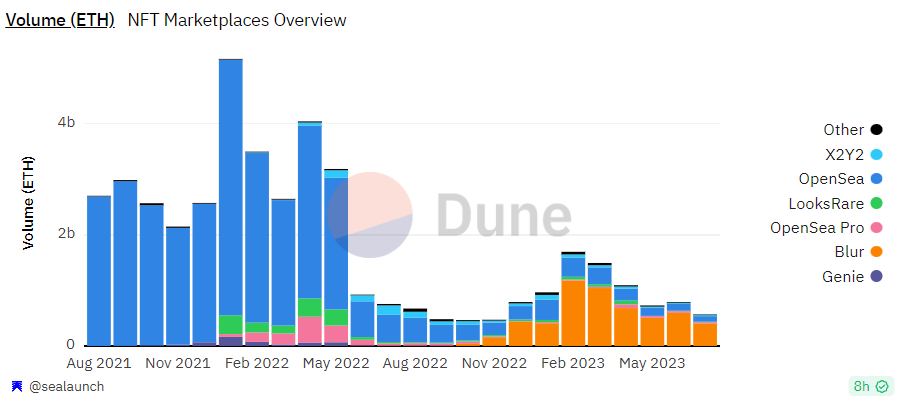

July 2023 was the worst month for Ethereum ($ETH) NFTs since last November; aggregated trading volume on major marketplaces dropped to $568.5 million in equivalent per month. As such, the segment witnesses an almost 90% decrease of trading volume compared to the whopping results of January 2022.

Such calculations were published by Sealaunch, a team of $NFT data researchers, through a custom-made dashboard on Dune Analytics platform.

Meanwhile, the number of unique $NFT users dropped to 107,000 holders; this is a multiyear low. In the last 12 months only, it dropped by over 66%.

Also, the count of independent addresses for OpenSea monthly transactions has dropped to 64,600, which is also below two-year lows. Last but not least, the aggregated number of $NFT sales lost 82% from the peak registered in February 2022.

To provide context, the largest metaverse-associated projects lost over 95% of their tokens' capitalization volumes, as covered in U.Today's guide.

Rise and further rise of Blur ($BLUR) marketplace

At the same time, for some new actors this recession resulted in achieving market dominance. Novel project Blur ($BLUR), which stole all the headlines with its airdrop, replaced old leader OpenSea in a number of indicators.

For instance, in July 2023, its trading volume eclipsed that of OpenSea by 300%. In Q1, 2023, Blur ($BLUR) even managed to surpass OpenSea by the number of $NFT sales.

Blur ($BLUR) scored all of these accomplishments, delivering its services to a 3x smaller userbase compared to OpenSea, the researchers noted.

u.today

u.today