The cryptocurrency market performed well in the third quarter of 2021. The total cryptocurrency market cap increased from around $1.4 trillion to $2.2 trillion, and peaked at $2.4 trillion in the second half of August.

All of the assets in the cryptocurrency top 10 except for Dogecoin displayed a positive performance. Solana was the strongest performer by far, as it recorded massive 336% gains between in the quarter. The Bitcoin price saw a 34.2% increase in Q3, while Ethereum improved by 44.3%.

If we briefly shift our focus to the cryptocurrency top 100, Axie Infinity’s AXS token was the clear winner of Q3 2021. The token’s price increased by a massive 1,202%, making even the second-ranked Terra’s 548% price increase look tame in comparison.

Looking at the quarter’s top performers in the cryptocurrency top 100, we can quickly see a strong presence of layer 1 blockchain platforms. As Ethereum transactions became more and more expensive, users started considering alternative blockchains, and crypto assets like Avalanche (AVAX), Fantom (FTM), Solana (SOL), Near Protocol (NEAR) and Cosmos (ATOM) benefited as a result.

The NFT markets had their biggest quarter ever

NFT markets continued to be very active in the third quarter, and in fact recorded their largest numbers ever in terms of trading volume and amount of on-chain transactions. DappRadar says that NFTs saw $10.67 billion worth of trading volume in Q3, a 704% increase compared to Q2.

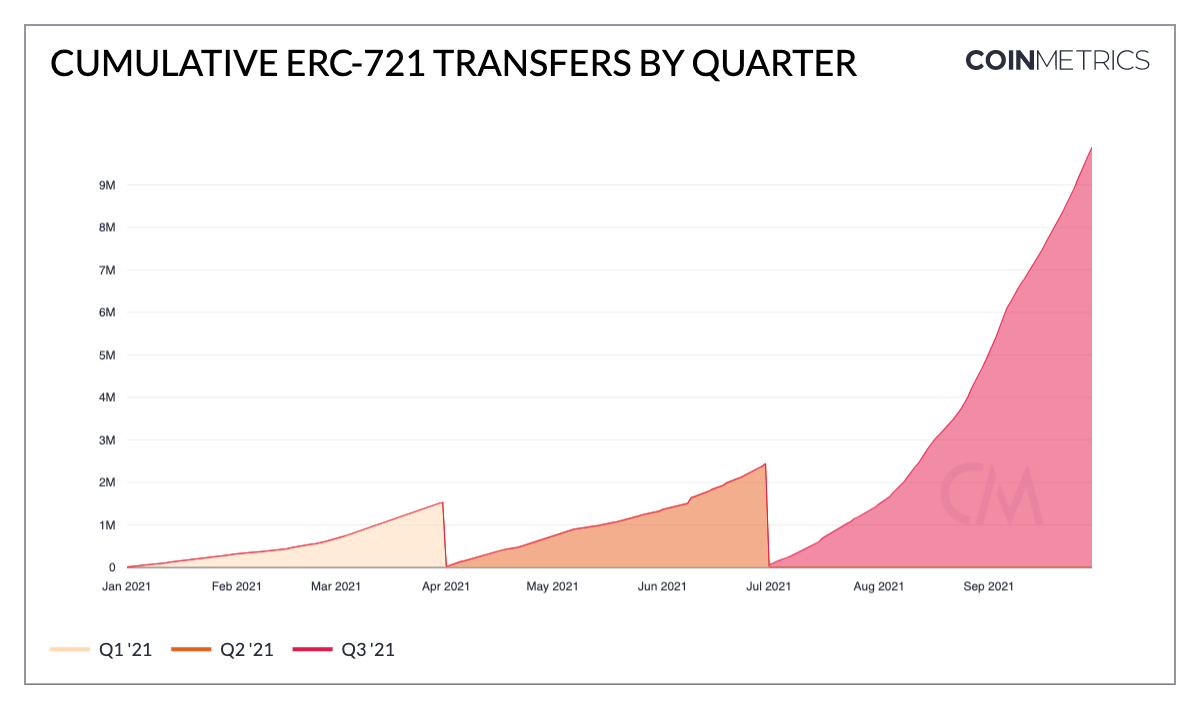

According to CoinMetrics, the amount of ERC-721 transfers increased by 305% compared to Q2 (ERC-721 is the most popular token standard for NFTs on the Ethereum blockchain). CoinMetrics also pointed out that in Q3, leading NFT marketplace OpenSea handled 3.8 million NFT purchases.

Cumulative ERC-721 transfers in Q3 compared to Q2 and Q1. Image source: CoinMetrics

Venture capital investors are definitely bullish on the future potential of NFTS, as notable projects like OpenSea and Sorare raised large funding rounds at unicorn valuations. In July, OpenSea raised $100 million at a valuation of $1.5 billion. In September, Sorare raised a massive $680 million Series B round at a valuation of $4.3 billion.

Axie Infinity, a game where users collect NFTs representing creatures called “Axies”, continued its meteoric rise in Q3. The game’s player base has now grown to over 2 million daily active users, and its marketplace has handled more than $2 billion in trading volume since its inception. The game’s AXS governance token saw a 12x price increase during the quarter, and easily outperformed all the other contenders in the cryptocurrency top 100.

The environmental impact of Ethereum’s Proof-of-Work consensus and the high costs of minting and transacting with NFTs on the platform continued to be important concerns. These factors contributed to blockchain platforms like Solana and Tezos emerging as popular Ethereum alternatives for NFT collectors. However, we should point out that Ethereum is still dominating the NFT space and the upcoming transition to Ethereum 2.0 is likely to solidify the platform’s position at the top even further.

Scaling solutions for Ethereum and Bitcoin continued to progress

Bitcoin and Ethereum are entrenched at the top of the cryptocurrency market cap rankings, but it’s clear that both platforms currently cannot scale to meet mass adoption.

Ethereum

In Q3, Ethereum’s transaction fees increased significantly, thanks in large part to NFT demand. According to BitInfoCharts, users were paying an average of $59.5 per Ethereum transaction on September 7.

Average Ethereum transaction fees in Q3 2021. Image source: BitInfoCharts

Thankfully, developers are working on layer 2 scaling solutions that allow users to enjoy faster and cheaper transactions while still benefiting from the security of the base blockchain.

Ethereum scaling solution Arbitrum One launched their mainnet in September, and the platform has already started gaining traction. According to ArbiScan, Arbitrum One has more than 200,000 unique addresses and is handling over 30,000 transactions per day.

Optimistic Ethereum is another prominent Ethereum scaling solution that’s based on optimistic rollups. Per Etherscan, Optimistic Ethereum is now handling about 37,000 transactions per day, and has about 170,000 unique addresses.

The layer 2 solutions like Arbitrum One and Optimistic Ethereum, which have already been deployed will likely see significant improvements over the coming months, both in terms of their performance and the number of projects deploying decentralized applications on them. The ongoing transition to Ethereum 2.0 will also bring significant improvements to the Ethereum user experience.

Bitcoin

Ethereum is certainly not the only blockchain that’s in dire need of scaling solutions. When it comes to Bitcoin, the Lightning Network is widely accepted as the most viable way of enabling cheaper and faster Bitcoin transactions.

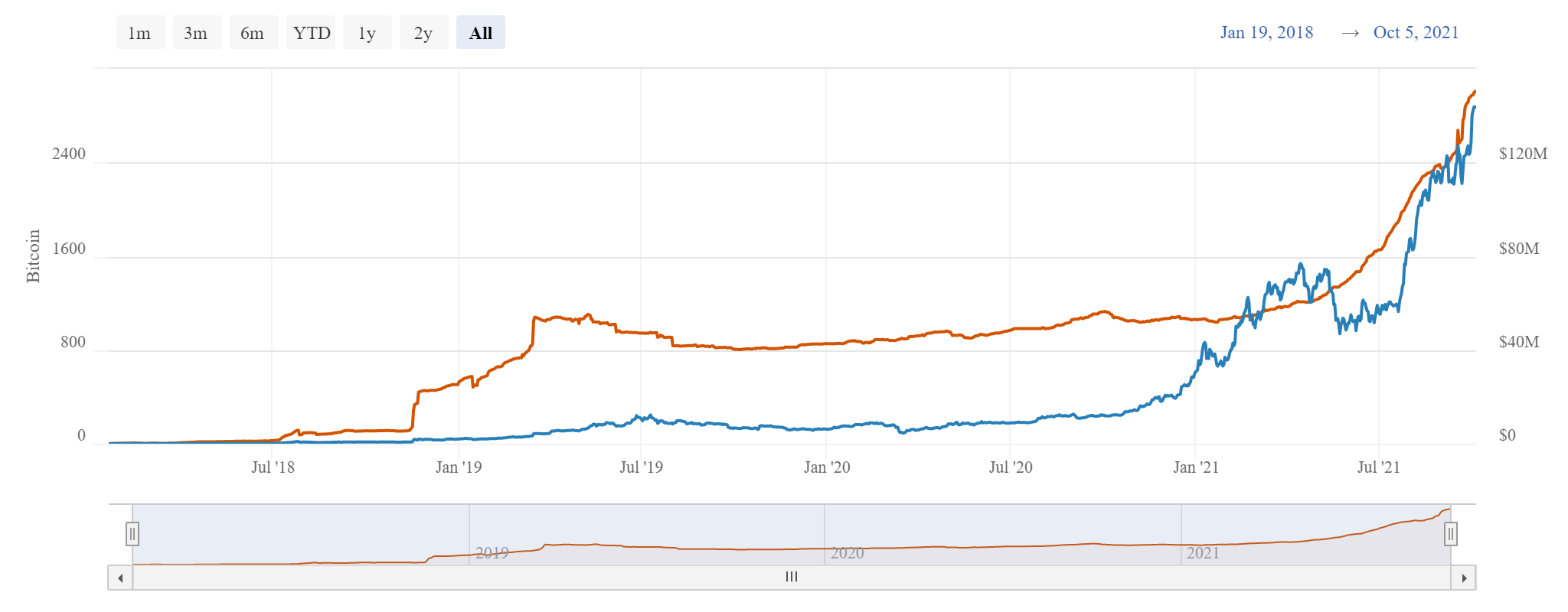

The Lightning Network enjoyed strong growth during the third quarter of 2021. Data from BitcoinVisuals shows that Lightning Network’s BTC capacity increased from 1,655 BTC to 2,975 BTC in Q3 (+79.7%). The number of Lightning Network nodes increased from 12,512 to 16,054 (+28.3%).

The Lightning Network’s BTC capacity in Q3. Image source: BitcoinVisuals

The biggest news for the Lightning Network came courtesy of social media giant Twitter, which introduced Lightning Network-powered Bitcoin tips to its platform. Twitter rolled out the new feature in partnership with Strike, a Bitcoin payments startup that uses the Lightning Network.

Crypto regulations continued being an important theme

The third quarter was also interesting when it came to activity outside blockchain networks themselves. The Bitcoin hashrate began recovering after it dropped considerably due to China’s cryptocurrency mining crackdown, which resulted in a large migration of hashrate out of the country and tanked the Bitcoin network’s total hashrate during Q2.

In Q2, the Bitcoin hashrate saw a very strong recovery and increased from 88.27 to 152.64 EH/s (exahashes per second), but it’s still off from the 196.2 EH/s all-time high that was recorded in mid-May.

The Bitcoin hashrate recovered during Q3, but is still off from its ATHs. Image source: BitInfoCharts

In September, news coming out of China shook the cryptocurrency markets yet again. This time, the People’s Bank of China and other Chinese government organizations reiterated their stance that activities like cryptocurrency trading and token issuance are not permitted in Mainland China. In response, cryptocurrency exchanges like Huobi, KuCoin and BiKi announced that they would no longer be providing services to customers from Mainland China.

Officials in the United States also did not sleep on the cryptocurrency and blockchain sector. In a September interview, SEC chairman Gary Gensler compared cryptocurrency to Wildcat banking in the 19th century, and said that private forms of money have historically not been viable over the long term. Gensler also expressed a critical stance on stablecoins, comparing them to poker chips at a Wild West-style casino:

“We’ve got a lot of casinos here in the Wild West,” Gensler said. “And the poker chip is these stablecoins.”

Circle, a company creating services based around the USD Coin stablecoin, recently revealed that it received an investigative subpoena from the SEC in July.

Binance, the most popular cryptocurrency exchange in the world, made major policy changes after it started being pressured from regulatory agencies across the globe. Binance is making identity verification mandatory for all users who want to continue trading on its platform, and the exchange also reduced the amount that non-verified users can withdraw in a single day from 2 BTC to 0.06. In addition, Binance has limited the maximum amount of leverage that can be used on the Binance Futures platform.

We should also point out that on September 7, El Salvador officially became the first country in the world to make Bitcoin legal tender. While El Salvador’s move is certainly an important milestone in the history of Bitcoin, critics have questioned some of the language used in the country’s “Bitcoin Law” and the authoritarian leanings of El Salvador president Nayib Bukele.

coincodex.com

coincodex.com